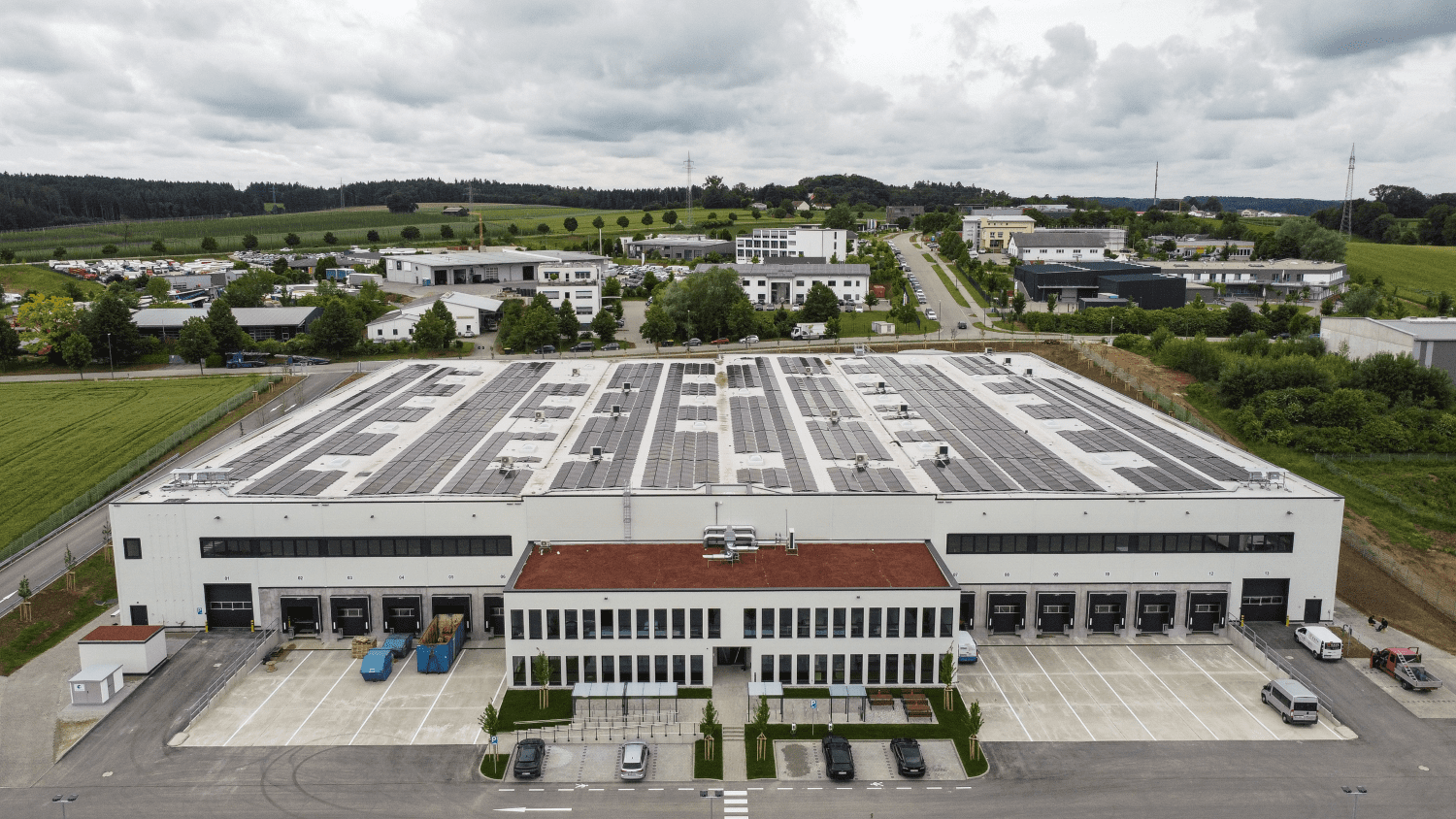

HIH Invest Real Estate (HIH Invest) has acquired a logistics property with around 12,500 square metres of rental space in Pfaffenhofen an der Ilm, Bavaria, for the open-ended special fund HIH Deutschland+ Core Logistik Invest. The seller is the Intaurus Group, which acquires and develops industrial and commercial real estate throughout Germany. The project development, which was completed in June 2025, is located in the Kuglhof industrial park at Schäfflerstraße 14, with a direct connection to the A9 motorway and around 40 kilometres from Munich Airport. The purchase price was not disclosed.

The space is made up of 10,200 square metres of hall space, 1,330 square metres of mezzanine space and 910 square metres of office and social space. In addition, the property has 57 parking spaces. The main tenant is New Flag GmbH, an international company for hair and beauty products based in Munich. The ten-year lease was concluded with an option to extend.

The property is built according to the criteria of the DGNB Gold Standard and has a heat pump and a photovoltaic system. Due to the modular space configuration, the property can be divided into two units if required, which ensures a high level of third-party usability.

“Pfaffenhofen offers first-class conditions as a logistics location. The proximity to Munich and Ingolstadt, combined with more moderate rent levels than in the metropolis, makes the location particularly attractive for companies from e-commerce, pharmaceuticals and industry,” explains Maximilian Tappert, Head of Transaction Management Logistics at HIH Invest.

Andreas Strey, Co-Head of Fund Management and Head of Logistics at HIH Invest, adds: “The property combines an excellent location in the heart of southern Germany with a sustainable building concept. With the long-term lease, we are securing stable cash flows for the fund.”

“We were able to develop a flexibly usable logistics property of the latest generation at the Pfaffenhofen site, taking into account all sustainability factors. We would like to thank the HIH Invest team very much for the trusting and cooperative sales process,” says Oliver Raigel, Managing Director of the Intaurus Group.

With the new logistics building, HIH Invest has acquired the eighth property for the HIH Deutschland+ Core Logistik Invest fund. Three of them are located in the Netherlands and the other properties in Germany. The fund is aiming for a target volume of at least 300 million euros. The focus is on modern core logistics properties with very good third-party usability and high ESG standards. The minimum subscription amount is five million euros, and the fund’s target group is institutional investors and credit institutions. The main investment location is Germany, while around 30 percent of the fund’s capital is invested in neighboring countries (the Netherlands, France, Austria). HIH Deutschland+ Core Logistik Invest pursues a strategy in accordance with Article 8 of the Disclosure Regulation.

The legal and tax acquisition review was carried out by HIH Invest by Baker Tilly, the technical and ESG due diligence by JT Solutions. The Intaurus Group was legally advised by Glock Liphart Probst & Partner. The transaction was brokered by Realogis.