In the third quarter of 2025, the Global Retail Attractiveness Index (GRAI) by Union Investment and NIQ-GfK confirms the continuing positive trend in the European retail markets. The EU-15 region clearly leads the global ranking, ahead of North America and the Asia-Pacific region. Despite a tight labour market and divergent national developments, consumer confidence and retail sentiment continue to rise, cementing Europe’s position as the world’s most attractive retail market. The EU-15 Retail Index reached a new high of 116.6 points, underlining the strong performance of the region.

The Global Retail Attractiveness Index (GRAI), which summarizes consumer and retail confidence, unemployment rate and retail sales, shows that Europe continues to be the most resilient retail region with a score of 116.6 points, significantly outpacing North America (97.54 points) and Asia-Pacific (96.3 points). Despite global challenges such as inflation, labour shortages and fluctuating demand, Europe is managing to maintain stability and maintain high consumer loyalty.

“The improved sentiment in retail investment is reflected in the new high of the EU-15 index, which for the first time exceeds the value from the first quarter of 2018. However, developments in Europe vary at the country level, with different labour market data in particular having a dampening effect. For experienced asset and investment managers, this offers attractive opportunities for targeted purchases and sales of retail properties,” says Roman Müller, Investment Management Retail at Union Investment.

Overall, the GRAI shows that European consumers remain engaged, retailer confidence is increasing in key regions, and retail is gaining momentum – positioning the European retail industry not only stable, but for active growth in 2026.

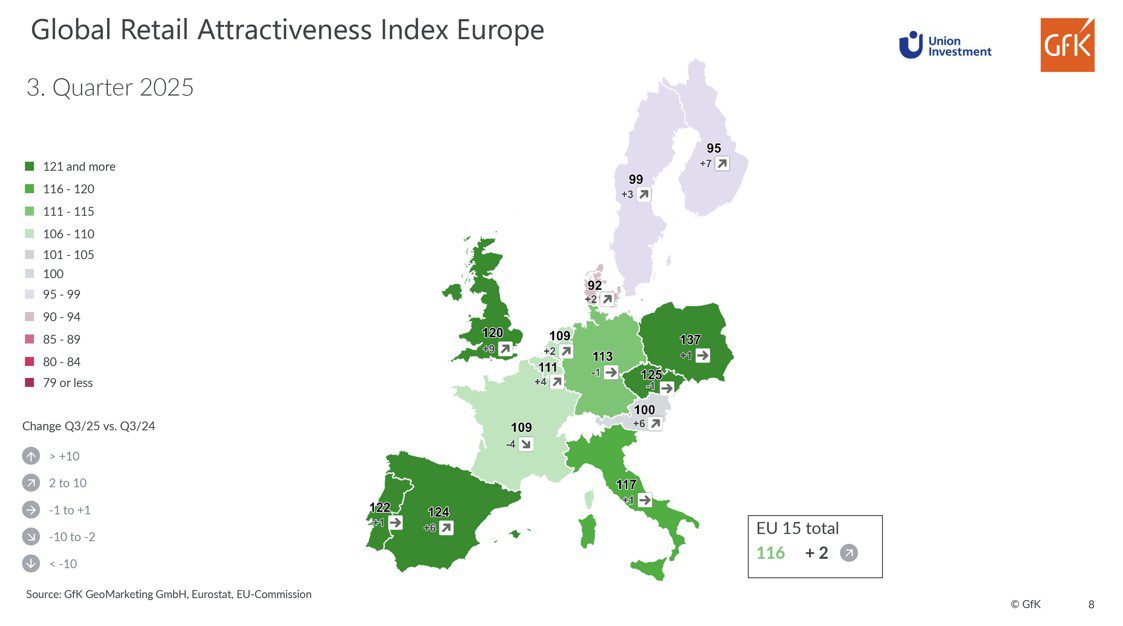

Although the EU-wide overall gives a clear signal of growth, national developments show a differentiated and dynamic picture within Europe. The strong increase in consumer confidence is particularly striking in Southern Europe and Eastern Europe, especially in Spain (+18.2 points), Poland (+6.6) and the Czech Republic (+6.8). Spain recorded the largest growth in Europe, indicating a recovery in household confidence and consumer spending after a period of stagnation.

Denmark, Finland, Austria and Sweden have the lowest scores in the Retail Attractiveness Index among the 15 markets surveyed. Austria continues to suffer from high inflation, while the three Nordic countries are severely affected by the Ukraine crisis. With scores of 91.9 (Denmark), 95.5 (Finland), 98.6 (Austria) and 98.9 (Sweden), they are well below the EU-15 average of 116.6 points.

France, Germany and the Czech Republic are facing challenges. France recorded the sharpest decline compared to Q3/2024 with a 10.8-point decline in consumer confidence and an overall loss of 4.1 points in the Retail Index, reflecting the ongoing macroeconomic uncertainties. Germany and the Czech Republic also recorded slight declines in confidence on the dealer side by 1.2 and 1.4 points respectively compared to the previous year. In contrast, the United Kingdom shows the greatest improvement of all European countries covered in the survey, with an increase of 8.7 points in the current Retail Index.