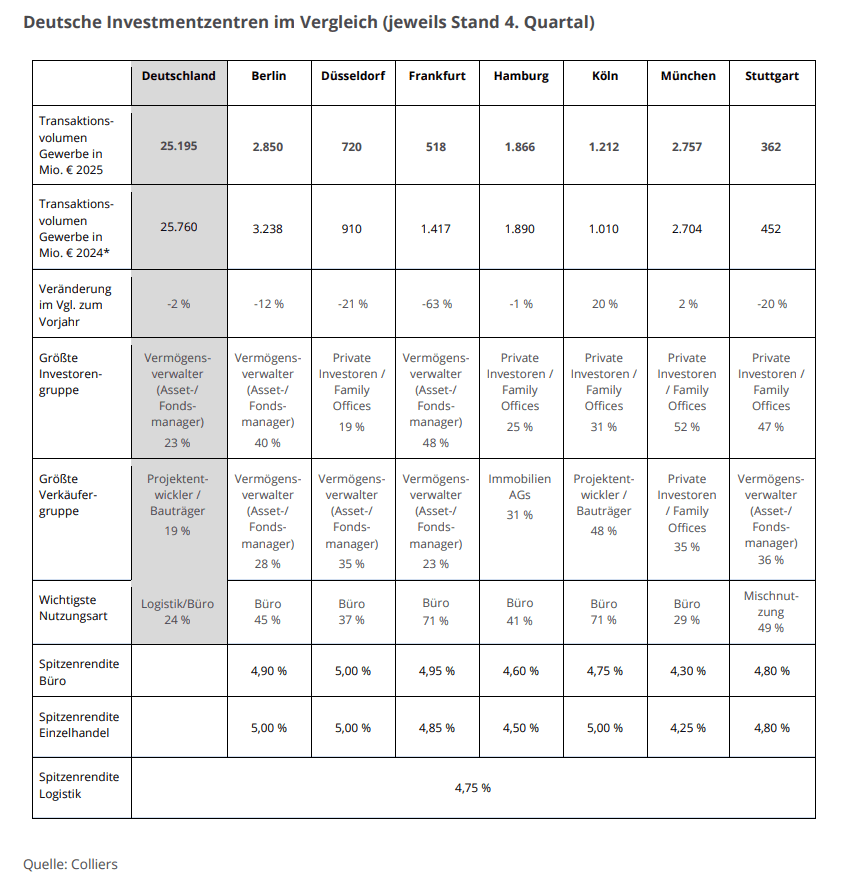

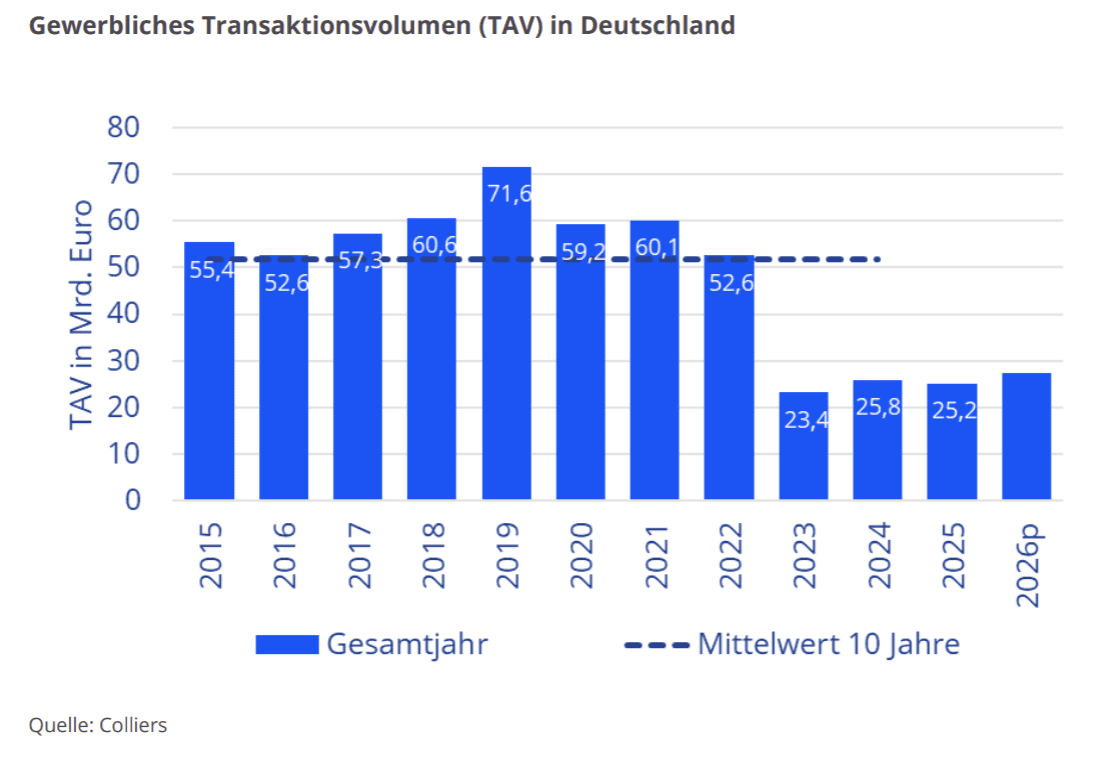

According to Colliers, real estate was traded for 34.3 billion euros in Germany in 2025. Of this amount, 25.2 billion euros were accounted for by commercial real estate and 9.1 billion euros by the institutional residential segment of ten residential units or more. The residential sector contributed to the 6 per cent year-on-year decline in transaction volume with a 15 per cent contraction, while the commercial sector missed its full-year result of 2024 by just under 2 per cent. The number of commercial real estate contracts rose by two percent.

The early-cycle upswing solidified in the course of the year.

Michael R. Baumann, Head of Capital Markets Germany at Colliers: “What is particularly pleasing about the developments in the course of 2025 is the continuous increase in transaction volume from quarter to quarter by an average of 12 percent. Even though there were no signs of a year-end spurt in 2025, commercial real estate achieved the strongest quarterly result between October and December at around 7.3 billion euros – even though some expected major deals did not come to fruition. Thus, the postponement of lighthouse transactions, such as the Frankfurt Opera Tower after 2026, and a fairly well-filled pipeline increase the prospect of the continuation of the early-cycle recovery trend this year. On the other hand, however, it also shows that large-volume transactions can still be classified as lengthy and with an open outcome.”

Francesca Boucard, Head of Market Intelligence & Foresight at Colliers, adds: “The framework conditions in the investment market continued to stabilise in 2025, also with the prospect of a slow economic recovery process in 2026. The ECB’s monetary policy communication is more transparent, and markets do not expect short-term interest rate shocks. This makes planning easier for investors and project developers. The real estate climate points to a gradual return of confidence among real estate investors. There is growing evidence that we have entered the early stages of a new cycle.”

Lack of major deals limits the momentum of the recovery.

Unchanged from the previous year, around 90 percent of all deals in the segment under 50 million euros take place. The volume-related market share in this segment rose slightly by 5 percentage points to 46 percent. This is also due to the subdued development of portfolio sales, which, like all more complex, large-volume transactions, have long exploratory phases. They were below the long-term average in size and number and contributed to the investment volume in 2025 with a historically low value of 21 percent.

In total, only nine transactions exceeded the 250 million euro mark, a third less than in 2024.The largest transaction of 2025 is the strategic takeover of the Porta furniture store portfolio by XXXLutz for around one billion euros, which took place at the beginning of the year. Second place and at the same time the largest single transaction of the year is the sale of the Berlin high-rise Upper West for 435 million euros. The property was transferred from the Signa Group to the private investor Schoeller in the first quarter.

Market activity in the top 7 remains weak.

Especially in the seven investment centers, individual transactions with a ticket size in the three-digit million euro range remained below average. Around 1.4 billion euros are attributable to sales from the insolvency estate of the Signa Group in prime inner-city locations, which went exclusively to private investors after long negotiations and sometimes at considerable discounts. These include the department stores at Neuhauser Straße 18 (Oberpollinger, Munich), Kurfürstendamm 229-231 (Berlin) and Jungfernstieg 16 (Hamburg) as well as the project development of the Munich office and commercial building project Corbinian, also on the site of a former department store. The sale of Oberpollinger for around 380 million euros was also the largest transaction of the final quarter in Germany.

Despite once again significant losses compared to the long-term averages, Berlin took the top spot in the top 7 with a difference of 90 million euros with a difference of 2.85 billion euros and a gap to Munich, while Frankfurt achieved a transaction volume of half a billion euros that was even below the crisis year of 2009. Only the smaller Stuttgart market is behind the banking metropolis with a value of 362 million euros. The markets outside the top 7 accounted for the majority of last year’s transaction volume at around 60 percent.

Baumann: “Core office investments by institutional investors in the top 7, such as the Cologne office ensemble Gerling Gardens, which was sold to Deka shortly before the end of the year, continue to be the exception. However, the shortage of future-oriented office space, which contributes to sustained growth in prime rents in prime locations, suggests a gradual increase in transaction activity in this segment in 2026. Accordingly, in the second half of the year, the first yield compressions of around 20 and 25 basis points were already registered in Munich, Hamburg and Cologne, while they remained stable in the other four markets.” Currently, yields are now in a somewhat widening range from 4.30 percent in Munich to 5.00 percent in Düsseldorf. Just behind the Rhine metropolis are Frankfurt (4.95 percent) and Berlin (4.90 percent), which currently still have the cheapest entry opportunities.

“At the same time, we are increasingly observing exploratory talks about value-add products. If the price negotiations are based on realistic market assessments and the still high construction and financing costs allow for an attractive business approach, foreign investors will increasingly seize the opportunities offered by the current market phase,” Baumann continued. The market share of international investors was 44 percent in 2025, 4 percentage points above the previous year’s level. In addition to good locations in A cities, B and C cities in the top locations also offer good entry opportunities. The progressive convergence in price discovery, which will also lead to further yield increases in 2026, especially outside central prime locations, should ensure a further market revival.

Transformation phase offers attractive entry opportunities off the beaten track.

Baumann sums up: “In the current phase of the new real estate cycle with major structural changes, the cards are being reshuffled. This is evidenced by both the shift in transaction volume between the individual types of use and the capital groups currently active on the market.” The neck-and-neck race between the three most established types of use industry and logistics, office (24 percent market share each) and retail (23 percent) continued in 2025. Behind them are development plots in third place with 12 percent, of which just under half are earmarked for the construction of data centers. In addition to the revival of the hotel (7 percent) and healthcare real estate (7 percent) markets, the sales of the designer outlet centers in Wustermark and Neumünster or a package of three thermal baths, which are still subject to antitrust approval, exemplify the increasing attractiveness of asset management-intensive business types and operator properties. They usually perform independently of the classic real estate and economic cycles and generate cash flows that can be planned in the long term. They serve to diversify and stabilise portfolios and will also be able to increase their market share in the new year, favoured by the focus on impact investing and infrastructure real estate, without, however, being able to compensate for the decline in traditional types of use.

In particular, investors with strong equity capital, who are not dependent on limited debt capital to realize such purchase opportunities, take advantage of such entry opportunities. In the past 12 months, private investors and family offices (18 percent) and corporates and owner-occupiers (15 percent) were the most active buyer groups, after asset managers (23 percent market share). Compared to the previous year, the dominance of private investors has strengthened by another three percentage points, with owner-occupiers replacing project developers in third place with an increase of 5 percentage points. In addition to asset managers (19 percent), project developers (18 percent) and corporates and owner-occupiers (15 percent), who are mostly under selling pressure, were on the podium among sellers.

Outlook: Investment volume of up to 30 billion euros realistic with moderate market recovery.

Baumann concludes: “Discussions currently give us the impression that more market participants will take advantage of the opportunities in the new real estate cycle in 2026. The product range is there, the deal pipeline is far larger than 12 months ago. This can also materialize a larger transaction volume. However, the marketability, especially of large tickets, remains limited. If the moderate growth rates registered in 2025 continue, which we also saw in the phase of 2013 after the slumps as a result of the euro debt crisis, up to 30 billion euros could well be traded in commercial real estate at the end of the year.”

Boucard adds: “2026 will be another transitional year with moderate growth. Both the impetus from announced government investment packages and structural reforms will only reach the real estate market in the medium term. Geopolitical developments act as a significant factor of uncertainty for the global economy and can have both positive and negative effects. A possible settlement of the Ukraine conflict would reduce risks, while the current tensions in Venezuela are expected to put additional strain on markets and trade flows.”