BNP Paribas Real Estate publishes European office market data for the 3rd quarter of 2025

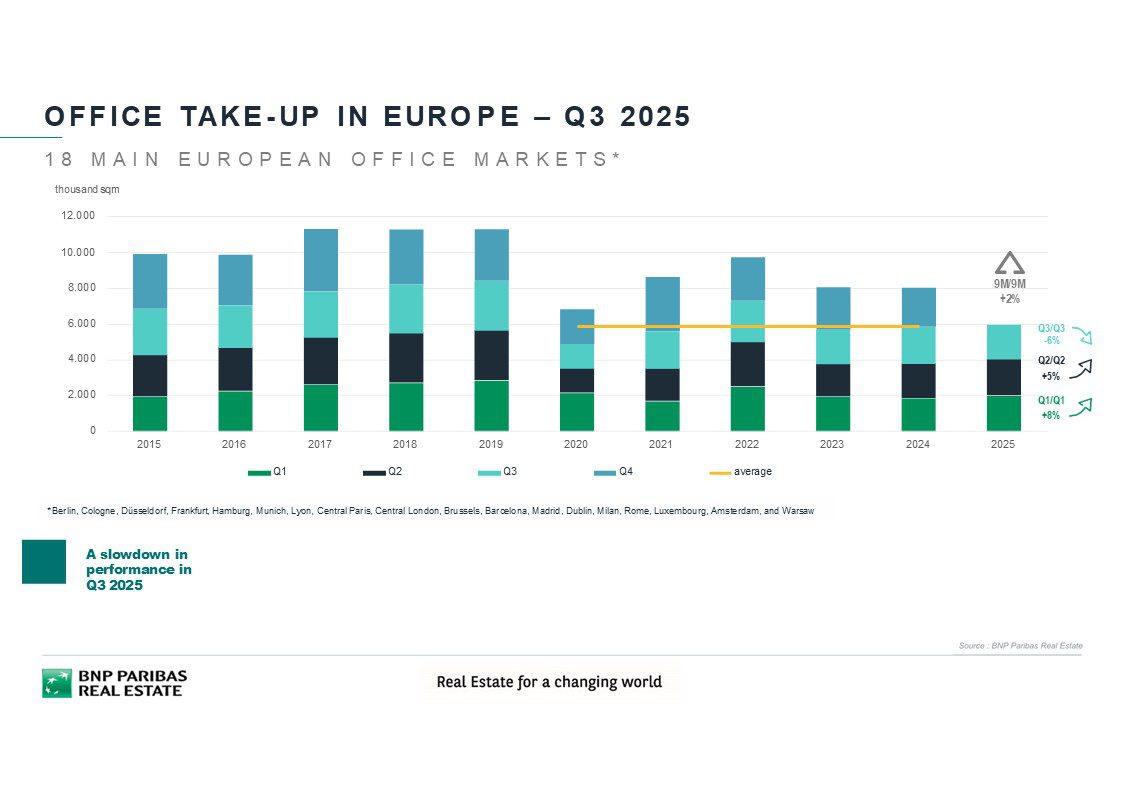

The first nine months of 2025 were promising for the European office market despite the persistently weak economic environment. Take-up in the 18 leading European markets (Amsterdam, Barcelona, Berlin, Brussels, Dublin, Düsseldorf, Frankfurt, Hamburg, Cologne, London, Luxembourg, Lyon, Madrid, Milan, Munich, Paris, Rome and Warsaw) amounted to around 5.9 million m². This means that the result is around 2% higher than in the same period of the previous year and roughly in line with the five-year average. After two relatively strong quarters, each with take-up of around 2.0 million m², however, the momentum slowed somewhat in the third quarter. This is the result of the analysis by BNP Paribas Real Estate.

The market dynamics in the top markets are currently still quite different. Some locations are more resilient than others, including Frankfurt and London, which continue to benefit in particular from mid- and large-scale deals. The German office markets (Big 6) closed the first nine months with a total letting volume of an impressive 1.9 million m². This means that the result is around 6% higher than in the same period of the previous year. With take-up of 501,000 m² (+63% year-on-year), Frankfurt’s office market is by far the most dynamic in Germany in the first nine months. It thus achieved the best interim result since 2001, with an above-average 42% of take-up attributable to the large-volume segment with more than 10,000 m² of office space. In particular, major transactions in the banking and financial services sector as well as advisory firms have a positive impact here, including Commerzbank (73,000 m² in Q1), KPMG (33,400 m² in Q2) and ING-DiBa (32,400 m² in Q2).

Driven by the regained confidence in several leading industries, London is also recording a positive trend in market development. Although major transactions are still rare, there is a brisk letting in the mid-range segment. Take-up in the centre of the British capital totalled around 860,000 m² in the first nine months of the current year, around 24% above the previous year’s figure and around a third above the five-year average. The office market in Dublin is also solid. Letting take-up amounted to around 173,000 m² (+14% year-on-year) by the end of September, exceeding the five-year average by 42%. With take-up of around 258,000 m², Barcelona recorded an above-average result (+35%). This is primarily due to the high turnover in the urban renewal area 22@Barcelona, which accounts for around 57% of the volume. The Spanish capital Madrid, on the other hand, reported a decline in take-up (-4%) at 387,000 m².

The continuing challenging macroeconomic situation is also having an impact on the French office markets. The political uncertainties in the country as well as at the international level reinforce the wait-and-see attitude of many users. For example, take-up in the centre of Paris at the end of Q3 amounted to only 1.09 million m², which corresponds to a decline of 8% compared to the previous year and a minus of 6% compared to the five-year average. In the Italian capital Rome, too, take-up is declining, which is primarily due to a certain lack of large-volume deals. At the end of September 2025, take-up was only around 94,000 m² (-28% compared to the previous year’s figure). Similar year-on-year trends were seen in Brussels and Warsaw (-18% and -1% respectively).

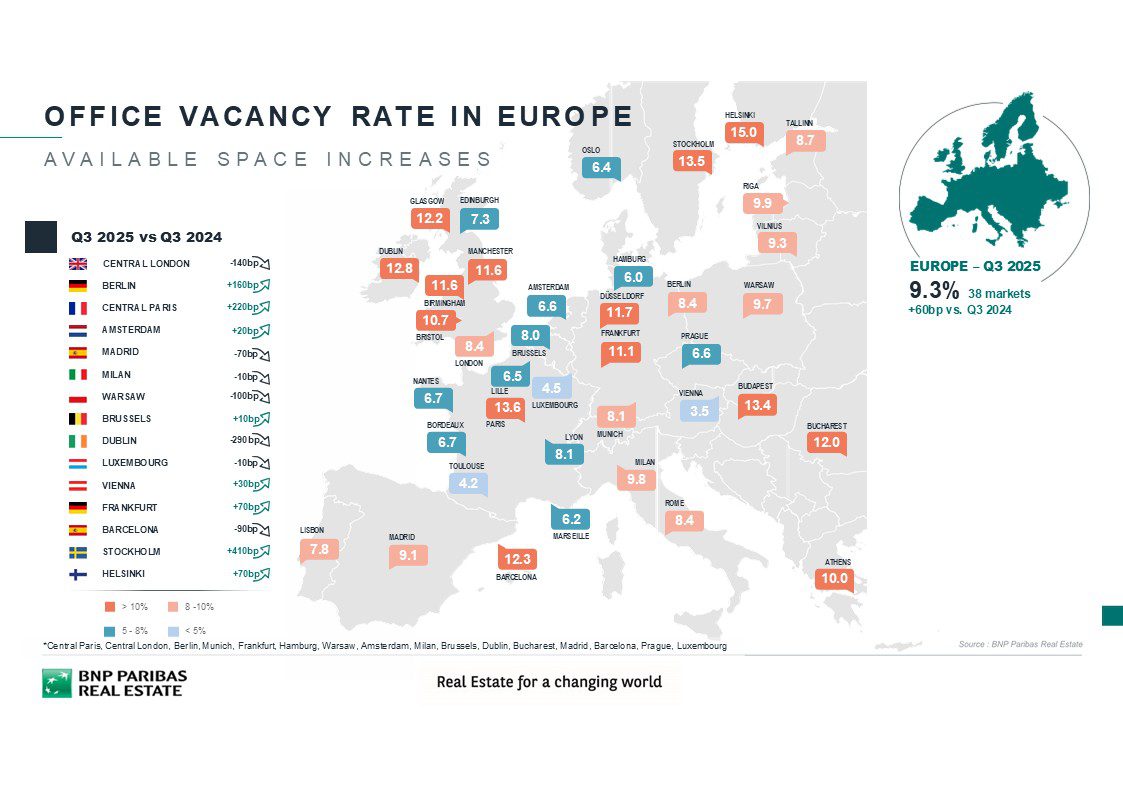

Vacancy rate continues: Modern space still scarce

The vacancy volume in the 18 leading European office markets has risen again despite declining construction activity and currently stands at 23 million m² (+6.4% year-on-year). The average vacancy rate at the end of the third quarter was 9.0%, 20 basis points higher than in the same period last year. Despite this general increase, the situation varies greatly depending on the location. While the vacancy rate in Barcelona, Dublin, London, Luxembourg, Madrid and Warsaw declined slightly year-on-year, it continued to rise in the other locations. The lowest vacancy rates continue to be recorded in Luxembourg (4.5%), Cologne and Hamburg (6.0% each) and Amsterdam (6.6%). It is 8.0% in Brussels, 8.1% in Munich and Lyon and 8.4% in Rome, London and Berlin. In Madrid (9.1%), Warsaw (9.7%) and Milan (9.8%), it remains above 9.0% despite a slight decline. By far the highest rates are recorded in Frankfurt (11.1%), Düsseldorf (11.7%), Barcelona (12.3%), Dublin (12.8%) and Paris (13.6%).

Space and location qualities decisive for vacancy development

The growing imbalance between supply and demand is noticeable in most cities: While supply remains limited, especially for modern space in central districts, vacancy rates in older, poorer quality existing buildings as well as in secondary locations and the periphery have risen considerably in some cases. In the most sought-after districts, the vacancy rate thus remains at a low level. Examples include the central business districts (CBDs) of Barcelona (2.1%), Milan (2.7%), and Munich (3.5%). In contrast, the vacancy rate in many peripheral office submarkets continues to rise and is trading in the double-digit percentage range. These values show the current focus on demand for higher-quality space equipment, very good transport connections (especially public transport) and central locations. The renewed increase in collaboration in the office, but also hybrid working, means that users prefer buildings in the established top locations more than before. In addition to accessibility, the neighbourhood and quality are also decisive for this. Across countries, the analysis shows that modern buildings currently under construction tend to be built in core areas rather than peripheral locations and are quickly absorbed by the market. High-quality space is also available at short notice in the outskirts, but these are often much less well connected, which reduces their chances of re-letting.

Furthermore, many European countries are also trying to convert old office space for other purposes in order to counteract vacancy and ultimately decay. In particular, the conversion into apartments, but also into hotels, is the focus throughout Europe. In Germany, there have been numerous repositioning and conversions since 2021, especially outside the city centres.

With the completion of new office space still limited, it is unlikely that the increase in vacancy across Europe will be exacerbated by new construction. A large part of this space has also already been pre-let. Due to persistently challenging conditions, construction activity continues to decline, so that a further decline in completions is expected in the coming months. This should allow part of the offer to be absorbed – especially if it meets user requirements in terms of location, quality and price.

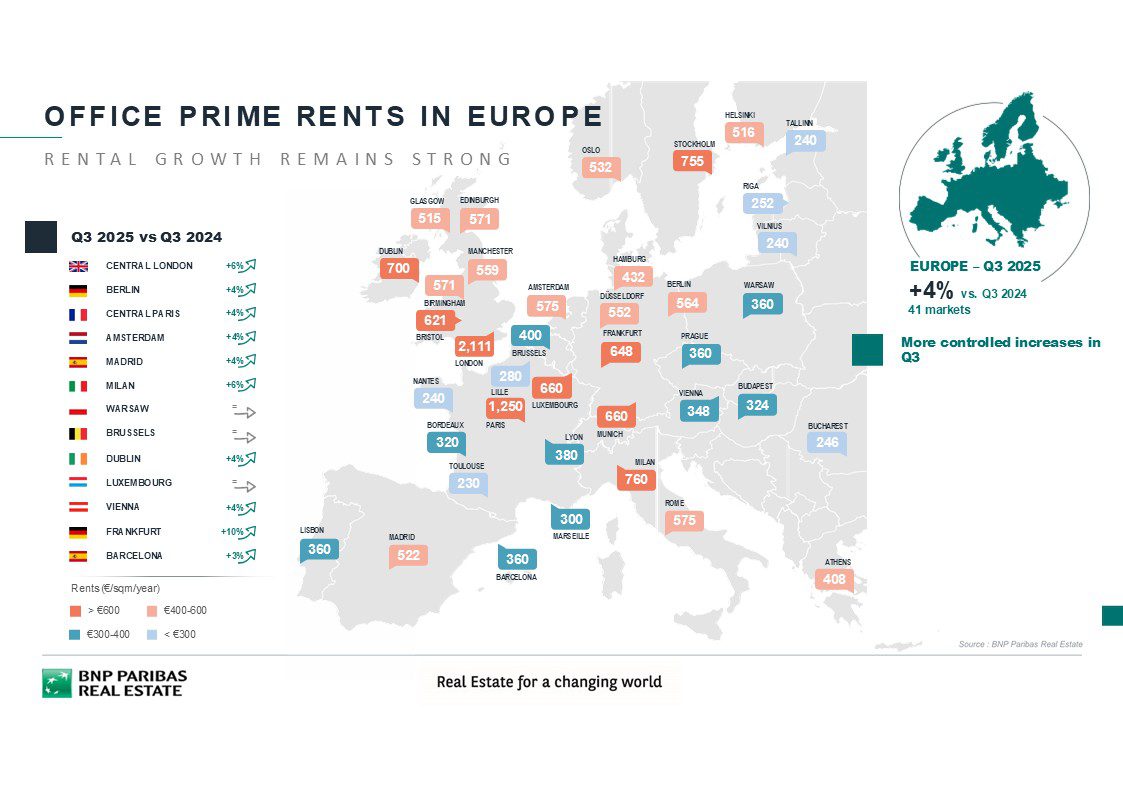

Prime rents continue to be under upward pressure

The high demand for central, high-quality real estate continues to drive up prime rents in most European cities. The shortage of supply further reinforces this trend. By far the largest year-on-year increases were recorded in Frankfurt (€54.00/m², +10%), Lyon (€31.70/m², +9%), Milan (€63.30/m², +6%), Düsseldorf (€46.00/m², +6%) and London (+6%). At a peak of €175.90/m², London continues to be the most expensive market among the 18 leading European office locations. In second place is Paris with €104.10/m² (+4%), which also exceeds the €100 mark. Prime rents have also continued to rise in Dublin (€58.30/m², +4%), Munich (€55.00/m², +3%), Amsterdam (€47.90/m², +4%), Berlin (€47.00/m², +4%), Madrid (€43.50/m², +4%) and Barcelona (€30.00/m², +3%). In Luxembourg (€55.00/m²), Rome (€47.90/m²), Hamburg (€36.00/m²), Cologne (€33.50/m²), Brussels (€33.30/m²) and Warsaw (€30.00/m²), prime rents remain unchanged compared to the previous year.

Inhomogeneous development in average rents, but trending upwards

Average rents also reflect the increased focus on demand for modern office space. On a year-on-year basis, they have risen by around 2% on average in the European markets, with growth rates varying from +25% in Frankfurt to just under +2% in Amsterdam. Only in Berlin (-7%), Milan (-8%) and Rome (-16%) has the average rent fallen. At €85.70/m², the average level is highest in London, followed by Paris (€49.80/m²) and Frankfurt (€30.20/m²). In Berlin, Munich and Milan, the average rent is just over €27/m². In Lyon (€26.10/m²), Hamburg (€22.50/m²), Amsterdam (€22.50/m²) and Madrid (€22.10/m²), the €20 mark is exceeded. Below this are Düsseldorf (€19.90/m²), Barcelona (€19.60/m²), Cologne (€19.40/m²), Rome (€18.30/m²), Warsaw (€17.90/m²) and Brussels (€17.60/m²).

The limited availability of modern space in central locations is prompting tenants to look for cheaper alternatives nearby. Peripheral locations can become an attractive option if rents are significantly lower compared to traditional top city locations. However, due to hybrid working, secondary locations and peripherals must offer other benefits beyond cost savings to generate demand. The most important thing is transport connections, as well as a lively, attractive environment.

Prospects

The European office market is currently still lacking the important economic tailwind. However, although the economic and geopolitical situation continues to be challenging, take-up is higher than in the previous year. Buoyed by brisk leasing activity in the mid-range segment and a growing number of major deals, the markets are solid overall in the current year. The office markets are increasingly segmented according to age and quality of the portfolio. More and more companies – especially in the banking, telecommunications, automotive and aviation sectors – are requiring their employees to come to the office more often. This supports the demand for first-class locations. Even though demand for top spaces and locations is increasing, putting increasing pressure on rents and yields, the market is still waiting for a real recovery across the board. This could occur in 2026 if the economic and financial environment continues to brighten. For 2025 as a whole, take-up slightly above the previous year’s level represents a realistic scenario. However, it remains to be seen how the individual European markets will develop for the time being.

The segmentation of vacancies is likely to continue, so that the vacancy volume in decentralised locations and older existing properties will most likely increase again. For the core locations, however, a further increase seems less likely, and the modern vacancy rate should slowly continue to fall. The pressure on prime rents is likely to continue unabated and lead to further rent increases.