German investment market for office properties: Stable, but still lacking momentum

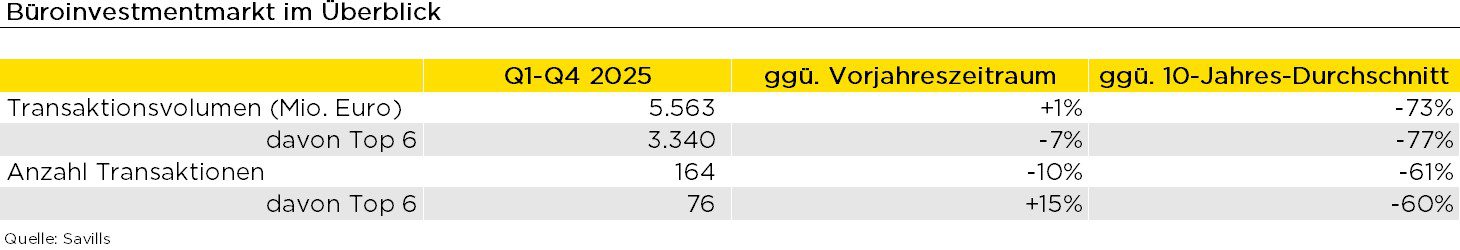

In 2025, the transaction volume with office properties amounted to just under 5.6 billion euros, according to Savills. This means that sales remained virtually unchanged compared to the previous year. The 10-year average, on the other hand, was missed by 73%. Savills registered around 160 transactions last year, which is 10% less than the year before. In Hamburg and Munich, prime office yields fell by 10 basis points in the final quarter of last year, while they remained unchanged in all other top 6 markets*. On average across all markets, they were 4.33%, 7 basis points below the previous year’s figure.

Karsten Nemecek, Deputy CEO Germany and responsible for Capital Markets at Savills, comments on the market as follows: “The office investment market stabilised last year – but nothing more. Although the number of sales processes has increased over the course of the year, the actual deals remain rare until recently. In the current environment, many properties are still difficult to market or only at prices that owners do not accept. The proportion of aborted trials is correspondingly high. The most liquid locations are the top locations, and this is true across all risk classes. Core properties are attracting great interest here, especially from private sources of capital, while properties with upgrading or conversion potential are in demand by project developers and other value-increasing-oriented investors. Institutional investors dominate on the seller side and this is unlikely to change in the current year. Overall, we expect the market to remain a clear buyer’s market and that the pressure on many owners and their stakeholders will even increase against the backdrop of rising vacancies.”

About 60% of the transaction volume was in the top 6 markets, where the transaction volume decreased by 7% compared to the previous year. The number of transactions in the top 6 markets, on the other hand, increased by 15%. Nevertheless, both key figures still remain well below the 10-year average.

* Berlin, Dusseldorf, Frankfurt, Hamburg, Cologne and Munich

Supplemental graphs and data can be found on the Savills online property investment market dashboard