For years, asset managers in Germany could only launch open-ended real estate funds under the German Capital Investment Code (KAGB). With the ELTIF, an alternative is imminent. Robert Guzialowski from HANSAINVEST explains when the ELTIF will be ahead as a real estate fund.

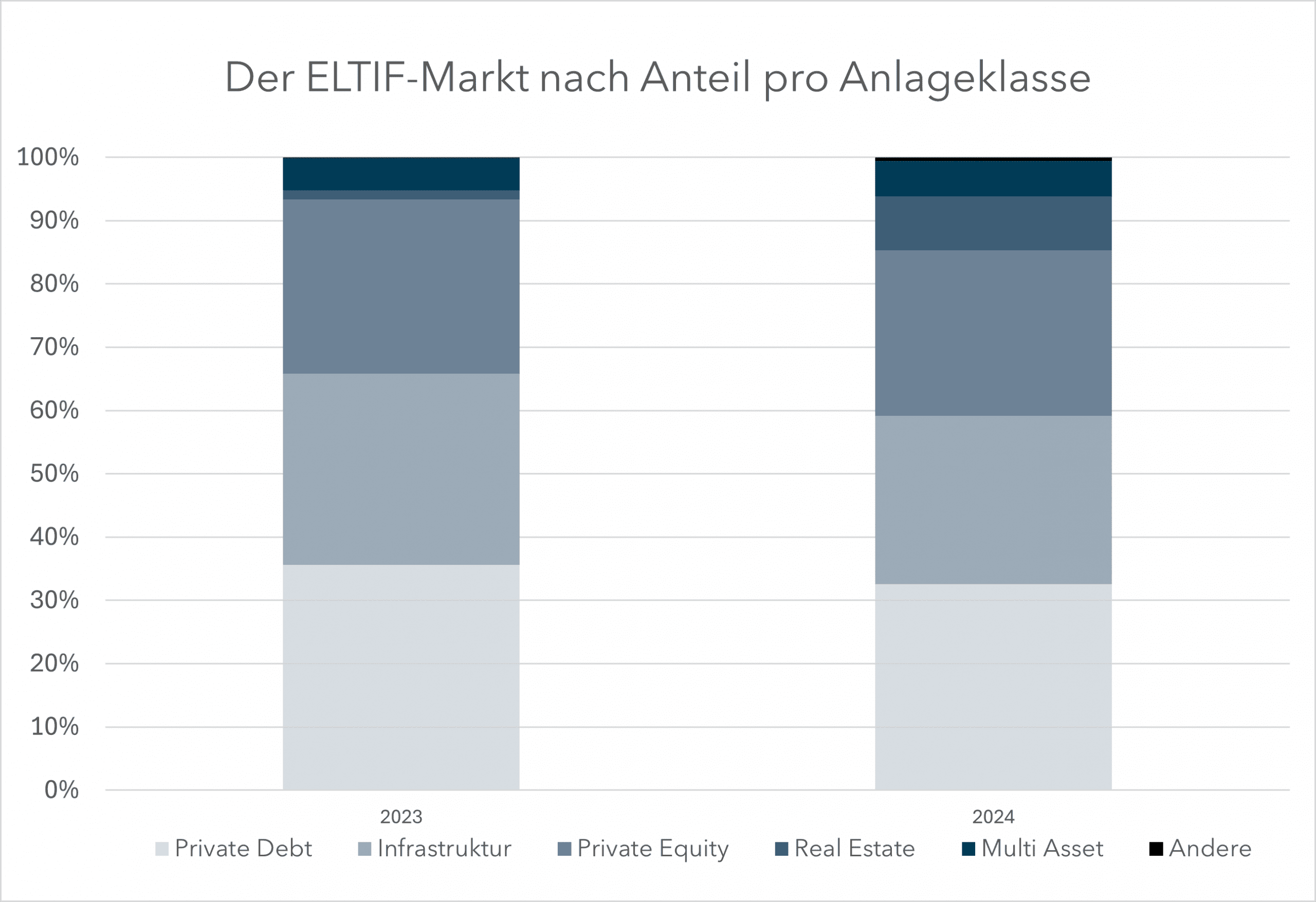

The year 2024 was a record year for the ELTIF industry after relaunches. However, it is striking that real estate ELTIFs have been rare so far. Only 8.5 percent of the total ELTIF volume is accounted for by real estate. The ELTIF can certainly be an alternative to the classic real estate fund, as a comparison shows.

ELTIF versus open-ended real estate mutual fund

For asset managers who also want to sell their real estate funds to retail and private investors, an open-ended real estate mutual fund in accordance with Sections 230 et seq. of the KAGB and the ELTIF is an option.

According to the KAGB, the open-ended real estate mutual fund has a strict catalogue of investments for the asset : according to this, the fund’s portfolio managers are allowed to invest in real estate, rights equivalent to real estate and participations in real estate companies and, for liquidity management reasons, acquire certain securities, money market shares and bank deposits. The situation is different with the open ELTIF – usually called semi-liquid ELTIF in practice. As a multi-asset product, it is allowed to invest in private equity, private debt and infrastructure in addition to real estate. In particular, real estate is subject to a rather broad definition of tangible assets in the ELTIF. This can facilitate the acquisition of foreign real estate or even enable the acquisition of a hotel property and its operation, for example.

The portfolio composition of the ELTIF is also worth mentioning: the borrowing limit may not exceed 50 percent of the ELTIF’s net asset value. In order to establish a certain comparability in the following, it should be noted that this limit corresponds approximately to a Loan To Value (LTV) of 33 percent. In the case of open-ended real estate mutual funds, borrowing is a maximum of 30 percent of the market values – which in turn corresponds to an LTV of around 30 percent. Apart from that, the rules for the portfolio composition of the ELTIF are less fragmented and thus less complex, but more flexible to handle.

Fund platforms shy away from the manual effort of new deadlines for ELTIFs.

There are also differences in liquidity management . In the case of open-ended real estate mutual funds, redemptions are only possible after a 24-month holding period and a 12-month notice period. These requirements have proven to be a support in practice, especially in recent years and various crises. In the case of the ELTIF, the legal requirements are very extensive and complex, but can be designed flexibly. However, initiators on the market do not often use this at the moment. This is because fund platforms, on the other hand, shy away from the manual effort of new deadlines, which is why they sometimes only accept the holding and termination periods of the open-ended real estate mutual fund.

The public ELTIF can be authorised for cross-border distribution throughout the EU via the EU passporting procedure. This does not apply to the open-ended real estate mutual fund. With this advantage, the simpler and more flexible handling of the portfolio composition and the slightly higher borrowing limit, the ELTIF outshines the open-ended real estate mutual fund.

ELTIF versus open-ended special real estate fund

If, on the other hand, asset managers want to sell their real estate fund exclusively to (semi-) professional investors, the ELTIF must compete with the open-ended special AIF in accordance with Section 282 KAGB or the practice-relevant open-ended special AIF with fixed investment conditions in accordance with Section 284 KAGB.

The scope of application for the asset of open-ended special AIFs is broader than that of open-ended real estate mutual fund. In addition to real estate and real estate companies, the open-ended special AIF with fixed investment conditions can also acquire securities, money market instruments, derivatives, bank deposits, investment shares, infrastructure project companies, precious metals, unsecuritised loan receivables, company shareholdings and crypto assets. The open-ended special AIF according to Section 282 KAGB goes even further: only the market value of the asset must be determinable. As already explained, the ELTIF also enables a broad portfolio – this does not change even if initiators only want to sell the ELTIF to (semi-)professional investors.

Fund managers are allowed to raise more debt capital with special funds than with an ELTIF.

Regarding the portfolio composition: ELTIF managers must invest at least 55 percent of their capital in the eligible investment assets – even if the ELTIF is only distributed to (semi-) professional investors. However, a single, eligible investment asset may then also account for more than 20 percent of the capital of the ELTIF and ELTIF managers can borrow 100 percent of the net asset value. This corresponds to an LTV of around 50 percent.

Now let’s take a look at the open-ended special ETFs: The principle of risk mixing must be adhered to for both KAGB fund vehicles. According to the currently prevailing opinion and practice, this principle is observed in the case of more than three assets with different investment risks. Otherwise, the open-ended special AIF does not have a fixed borrowing limit under section 282 KAGB. In order to differentiate yourself from hedge funds, however, the limit should be an LTV of around 75 percent. The open-ended special AIF according to Section 284 KAGB is allowed to take out loans up to 60 percent of the market value of the real estate in the fund. This, in turn, corresponds to an LTV of about 60 percent. Fund managers are therefore allowed to raise more debt capital with special funds than with an ELTIF.

Maximum borrowing per fund structure measured by the simplified calculated LTV

| ELTIF | Real estate funds according to KAGB | |

| Fund distributed to private and (semi-)professional investors | approx. 33 percent | approx. 30 percent |

| Fund that is only distributed to (semi-)professional investors | approx. 50 percent | approx. 75 percent (§ 282 KAGB), or approx. 60 percent (§ 284 KAGB) |

Source: Own calculations

The liquidity management of an ELTIF, which is only sold to (semi-)professional investors, is no different from that of an ELTIF, which is also suitable for private investors. For the open-ended special AIF pursuant to section 282 KAGB, it is only necessary that the assets must be sufficiently liquid to enable the redemption of shares or shares provided for in the special AIF. For the open-ended special AIF with fixed investment conditions, Art. 46 to 49 of the Delegated Regulation (EU) No. 231/2013 (Level II Regulation) is decisive for liquidity management rather than the KAGB. Accordingly, the capital management company must ensure that it has liquidity management and procedures in place to monitor liquidity risks. It must also ensure that the liquidity profile of AIF investments is consistent with its underlying liabilities. As a result, there are no significant differences between ELTIFs and open-ended special AIFs. Both the ELTIF and the special fund can exploit the advantage of cross-border distribution , and EU passporting is possible for both.

The Bottom Line

It can be said that the open-ended special AIF according to Section 284 with fixed investment conditions is structurally optimally positioned for the launch of real estate funds and, in particular, allows more borrowing, which is why it should continue to be the rule in practice.

However, the following anecdote proves that ELTIFs can be a good and perhaps even better idea alongside real estate mutual funds: In 2024, an asset manager transferred two of its previous real estate funds to an ELTIF structure. The asset manager’s argument: a larger investor base and more international sales. It is therefore conceivable that the ELTIF will also become more important as a real estate fund and will become an alternative for open-ended real estate mutual funds under the KAGB. The fact that this has not been the case so far is probably also due to the fact that the ELTIF 2.0 was born into a difficult time for the real estate market.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information