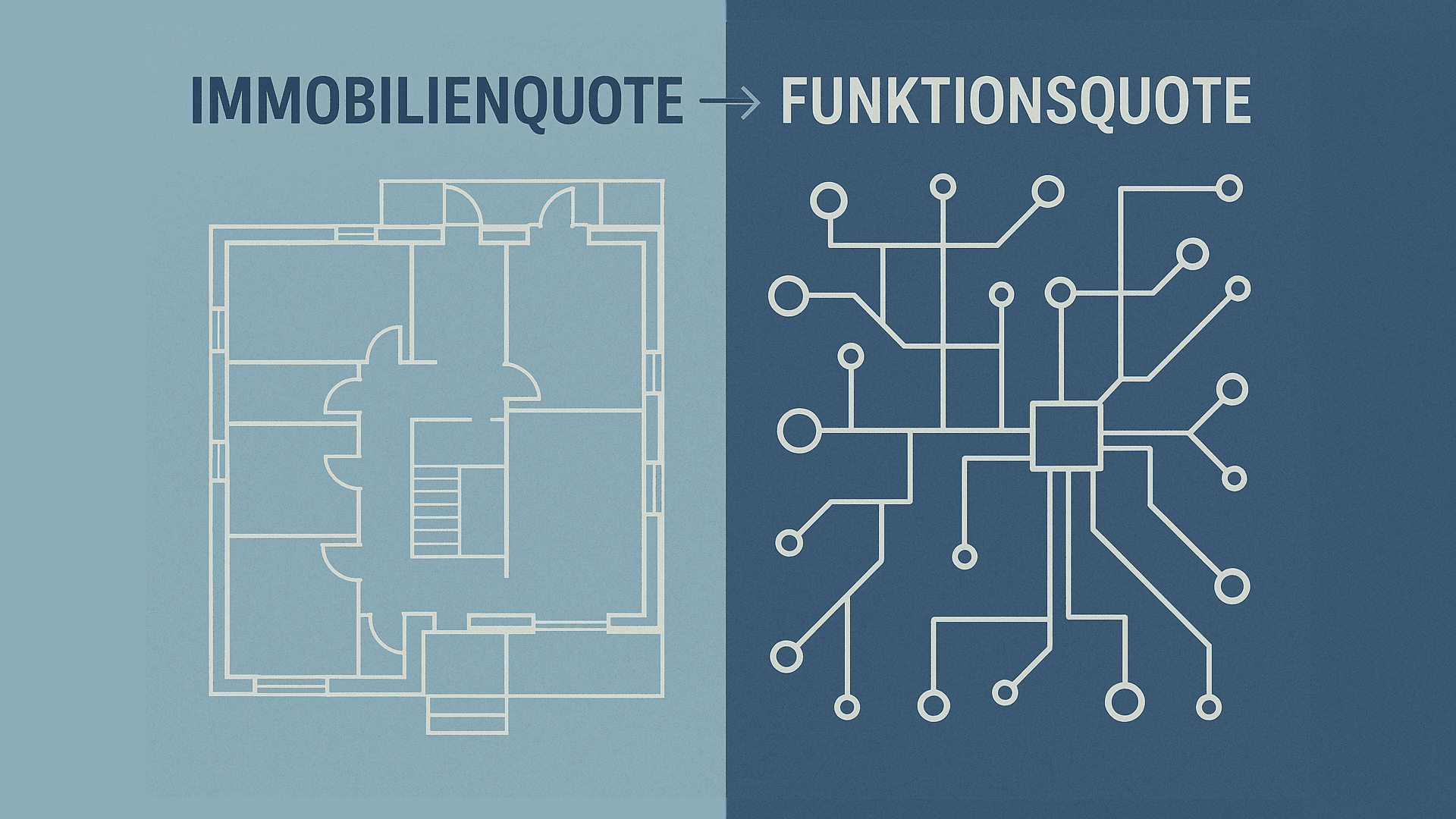

Institutional investment has a fixed coordinate: the real estate quota. A clear, established component in the portfolio – easy to explain. But isn’t this view starting to fall short? Anyone who still asks for a real estate quota in the context of institutional real asset investments today may miss the development towards a supply and function quota.

Function instead of category

This is because real plants are no longer defined only by their structural form or rental contract structures, but by their role in the supply system of a modern economy:

- Provide and store energy

- Transporting and processing data

- Securing health and care services

- Enabling mobility

- Operate neighbourhoods, not just build on them

Capital is increasingly oriented towards function instead of category.

Regulation is still anchored in segments — reality has long since arrived in systems

The introduction of an infrastructure quota in the AnlV was an important step. And at the same time, it makes visible how traditional logic reaches its limits:

Real estate in one quota, infrastructure in the other. This separation can hardly be maintained in modern value creation. Examples:

- A data center is structurally a building,

but operationally a network and energy object. - The residential quarter is increasingly becoming an energy and mobility hub.

- Logistics locations are also part of public services.

- Nursing campuses and clinics are care clusters, not just objects.

While regulation is still clinging to the tried and tested categorization, reality has long since arrived in systems.

Anecdotal but significant finding: Expo Real

An anecdotal but significant finding: Expo Real this year.

Actually, the classic real estate fair. But the program now regularly shows formats on:

- Data Center Locations

- Energy and grid infrastructure

- digital supply and critical systems

If even the leading forum of the real estate world discusses connected load, data throughput and energy capability, then reality has shifted

– from the square metre to the logic of supply.

📌 Relevant follow-up questions: What does this mean for institutional real assets investment?

The exclusively regulatory valuation of real assets may be misleading in the actual management of the capital investment. Because even if the categories remain, new questions arise for the institutional investor:

- How do you measure supply capacity in the context of a portfolio?

- What role do connectivity, resilience, operating models play?

- What key performance indicators are created beyond vacancy, rent, IRR and LTV?

- And how do you integrate hybrid assets that don’t lie neatly in any drawer?

- Certainly more questions, which the author of this column himself does not yet know…