The price developments of real estate stocks and REITs have largely stabilized in the past six months (as of the end of September) after a short phase of higher volatility. However, they are lagging behind the general stock market development, which in some cases set new price records. While interest rates in the euro area are likely to have consolidated, the further development of interest rates after a first key interest rate cut in September and in view of political pressure remains unclear. The resulting exchange rate development between the euro and the US dollar was clearly noticeable in the performance of the exchange rate development.

Compared to the S&P, the development of listed real estate stocks and REITs was much more subdued. The total return of the FTSE EPRA Nareit Index was 3.8% for North America and 5.8% for Europe. In each case, it was slightly below the performance of the DAX.

“Real estate stocks are currently unable to keep up with the technology-driven boom, especially in the S&P 500 index. Compared to the high valuations of the general equity market, the real estate sector can currently be considered moderately priced on the basis of implied cap rates and NAV spreads. A comparison of the real estate segments continues to show a post-pandemic consolidation effect: the temporary exaggerations of individual segments (logistics, towers, self-storage, residential real estate in the United States) are giving way to a more balanced relationship with the overall market. Hope for the future of the office segment is given by the increasing takeover activity in the USA. The general valuation differences based on net asset value between North America and Europe remain at the expense of Europe despite the political and economic turbulence in the United States,” says Dr. Karim Rochdi, Founder and Managing Partner of AVENTOS.

Winners and losers

The outperformers of the past six months (as of September 30) were Diversified Healthcare Trust (+92%), a specialist for various healthcare and office segments in the USA, followed by the US logistics REIT Industrial Logistics Properties Trust (+85%) and the US office provider Paramount Group (+59%). However, the positive performance of all three “winners” should be seen in the light of the low starting point of their shares.

The list of underperformers is headed by the only two listed US cold storage specialists, Americold Realty Trust (-38%) and Lineage (-30%). The two cover about 70% of the American market. The business is low-margin and capital-intensive, earnings are volatile and cyclical due to their structures, and many properties are getting on in years and need to be modernized.

Transaction market in the listed real estate segment has picked up speed

Transaction activity on the real estate market as well as in the listed real estate segment has slowly increased again in recent months, albeit at a low level. For example, there were some notable transactions in the observation period from April to September 2025. The European healthcare sector ranked first and third among the largest transactions in the period under review: the acquisition of the Belgian nursing home company Cofinimmo by the competitor Aedifica, also listed in Brussels and active in several European countries, for 5.6 billion euros, and the acquisition of the British healthcare REIT Assura by the British Primary Health Properties for the equivalent of 3.5 billion euros. In all likelihood, the second-largest deal of the period will be the €4.9 billion privatization offer of the U.S. office REIT Paramount Group of listed investment manager Rithm Capital, which was published in September. Together with the acquisition of City Office REIT by affiliates of Paul Singer’s hedge fund Elliott Management (1.0 billion euros) and the ultimately rejected offer for Orion Properties (0.6 billion euros), the offer for Paramount indicates the increasing interest of opportunistic buyers in the North American office segment.

In addition to complete company takeovers, the increasing preoccupation of activist investors with the real estate sector continues to be noticeable. For example, in addition to the aforementioned City Office offering, Elliott Management also had commitments to two major US REITs (data center REIT Equinix and US logistics REIT Rexford Industrial).

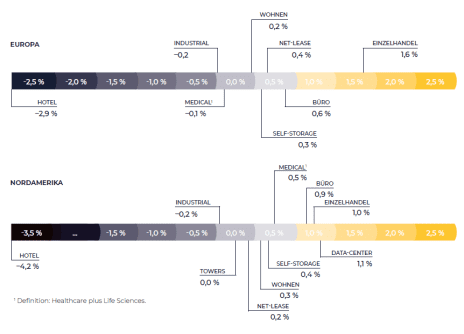

ACM Sector Momentum

The “ACM Sector Momentum” indicator compares the current pricing of a sector based on the implied cap rates with the pricing of the overall market and compares the price difference with the historically observed implied cap rates (since 2020). A sector with a negative momentum value is therefore priced relatively low on the stock exchanges by historical standards, while a sector with positive momentum is relatively high – always measured by the implied cap rates. Relatively high implied cap rates correspond to relatively low valuations.

The values for the “ACM Sector Momentum” are now strongly influenced by the gradual normalization of the special effects of the pandemic that have prevailed in recent years. It is striking that the logistics segment on both continents is losing the (comparatively) high valuations of recent years. The observed convergence of implied cap rates in a segment comparison is therefore also reflected in the momentum values. Relative winners on both sides of the Atlantic are, unsurprisingly, the traditional retail and office sectors. The special role of the US data center sector continues to be eminent. The valuation corrections of other segments are not seen due to the dizzying demand for capacity in data centers. For the hotel segment, there is still a special effect resulting from the slump in revenues in the first pandemic years of 2020 and 2021, which temporarily pushed the segment’s implied cap rates close to zero in these years.

The entire report as well as other publications by AVENTOS on real estate stocks and REITs can be found in the AVENTOS Capital Markets MAGAZINE. There you will find current technical articles from AVENTOS Capital Markets, such as detailed equity research papers and well-founded market commentaries by AVENTOS experts.