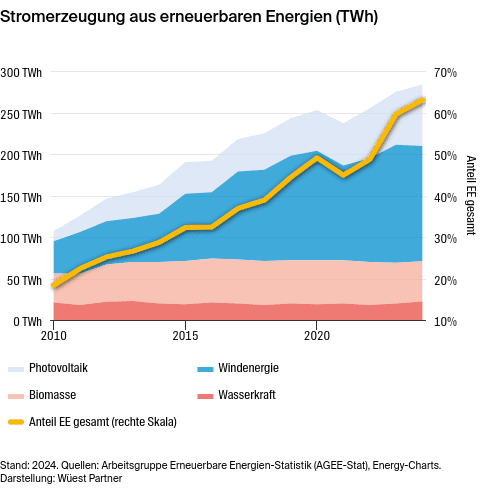

Germany is basically on track with the energy transition, but progress is uneven. This is shown by the new “Renewables Report Germany 2025: Real Estate and Renewable Energies” by Wüest Partner. In the first half of 2025, around 61 percent of net electricity already came from renewable energies, an increase of 3.2 percentage points compared to 2023. This means that renewables have become the mainstay of the energy supply. Photovoltaic rooftop systems in particular are becoming the engine of the energy transition, and real estate investors are playing a key role in this.

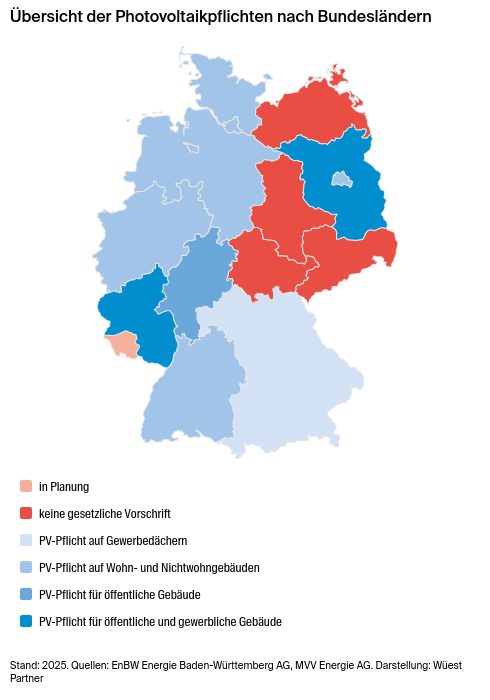

In the 25th anniversary year of the Renewable Energy Sources Act (EEG), the report concludes that the expansion of renewable energies is progressing well overall, albeit with clear differences between the energy sources. Wind power remains the most important source, but continues to fall short of the targeted expansion targets. Solar energy, on the other hand, recorded a record increase of 17.3 gigawatts in 2024. According to the EEG, at least half of the photovoltaic expansion is to be carried out via rooftop systems in the future. This will make PV rooftop systems a de facto regulatory and economic obligation and will gain significant weight in the real estate portfolio.

“If you leave available roof space unused, you are foregoing predictable additional returns, CO₂ reduction and value appreciation. The framework conditions are good enough, you just have to start,” emphasizes Thomas Lehmann MRICS, Partner at Wüest Partner.

Billion-dollar potential for real estate funds and transformation of rooftop PV

The planned Economic Development Act (StoFöG) is intended to open up a new playing field for institutional investors in the near future. In the future, they could invest up to 15 percent of their assets in project companies and purchase supplementary infrastructure such as storage solutions or charging points. The net fund volume of open-ended real estate funds alone thus holds a potential investment volume of more than 15 billion euros.

At the same time, there are structural hurdles: overloaded grids, sluggish expansion, political uncertainty on feed-in tariffs and growing phases of negative electricity prices are dampening the momentum. The share of building solar systems fell below the 50 percent mark for the first time in 2025. Without sufficient storage solutions, there is also a risk of yield losses because the number of hours with negative electricity prices is increasing and electricity is often produced when it is worth little on the market.

Nevertheless, the potential remains enormous: According to GARBE, there are around 360 million square meters of unused space on German industrial and logistics roofs – with a technically installable potential of around 36 gigawatts.

“The time of long-term guaranteed EEG payments may be over. Under these conditions, ‘business as usual’ is not possible in the long term,” says Lehmann MRICS. “For investors with a real estate background, a careful examination of the energy market before entering the market is all the more important.”

Despite the obstacles, investments in rooftop PV systems remain economically attractive. High direct consumption is the most important lever for increasing cash flow. In addition, PV systems are a strategic ESG instrument that reduces the CO₂ footprint and strengthens tenant loyalty.

Actionable insights from market leaders

The Renewables Report also includes interviews with leading market players. Thomas Kallenbrunnen (GARBE Infrastructure GmbH) and Moritz Wickert (GARBE Renewable Energy – GREEN GmbH) report on more than 100 megawatts of projects that have been implemented. Alessandro Mauri (Voltaro Energy GmbH) explains concrete remuneration models and implementation strategies.

With the Real Assets Approach, Wüest Partner also combines the areas of real estate and infrastructure in the valuation. The report thus provides investors not only with a market overview, but also with practical strategies and clear assessments of opportunities and risks.