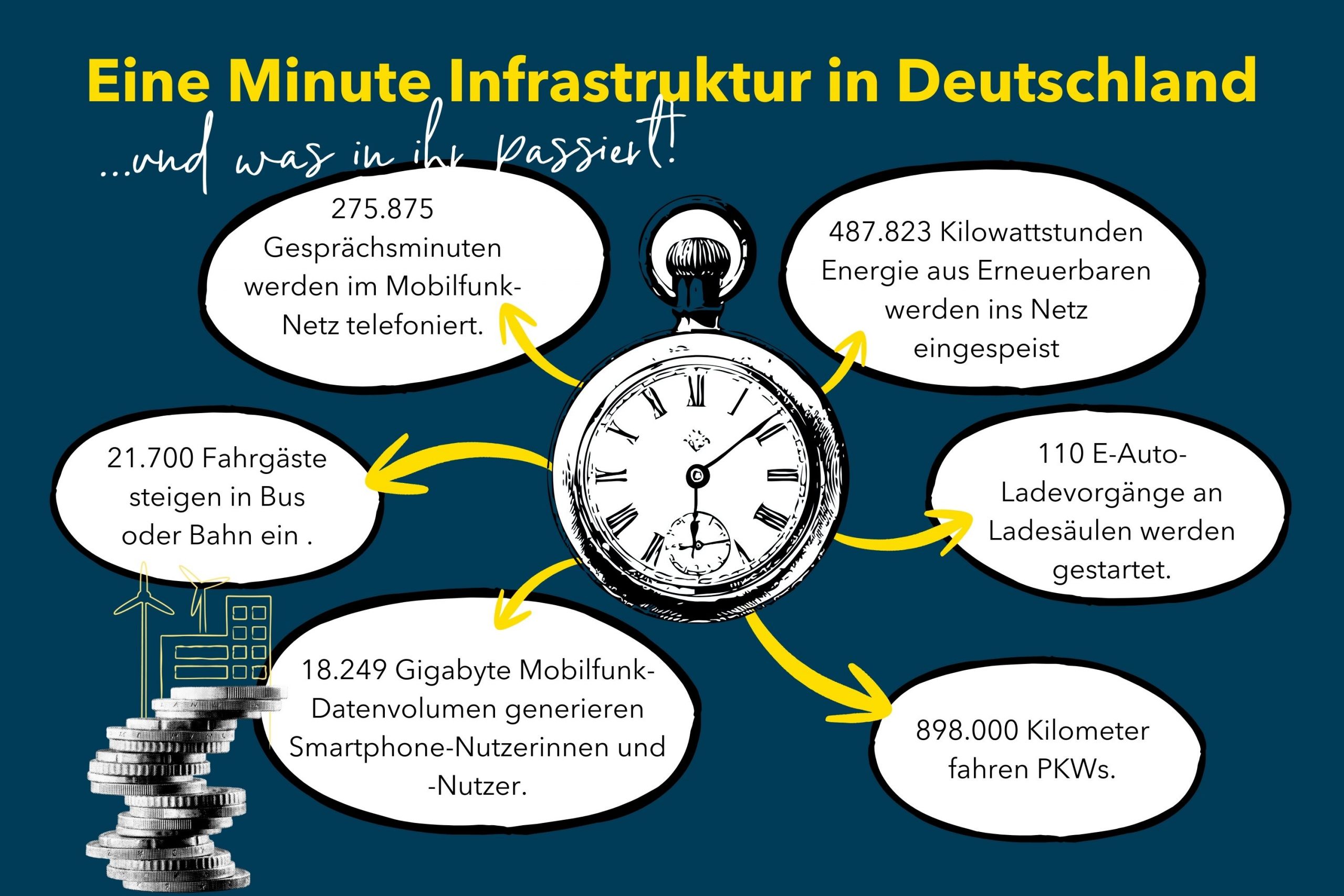

What a modern infrastructure has to do is so abstract that it is difficult to grasp. That’s why Robert Guzialowki, Head of Business Development Real Assets at HANSAINVEST, dares to do a thought experiment: What does one minute reveal about infrastructure investments?

Every minute, 232 million emails are sent worldwide, videos with a total length of one million hours are streamed, around 5.7 million Google searches are started and about 1.75 million prompts are sent on ChatGPT. What this means for the infrastructure often only becomes clear at second glance: According to conservative assumptions, a ChatGPT prompt requires about 0.3 watt hours of energy. If you continue to calculate this and the average energy generation of Germany’s wind turbines, it becomes clear that two to three wind turbines are needed just to cover the annual energy demand for German ChatGPT prompts – the construction of which quickly costs a mid-double-digit million amount. ChatGPT is responsible for less than 0.001 percent of the total energy demand in Germany – for which thousands more wind turbines are needed.

If the federal government promises 500 billion euros for infrastructure in total, then that is a drop in the ocean.

This is a considerable investment that is likely to increase significantly in the coming years. Precisely because artificial intelligence is becoming more and more commonplace, the annual and global energy demand of data centers could be as high as that of the whole of Japan as early as 2027. Germany’s energy grids are not yet prepared for this.

In Germany alone, investments of around 650 billion euros are therefore needed in the electricity grid infrastructure by 2045, plus the expansion of renewable energy sources or electricity storage facilities. According to a meta-study by the DIHK, between 113 and 316 billion euros per year are likely to be required by 2035 to manage the energy transition in this country. In addition, investments in the ailing transport infrastructure are necessary, and digital and social infrastructure also need capital. So if the federal government promises 500 billion euros for infrastructure in total, then that is a drop in the ocean.

Parts of the infrastructure expansion are already working well: The photovoltaic targets for 2024, for example, were met after just a few months. On other fronts, however, there is a need to catch up. It is not for nothing that the solar industry is calling for binding expansion targets for battery storage systems, and offshore wind power expansion is also faltering. The good thing is that there is still a lot of interest among investors who could drive the infrastructure expansion. More than half of the institutional investors surveyed in the BAI Investor Survey 2025 intend to increase their infrastructure equity or infrastructure debt allocation. Only a fraction are thinking about reducing infrastructure allocation. In addition to renewable energies and digital infrastructure, transport, social infrastructure and the utilities sector are in demand.

Portfolio diversification is even more important for infrastructure investments than for private debt, private equity and real estate – this is also shown by surveys of investors such as the BAI Investor Survey 2025. And indeed, infrastructure investments are negatively correlated with various bond segments, for example. Investors also cite regular investment income as the reason for their interest in infrastructure.

Both the European Union and the German government are working to remove obstacles.

But it is also a fact that a large part of this business takes place away from the public markets and thus in the private markets. In the past, there were still some obstacles that inhibited investment, even for institutional investors. Private investors even lacked suitable ways to become active in the private markets. Both the European Union and the German government are working to remove these obstacles. At the EU level, the Commission reacted with new requirements for the ELTIF, which is also intended to introduce small investors to private markets – after all, a quarter of the assets managed in ELTIFs in 2024 were accounted for by the infrastructure asset class.

In addition, the Eighth Ordinance Amending Ordinances under the Insurance Supervision Act (8th VAGVÄndV) introduced an infrastructure quota of five percent. This came into force on 7 February 2025 and amended the Investment Ordinance (AnlV), which regulates the investment requirements for regulated investors such as pension funds, small insurance companies and pension funds. Tax uncertainties are to be eliminated by the Economic Development Act.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information