Business & Real Estate: Two Perspectives, One Location

The following analysis summarizes the central contents of the Expo Real special edition of the webinar series “Macro Matters – The KINGSTONE View“. The article was written by Sebastian Müller, junior analyst at KINGSTONE Real Estate. As part of Expo Real 2025 in Munich, another edition of the series was held – this time with a clear focus on North America. In this special edition, Wenzel Hoberg (FIERA Real Estate), Prof. Dr. Ulrich Nack (EBZ Business School) and Maximilian Radert (KINGSTONE Real Estate) discussed Canada as a complementary target market for institutional investors from German-speaking countries. The focus was on the country’s macroeconomic strengths – stable population growth, reliable institutions and a solid financial position – as well as the geopolitical and economic policy factors that make Canada a stable investment haven. In addition, the real estate market was analysed, which impresses with its high level of transparency, low vacancy rates and a structurally growing demand for space, especially in logistics and housing.

Economy in Focus: How Canada Performs Internationally

The Canadian economy is supported by a broadly diversified service sector and a strong energy industry. According to the IMF, Canadian GDP growth remains solid and low volatile; 1.2% is expected for 2025 and 1.3% for 2026. Canada is thus on a stable growth path. The US, on the other hand, faces significantly higher economic uncertainties in view of Trump’s policies, including tighter tariffs, the risk of financial repression and possible interventions in the independence of the central bank. In 2025, the construction and real estate-related services sector accounted for the largest share of value added at around 13%, followed by manufacturing (9%), health and social services (8%) and financial and insurance services (7%). This sectoral breadth underlines the structural resilience of the Canadian economy. At the same time, although Canada has not yet succeeded in fully translating the strong population growth of around 1% per year into productivity gains, it is focusing specifically on a skills-oriented immigration policy that offers considerable growth potential in the long term. This model is increasingly seen as a point of orientation for German migration policy.

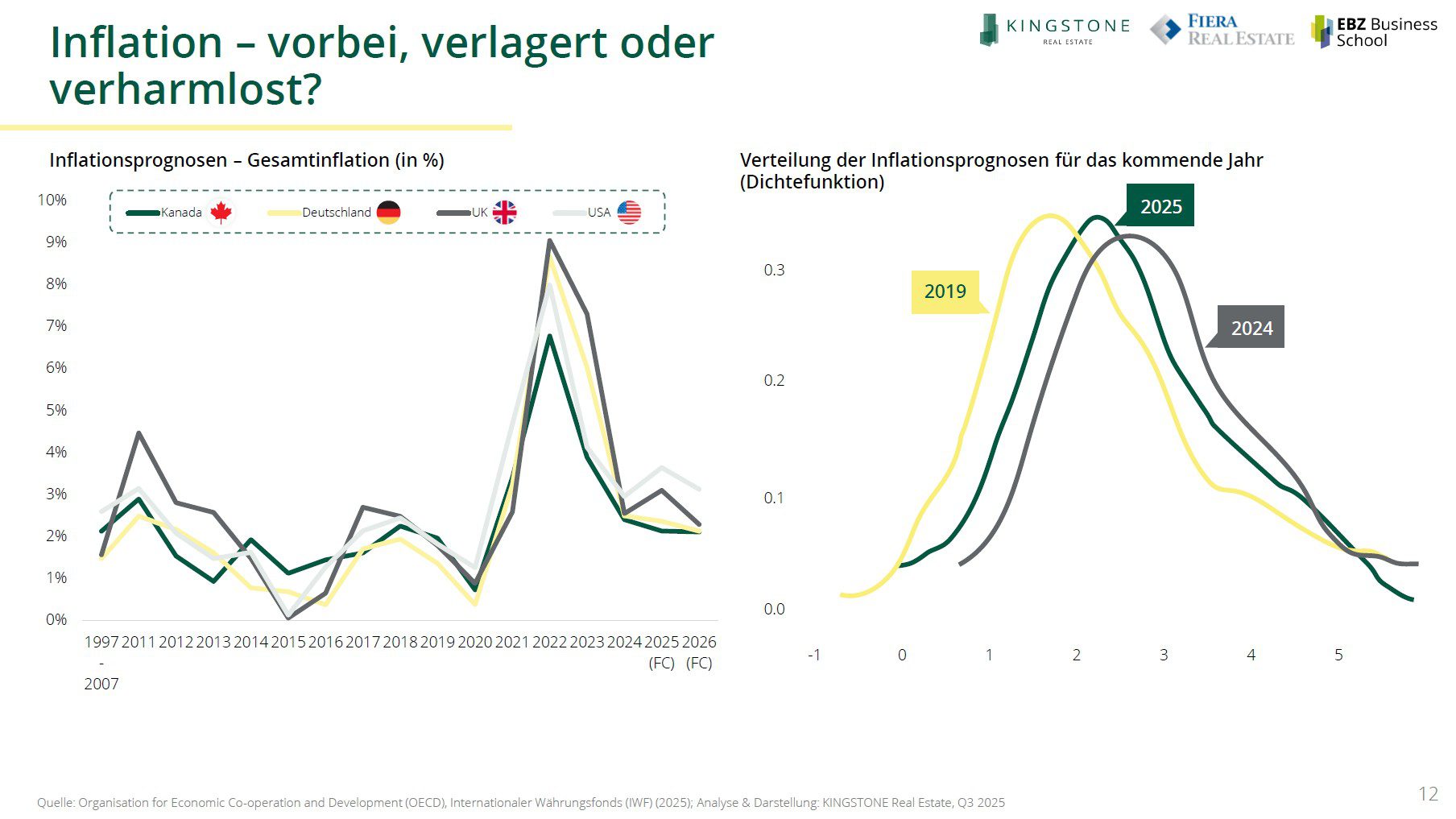

Inflation – over, relocated or trivialized?

The monetary policy dimension is becoming increasingly important as it determines whether economic momentum can be translated into real growth. Canada has overcome pandemic-related high inflation, which was largely driven by energy prices, comparatively quickly: Inflation was already 2.8% in 2023, well below the German annual figure of 5.9%. In September 2025, the inflation rate was 2.4%, while the core rate remained stable at 2.8%. By 2030, an average price level of around 2.1% is forecast, slightly below expectations for the US and Germany. The Bank of Canada responded with a clear realignment, cutting the key interest rate to 2.25% at the end of October 2025 after tightening to 5% in 2023. In the medium term, a level of around 2.7% is expected – slightly above the euro area and China, on a par with the USA. As the central bank of a small currency area, the BoC has traditionally been closely guided by the monetary policy signals of the US Federal Reserve. Against this backdrop, the Canadian dollar shows low volatility, while the US dollar has recently lost stability despite higher interest rates due to trade policy uncertainties and economic policy volatility under the Trump administration. For investors, this means more stable returns in real terms and greater predictability.

Canada’s Demographics in a Global Context

Canada has an exceptionally dynamic population development. With growth of around 1.8% in 2024 – over 700,000 additional inhabitants – the country is one of the fastest-growing industrialised countries. Qualification-oriented immigration policy stabilises the labour market and cushions the demographic ageing process. By 2040, Canada will be the clear leader of the G7 in terms of expected population growth. This is a key driver of long-term demand for residential and commercial real estate.

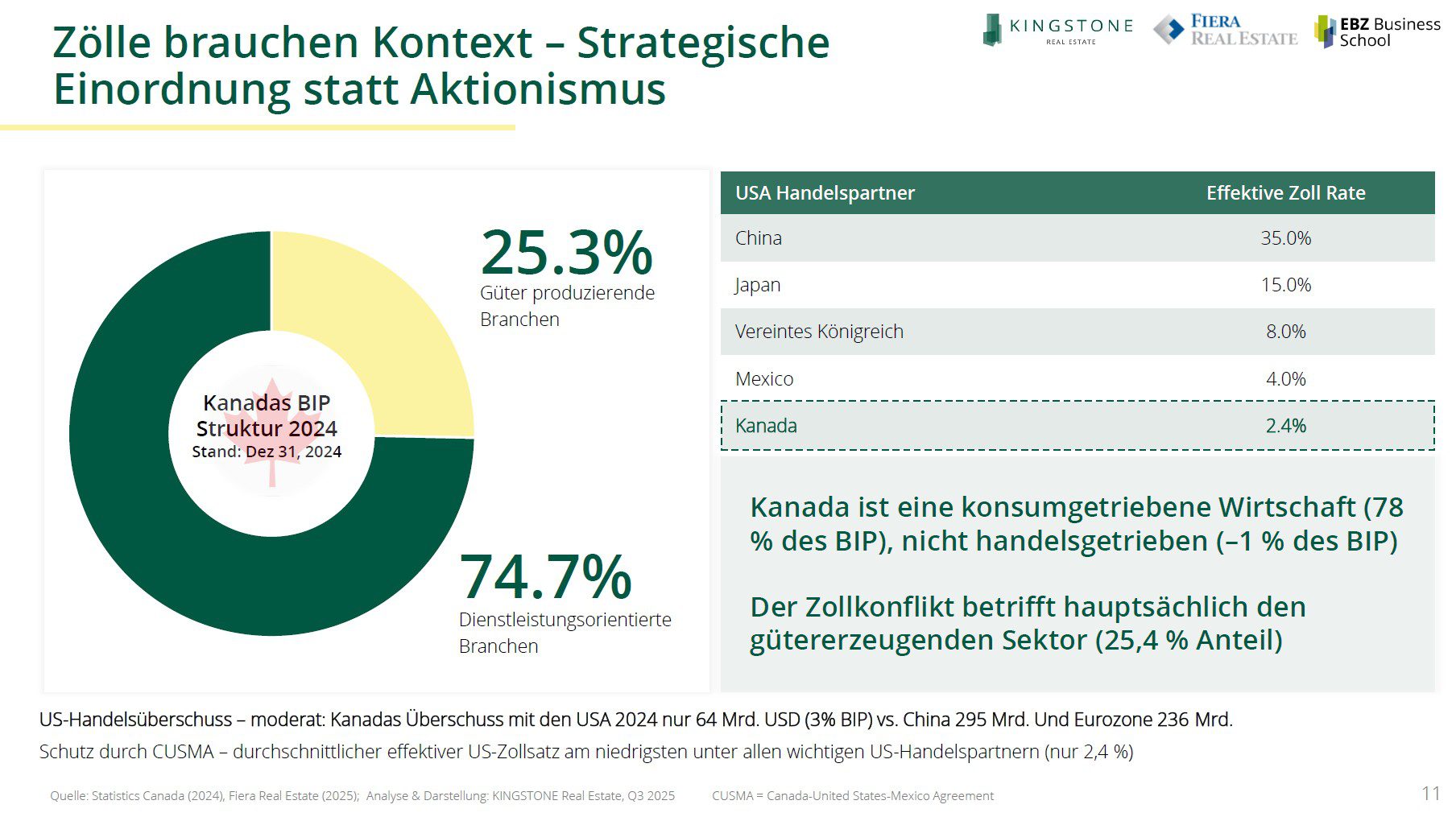

Canada’s resilience in a protectionist world

In recent years, there has been a clear trend towards protectionist measures around the world – a process that was already apparent before Donald Trump’s term in office and accelerated significantly under him. With his openly protectionist stance (“I love tariffs“), the number of additional tariffs and trade restrictions increased noticeably. Canada was also repeatedly targeted and faced nominal punitive tariffs of up to 35%. At first glance, this could indicate a particular vulnerability to US trade barriers. In fact, however, Canada is proving to be remarkably resilient. The country’s close integration into North American production and supply chains as well as the trilateral Canada-United States-Mexico Agreement (CUSMA) protect the country from many additional US tariffs and punitive tariffs. In addition, the Canadian economy is less export-driven than consumption-driven, which means that external shocks have less of an impact. Calculatedly, the effective US tariff rate on Canadian products is only around 2.4%

Other fundamentals that strengthen Canada

Canada has an exceptionally strong commodity base – including wood, metals, rare earths, large water reserves and oil and gas reserves – making it energy and import independent in key areas. This strengthens geopolitical stability. At the same time, Canada is one of the leading sustainable economies in the world. Strict environmental standards, an ambitious climate policy, a growing share of renewable energies and transparent governance structures create reliable framework conditions for long-term investments.

In our view, Canada is one of the few G7 markets with a permanently attractive investability – close to the US in terms of growth, but at the same time with significantly higher political stability.

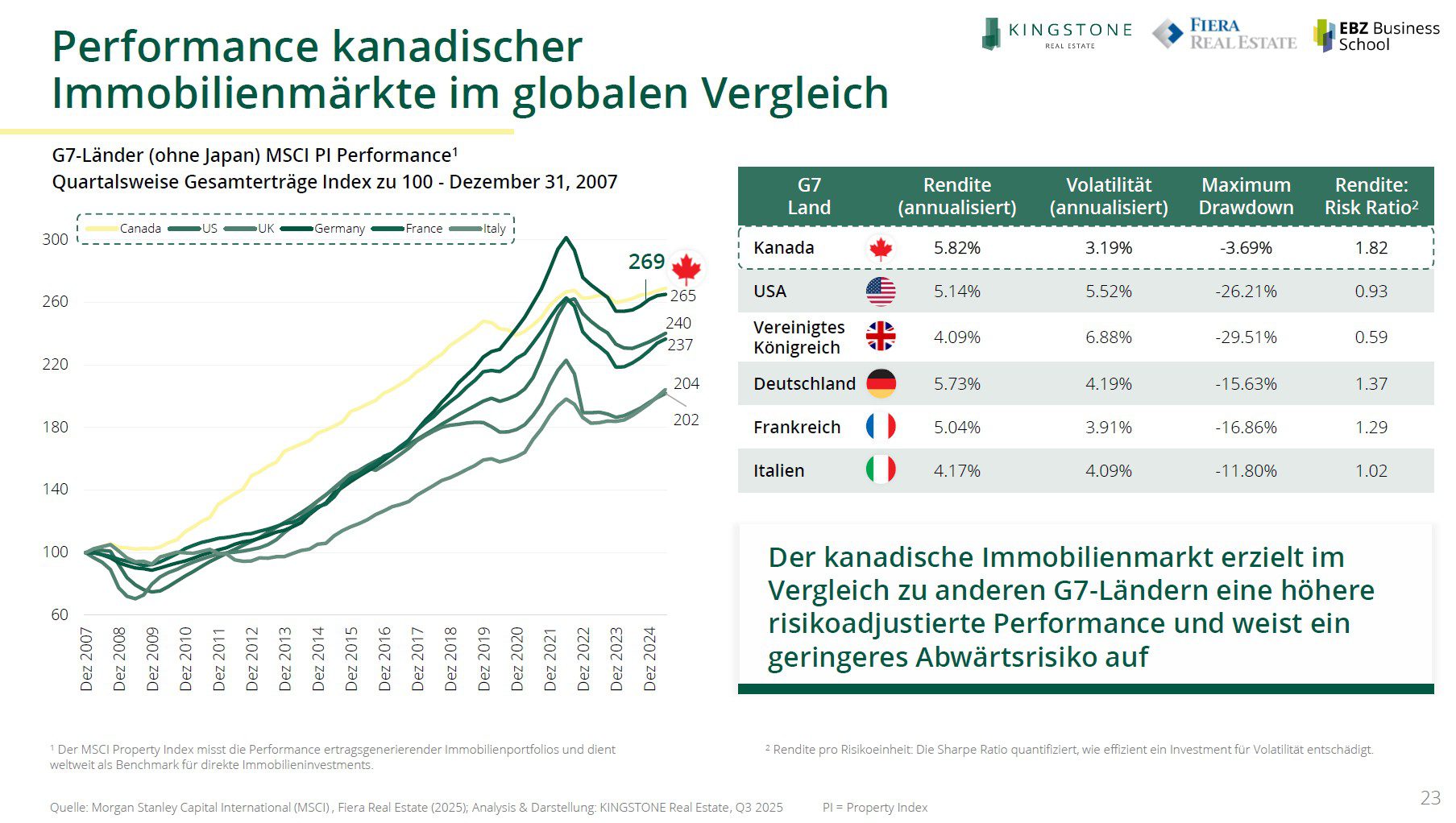

Drivers of stability and growth in the real estate market

Canada is one of the largest and most transparent real estate markets in the world. In 2024, transactions worth USD 44.4 billion were made, which is around 10% of the estimated total market size. More than 100 years of analysis confirm the market’s exceptional resilience to economic cycles. In the G7 comparison, Canada has the highest Sharpe ratio – the result of stable returns with low volatility and low cyclicality. The residential real estate sector is also supported by structural factors: the rising house price-income ratio since 2015 does not signal speculative overheating, but the increasing housing affordability problem and the continuing excess demand. Housing remains structurally scarce, and demand is high due to strong demographics. For institutional investors, this creates a long-term stable submarket.

The investment behaviour of large Canadian pension funds is also showing interesting shifts. While they have traditionally had a strong international focus and have been among the most active investors in the US real estate market, a significant decline in acquisitions was observed in 2024. At the same time, the domestic market is moving more into focus, which suggests that the previous home bias is being reduced. This development could become a reference model for other countries whose institutional capital flows have so far flowed disproportionately into the USA. Canada itself is thus becoming increasingly important – as a substitute for US investments and as an independent, strategically relevant market alternative.

Key results at a glance

Canada presents itself as one of the most stable and low-volatility economies within the G7. The country’s resilience is ensured by its robust macroeconomic base, targeted migration model, and investor-friendly monetary and monetary policy environment. This stability is directly reflected in the real estate market, which impresses with its high level of transparency, low volatility and the highest Sharpe ratio in the G7 comparison. Structural demand impulses – especially in housing and logistics – underpin the long-term attractiveness of the market. Canada is thus increasingly becoming a strategic alternative to US investments and a reliable location for long-term institutional investors.