Large-scale battery storage systems (BESS plants) that can be monetized in the electricity and balancing power market are increasingly attracting the interest of institutional investors as an infrastructure asset class – most recently due to return expectations in the double digit range (proclaimed by fund providers).

High system benefits due to imbalance in “green” electricity production

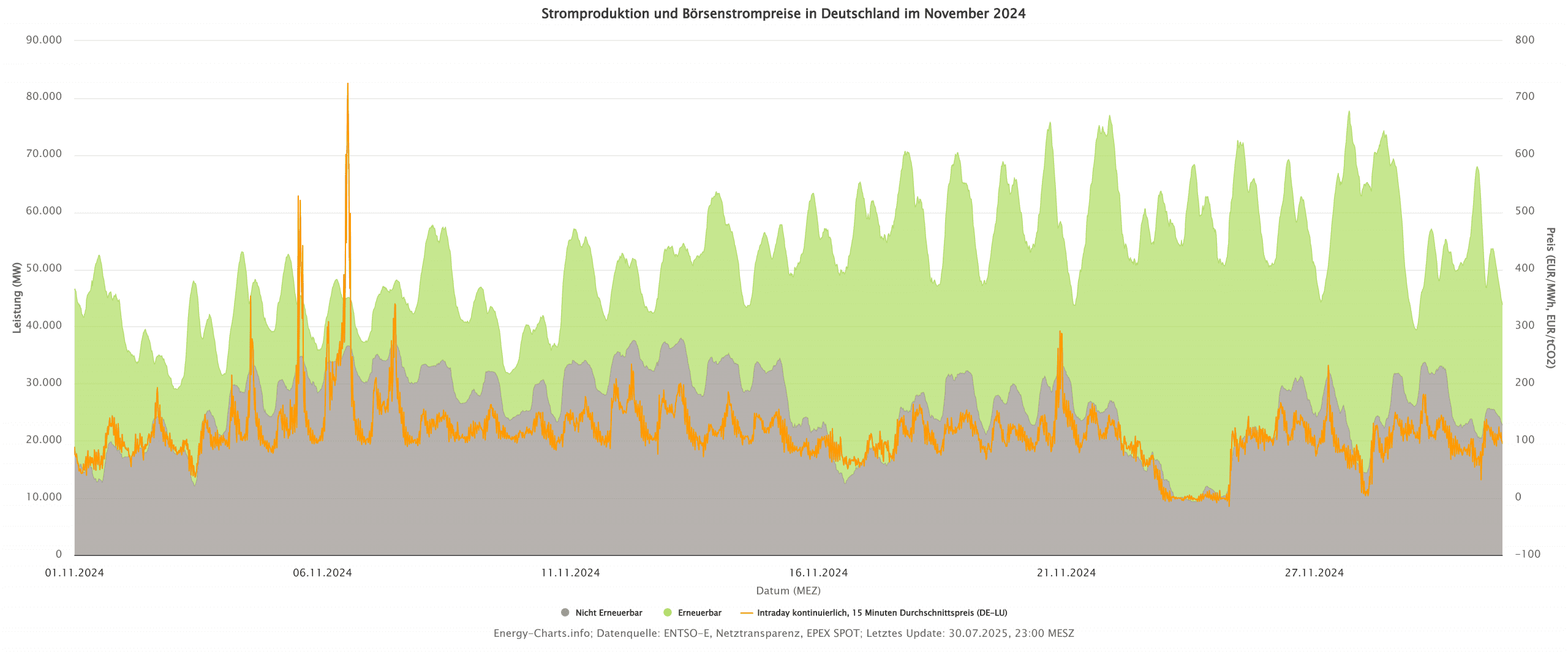

Approx. 59% of net electricity production in 2024 resulted from renewable energies, of which approx. 31.4% was attributable to wind power and approx. 13.8% to photovoltaics. However, the high proportion of non-controllable energy sources leads to fluctuations in electricity production.

For example, the German Weather Service defines “dark doldrums” as weather conditions in which little wind and little sun occur at the same time, which severely limits or prevents electricity production from wind turbines and solar plants. In the period from 2.11 to 7.11.2024, an extreme dark doldrums event occurred, which led to a sharp increase in exchange electricity prices of up to 725 EUR/MWh (for comparison: the average price in 2024 was 78.46 EUR/MWh).

BESS system services with yield and market and grid stabilization

In such scarcity phases, BESS operators take advantage of the arbitrage in the market and sell the electricity stored at more favourable conditions on the spot market. This leads to more supply and at the same time contributes to the stabilization of prices.

In order to compensate for short-term imbalances between electricity feed-in and withdrawal and thus keep the grid frequency stable at 50 Hz, the four transmission system operators are tendering products in the regulating power market in which BESS plants can also be used to create value.

According to the recently published monitoring report of the Federal Government on the energy transition, large-scale battery storage systems continue to be important pillars of grid stability in Germany.

Increase in installed capacity or capacity to be expected

One of the first BESS plants in Germany was commissioned in Feldheim (Brandenburg) in 2014 with a capacity of 10 MW. In the meantime, significantly larger storage systems with capacities of approx. 500 MWh are being built (this corresponds to the capacity of approx. 50,000 standard household battery storage systems).

In mid-2025, there will be approx. 526 large-scale storage systems (> 1 MWh) with a capacity of approx. 3,320 MWh on the market or on the grid. According to the market master data register published by the Federal Network Agency, around 557 large-scale storage projects with a capacity of over 8,500 MWh are being planned. The latter figures should be taken with a grain of salt, because it is unclear whether all planned plants are solidly financed and will receive a grid decision.

Brief technical digression on BESS systems

In addition to the areas of application, the technical details are also interesting from an investor’s point of view.

The service life of a battery is mainly influenced by the number of charging cycles, i.e. the complete discharge and charge. An example of (cyclical) degradation in a business plan: The exit of a battery is aimed at 20% degradation after 6,000 charging cycles guaranteed by the manufacturer. The monetization of the storage medium requires an average of 1.7 charging cycles per day. This results in an economic service life of approx. 10 years (approx. 620 charging cycles per year). After 10 years with a residual capacity of 80%, the battery still has a certain benefit, but should no longer achieve a significant residual value. Conversely, this means that the BESS system (according to the business plan) has paid for itself over the life of the system by means of the yields (at best several times).

Battery cell technology (as in electromobility) is characterized by lithium iron phosphate (LFP), which represents a good compromise in terms of energy density, thermal stability (low fire risk), durability and – above all – procurement costs. Purchasing costs are part of the good market momentum for BESS: Due to the technological progress in LFP technology, the upscaled production in Chinese gigafactories of CATL and BYD and the associated overproduction, as well as good material availability (iron and phosphate), cell prices have fallen from over $100/kWh to $56/kWh within two years.

Security and connectivity of the systems

The systems, which are usually installed in rural outdoor areas on solid concrete foundations or metal frames, are connected to data traffic either with fiber optics or 5G connection. This is necessary in order to monitor the systems under safety aspects (temperature, faults), but above all to control the charge/discharge cycles in the relevant markets. System security in battery control in connection with the inverter is a sensitive area: Dependencies on third-party software can influence data security and increase operational risks (e.g. hacker attacks).

In conclusion, BESS plants are important media in the electricity market to support security of supply and grid stability. Asset monetization is currently adequate, and forecasts from independent research institutes suggest that this may still be the case in the future. From an investor’s point of view, the various monetization models are interesting, but also a look at technical trends and details.