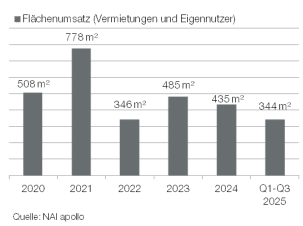

The warehouse and logistics space market in the Rhine-Main region experienced an increase in leasing activities in the third quarter of 2025. NAI apollo, a member of NAI Partners Germany, registered a take-up of space of around 133,000 square metres for the past three months as a result of lettings and owner-occupancy. Compared to the previous quarter, this represents an increase of 18.0 percent. The third quarter of 2024 was even exceeded by 40.5 percent. “In a short-term comparison, the current result is therefore positive. However, a different picture emerges in the long term. Both the five- and ten-year averages of the previous third quarters of 141,500 and 154,100 square meters respectively could not be reached. A similar trend can be seen in the annual results so far,” says Stefan Weyrauch, Head of Industrial and Logistics at NAI apollo. Take-up in the first three quarters of 2025 totalled 344,300 square metres. The previous year’s 343,700 square metres was thus slightly exceeded. The five-year and ten-year averages continue to be significantly higher – at around 40,000 and 100,000 square metres more, respectively.

“The economic mood in the Rhine-Main region has recently been robust, as the last economic survey conducted by the local Chamber of Industry and Commerce in early summer showed. However, the framework conditions remain challenging. In the current joint forecast, the leading economic research institutes now expect only a slow recovery in the second half of the year after stagnation in the first half of 2025, although there are some risks that will slow down lasting momentum,” says Dr. Konrad Kanzler, Head of Research at NAI apollo.

“Against this background, market participants in the warehousing and logistics market in the Rhine-Main region continue to act with restraint. Leasing decisions will continue to be reconsidered for longer and flexible solutions will be preferred,” Kanzler continues. “Influenced by this, subletting is becoming increasingly important, especially in the large-scale segment. At the end of the third quarter, these accounted for over 33 percent of total take-up, and in clusters above 5,000 square meters even more than 46 percent. In contrast, the new construction segment has clearly lost,” adds Weyrauch. Leases in new developments or owner-occupier construction projects have a market share of 20.8 percent. Take-up fell accordingly from 141,300 square metres in the previous year to around 71,500 square metres.

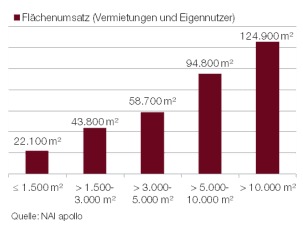

Large-scale subletting characterises the distribution of turnover

Subletting – which includes the two largest deals in the course of the year so far by two logistics companies over a total of almost 64,000 square metres – has also led to the largest market shares falling back to the large-scale clusters. The ranking is led by the segment above 10,000 square meters with a market share of 36.3 percent, which gained especially in the third quarter. The space segment between 5,000 and 10,000 square metres follows in second place (market share: 27.5 per cent). In total, these two segments have leased 219,700 square metres, which represents an increase of 3.8 per cent compared to the previous year. In contrast, the sharpest decline of -42.3 percent compared to the previous year was recorded for small areas up to 1,500 square meters. A take-up of 22,100 square metres also means the lowest market share of 6.4 per cent.

Warehousing and logistics service provider again strongest demand group

At the end of the third quarter, the group of transport, warehousing and logistics companies once again took the top position as the user group with the highest turnover after steady increases in leasing activities, with a number of major leases in particular making a key contribution in the third quarter. Take-up of 119,300 square metres means a market share of 34.6 per cent, almost completely reaching the previous year’s level. Second place is occupied by retail with 76,500 square metres, closely followed by companies from industry and manufacturing with 73,100 square metres. “While warehousing and logistics companies steadily increased leasing activities over the course of the year after a weak start to the year, companies from industry and manufacturing showed the opposite development. At the end of the third quarter, they have now lost their leading position from the summer,” said Kanzler.

Within the Frankfurt/Rhine-Main market area as a whole, the traditionally strong southern sub-markets have further increased their market shares in the past three months. “This is where most of the deals, as well as the largest deals, of the year took place. The south-west in particular, located between the A63 and A5 motorways, plays a dominant role with 150,600 square metres,” says Weyrauch. The “south-east” with 77,100 square metres is followed by the other sub-markets with sales of between around 15,000 and 40,000 square metres. Only the north-east, which last appeared more clearly in 2024 with an owner-occupier building by DHL in Florstadt, is now falling behind more significantly with less than 5,000 square meters

Other market activities remain at the current level

The general conditions remain difficult, with a slow economic recovery and continuing risks, partly due to geopolitical challenges. Even though market activity has picked up in the past three months, the trend towards a wait-and-see attitude to leasing decisions persists. “As a result of this development, space availability has continued to increase. So far, however, vacancies, as long as they meet the general requirements, continue to find new users quickly,” says Kanzler. At the same time, demand remains high, especially for centrally located, modern space and has led to a renewed increase in prime rents in the past three months. The prime rent for warehouse and logistics space of 5,000 square metres or more now amounts to 8.30 euros per square metre, which means an increase of 10 cents compared to the previous quarter and 35 cents in the same quarter of the previous year. “No major changes on the demand side are expected at this point in time for the year-end quarter. In terms of take-up, this means a year-end result above the previous year’s level, in which 435,000 square metres were achieved. This means that our forecast from mid-year remains valid,” says Weyrauch.