Against the backdrop of ongoing global political tensions, the associated uncertainty and a continuing weakening German economy, there was no year-end rally in the German real estate investment market. Although the 4th quarter was the strongest quarter of the past year with a transaction volume of 9.4 billion euros, sales were at the same time a good quarter below the volume in the final quarter of 2024. For the whole of 2025, sales thus amount to approx. 31.3 billion euros, which represents a decline of 17% compared to the previous year and is only about half as much as the average of the previous ten years.

Karsten Nemecek, Deputy CEO Germany and responsible for Capital Markets, comments on the market as follows: “The last few months reflect the year as a whole: Of the many ongoing transaction processes, only very few resulted in a sale. The others are dragging on or have even been broken off. Although potential buyers and sellers are increasingly converging in their price expectations, there are market segments for practically all types of use in which the gap is still large and hardly any transactions take place. On the other hand, there are definitely segments in which transactions take place reliably. In addition to good existing apartments, this also includes small to medium-sized office buildings in prime locations. In the future, the significant increase in the number of transaction processes in all asset classes last year is also likely to translate into more deals.”

Sharpest decline in take-up in logistics and residential real estate

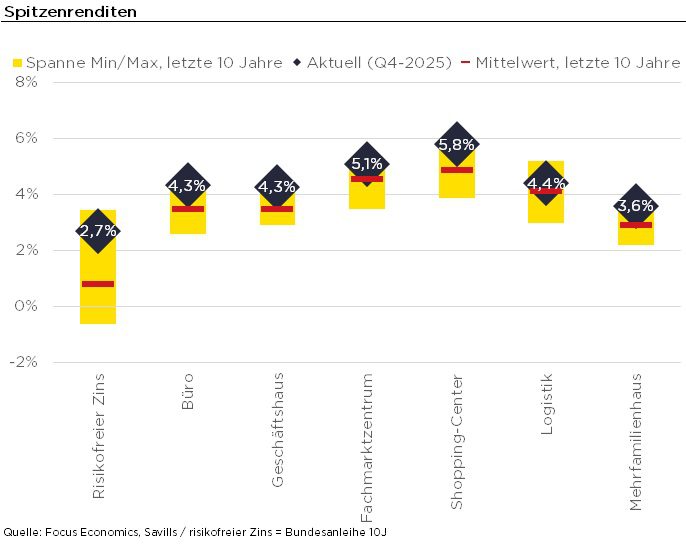

Residential real estate remained by far the type of use with the highest turnover (approx. EUR 8.1 billion), although the transaction volume fell by 23% compared to 2024. The decline in take-up was even more pronounced at -38% only for industrial/logistics properties, which ranked fourth with a transaction volume of approx. 5.1 billion. In the case of retail and office properties, take-up remained stable compared to the previous year. A transaction volume of approx. EUR 6.1 billion and EUR 5.6 billion respectively means rank 2 and 3 in the sales ranking. Revenue from healthcare and social real estate reached EUR 1.2 billion, slightly above the previous year’s figure. Prime yields remained largely unchanged. Only in some of the top 6 markets did initial yields for prime office properties fall by a few basis points over the course of the year.

Private investors with record acquisition volume

Private buyers played a significant role in many segments. Overall, private investors, including family offices, achieved a direct investment volume of around 4.2 billion euros last year. This means that this group of investors has bought significantly more than ever before. However, by far the largest group of buyers was still the investment managers, with a purchase volume of approx. EUR 9.3 billion, although this group also sold real estate for approx. EUR 7.1 billion. Matthias Pink, Head of Research Germany at Savills, comments: “After institutional investors dominated the last cycle, they play a much smaller role in the current cycle. The higher interest rate level and the structurally higher risks for some uses also suggest that they will not regain their old dominance in the further course of the cycle.” The share of institutional investors in the acquisition volume stabilized at around one third last year, but is still well below the 10-year average of 50%.

Similar framework conditions to be expected for 2026

“Overall, the market is likely to remain a buyer’s market this year, which opens up opportunities above all for those investors who can react flexibly to opportunities that arise,” Nemecek looks ahead. Pink adds: “The framework conditions for the real estate year 2026 are unlikely to differ much from those of last year. We will therefore be able to observe many phenomena that we know from last year – including an increased number of insolvencies, discrepancies between demanded and offered prices as well as liquidity-driven sales – this year as well.” In its baseline scenario, Savills expects a transaction volume for 2026 that is roughly the same as in the two previous years, i.e. around 35 billion euros.

* only transactions with 50 residential units or more / ** banks, pension funds, sovereign wealth funds, insurance companies and investment managers (excluding private equity companies)

Additional graphics and data can also be found in our online dashboard on the real estate investment market.