Investment market delivers its best performance of the year so far in the third quarter

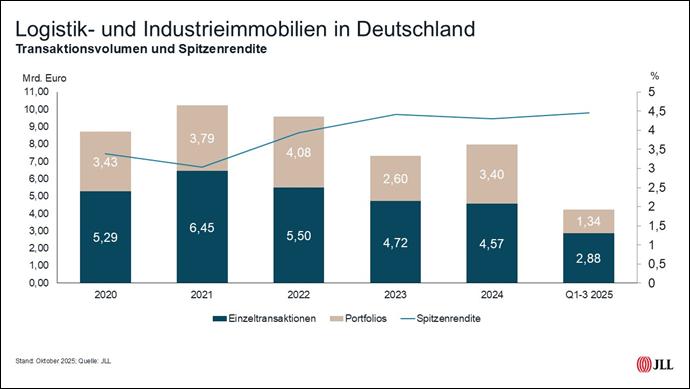

The German investment market for logistics and industrial real estate recovered noticeably in the third quarter of 2025, reducing the gap to eleven percent compared to the previous year. At the end of the first half of the year, this had been 24 percent. In the third quarter, the market achieved a transaction volume of 1.8 billion euros, by far the highest quarterly figure this year. In total, 4.2 billion euros are on the books after three quarters. The average deal size rose significantly from EUR 20 million in the previous quarter to EUR 30 million, which is why a significantly higher volume was achieved even with a decline to 61 transactions after 65 in the second quarter and 67 in the first quarter.

“The positive development is due to increasingly larger deals with medium volumes,” says

In a comparison of the risk classes, core-plus properties clearly lead the field at 44 percent, but are below their five-year average of 53 percent. In the past three years, their share had always been more than 60 percent. Although the core segment again rose slightly to 23 percent, investors remain selective here. Meanwhile, value-add products are much more in demand than in previous years at 22 percent, while opportunistic properties only account for eleven percent.

International market participants were more active on the buy-side at 62 per cent, while they were responsible for only 15 per cent of the volume on the sell-side. On balance, they have thus built up their real estate portfolio by almost two billion euros in the year to date. “The third quarter in particular gave a boost here, and it is having an effect that international investors seized the opportunities on the German market in some cases well ahead of domestic players and have now completed these transaction processes,” Schumann analyses.

In a quarter-on-quarter comparison, there was a slight correction in prime yields in four cities: Berlin, Düsseldorf, Cologne and Stuttgart recorded an increase of ten basis points to 4.50 percent, while Frankfurt, Hamburg and Munich remain at 4.40 percent.