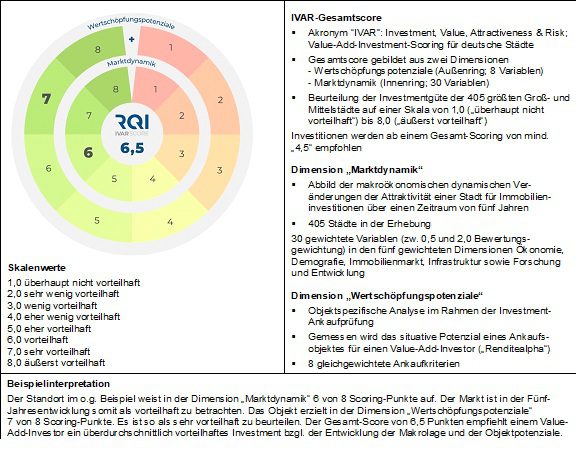

With the IVAR score (Investment, Value, Attractiveness & Risk Score), the real estate investor RQI Immobilien AG, which is active throughout Germany, presents an evaluation tool for real estate market and property potential. This makes it possible to holistically assess the development of the economic base of German cities on the basis of rates of change for specific real estate investments. The IVAR score serves as an analytical tool for the structured assessment of investment locations in Germany and offers a fact-based, objective and uniform basis for decision-making for real estate investments with value creation potential.

The Top 10

The top 10 cities of the IVAR score only for the area of international locations (“A-cities”), national locations (“B-cities”) and regional locations (“C-cities”), filtered in comparison with the classification of bulwiengesa AG, excluding local real estate markets (“D-cities” and others), are:

Rank City Classification

1 Offenbach am Main C-Stadt

2 Potsdam C-City

3 Mainz C-Town

4 Freiburg im Breisgau C-Stadt

5 Dortmund B-Town

6 Berlin (City) A-City

7 Wiesbaden B-Town

8 Münster B-Town

9 Munich A-City

10 Mannheim B-Town

The IVAR score measures the rate of change over the past five years, regardless of level. For the final assessment of whether an investment makes sense, an additional case-by-case examination should be carried out. This is because sometimes existing potential cannot be leveraged or a city is classified as non-institutionally investable (“investment-grade”) (e.g. due to a lack of size).

Systematic site assessment for sustainable value creation

The IVAR score was developed to provide data-driven and structured support for investment decisions for opportunity-oriented investors in an increasingly complex market environment. The score evaluates 405 German cities with 18,000 inhabitants or more in the “Market Dynamics” dimension on the basis of 30 central parameters, which are clustered into five categories:

- Economy – This category measures the development of a city’s economic strength and stability. Factors such as gross domestic product (GDP), the purchasing power of the population and the unemployment rate are included in the assessment. A strong economic basis and its positive development signals long-term investment security and stable rental income.

- Demographics – Population development is a key factor in the attractiveness of a location. Here, age structure, migration movements and the general growth of the population are analysed. Cities with positive demographic development signal a robust demand side. They offer better framework conditions for sustainable investments.

- Real Estate Market – In this category, market attractiveness is assessed using factors such as rental yields, vacancy rates, liquidity, and market absorption capacity. Healthy real estate markets with stable prices and high demand increase investment security.

- Infrastructure – The development of infrastructure influences the quality of life and location.

Transport connections, public transport, broadband supply and the approval situation for construction projects are decisive indicators for sustainable location development. - Research & Development (R&D) – Innovative strength is an important location factor. This category evaluates, among other things, the number of universities, research institutes, start-ups and companies from high-tech industries. A rapidly developing innovation environment with high start-up activity, among other things, has a positive effect on the long-term attractiveness of the location.

“With the IVAR score, we are setting a benchmark in the value-add area in the location and risk assessment for real estate investments. The aim is to provide our investors with a better basis for decision-making for sustainably high-yield investments through a fact-based and dynamic analysis of real estate potential based on rates of change,” explains Professor Dr. Nico B. Rottke, CEO of RQI Immobilien AG.

“In acquisitions, we are expanding the market view of the ‘market dynamics’ dimension to include a property-specific view of value creation potential with a further eight variables for individual property purchases. This perspective provides surprising insights, for example that the markets with the highest potential in the medium term do not necessarily have to be just the popular ‘Big 7’.”

“Location-specific market dynamics together with property-related value creation potential result in an overall picture that combines the view of market development with the potential of the specific property,” adds Dominik Schott, Managing Director of RQI Asset Management GmbH.

Dynamic scoring for a changing market environment

The IVAR score is based on a weighted point system and is determined over a five-year period with current market and economic data. This enables a well-founded assessment of investment locations that takes into account current economic, infrastructural and demographic changes. To this end, 30 decisive parameters are integrated into the evaluation system, which are made up of corresponding market-specific factors. These parameters are weighted differently to reflect their actual importance to a city’s real estate appeal. The weighting takes into account, among other things, the stability of the economy, the dynamics of the real estate market and the long-term development prospects of a city. Higher scoring results signal a high level of positive market dynamics and thus a positive change in the attractiveness of the location – and thus investment risks that can be better assessed.

The rating is graphically displayed on an eight-level colour scale, ranging from low values (“red”) for lower advantages to averagely advantageous cities (“yellow”) to higher values for particularly advantageous locations (“green”). The traffic light system allows a visual classification of individual investment potential.

“The German real estate market is more heterogeneous than ever. Our IVAR score differs from other assessment instruments in that it takes into account different location factors and enables cities to be systematically classified with regard to their real estate market potential. This is crucial for realising successful investment strategies in the long term,” concludes Hendrik Th. Möller, Chief Operating Officer of RQI Immobilien AG. “The IVAR score shows a high level of forecast accuracy and contributes to the RQI investment decision.”