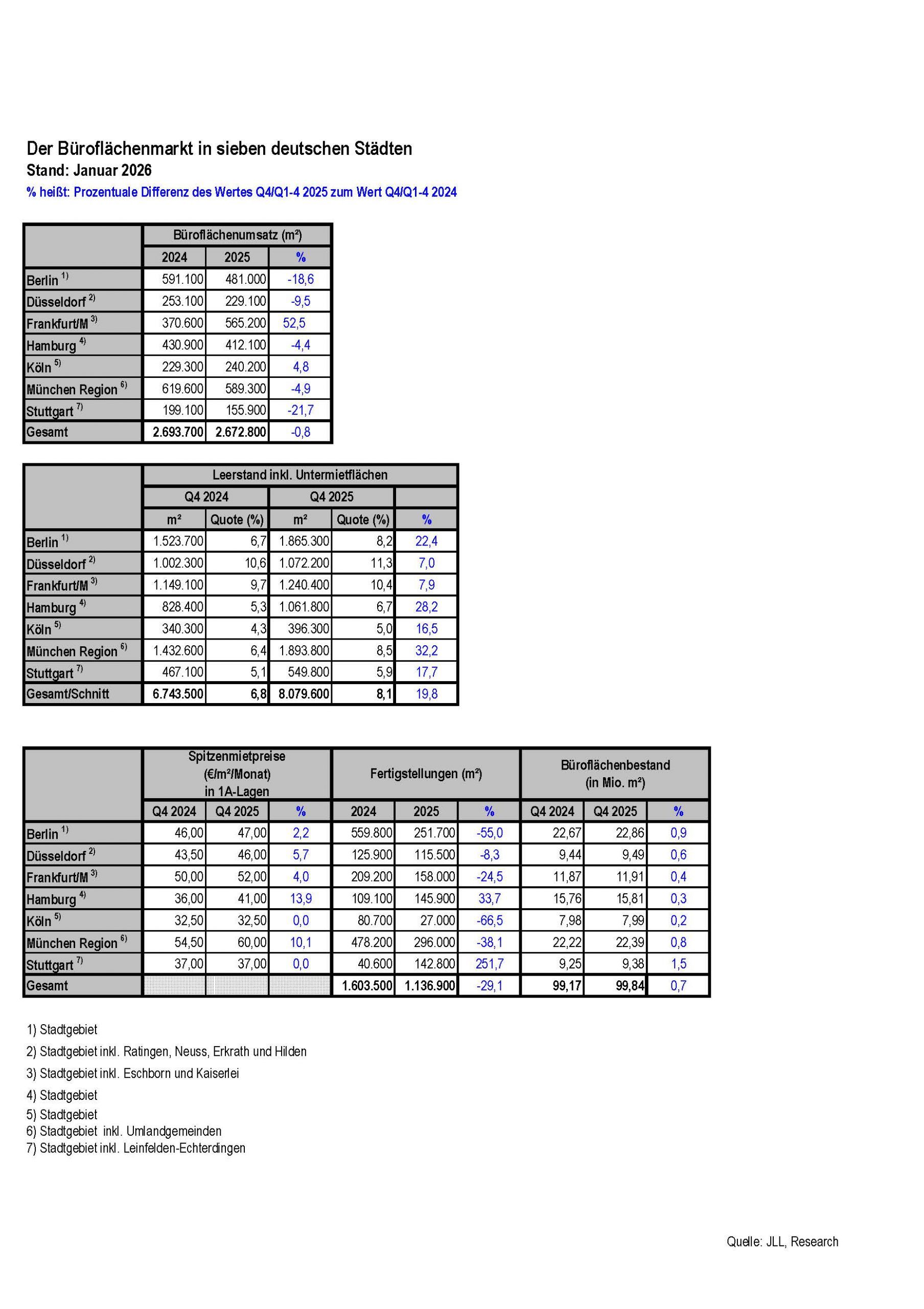

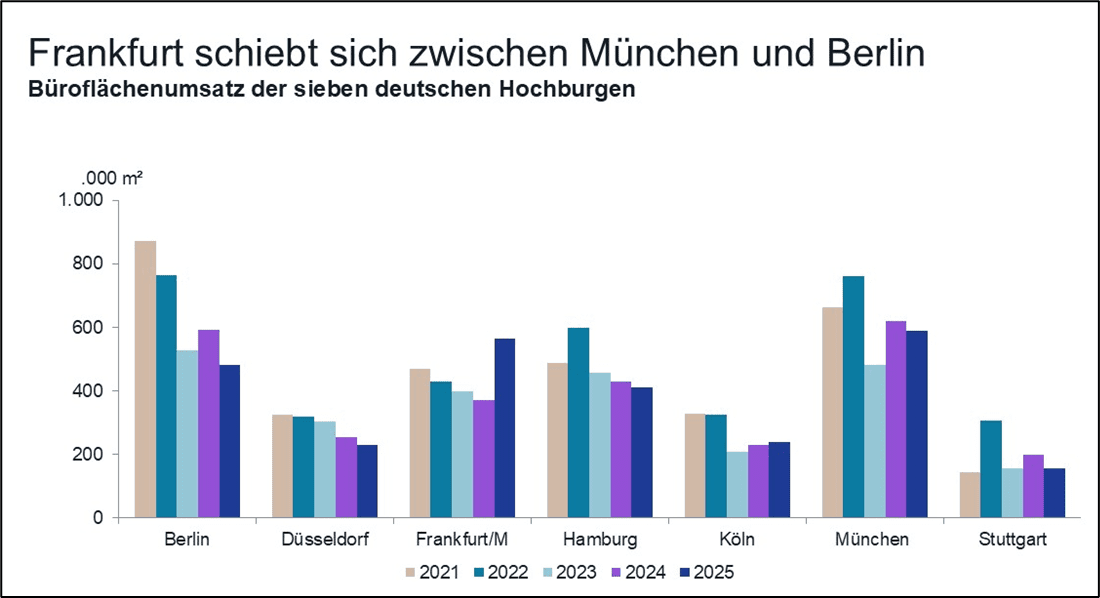

At 2.67 million m², take-up in the seven metropolises is on a par with the previous year

At the end of 2025, the German office letting market shows a differentiated picture with clear structural and regional differences. Total take-up reached 2.67 million m² and, at 0.8 per cent, was only slightly below the previous year’s figure. Even if it is a slight decline, this stabilization can certainly be seen as a positive signal. The rental market had to do almost completely without economic tailwind, the German economy grew only minimally and the labour market is also showing the first signs of the sluggish economy. The number of employees fell for the first time since 2020, with an average of around 46 million people in employment last year. In addition to the economic weakness, the ever-increasing effects of demographic change contributed to this development. As a result, fewer and fewer young workers are moving up to replace the baby boomers who are retiring from working life. On the other hand, the net immigration of foreign workers and an increase in the labour force participation of the domestic population continued to support the labour market.

Konstantin Kortmann, CEO of JLL Germany, says: “With their resilience, the rental markets generally contributed to the stability of the real estate industry in the past year. This is all the more remarkable because the office rental markets in particular are linked to the situation of the real economy and the labour market. There is still stagnation and job cuts in many cases in view of the geopolitical risks, but in particular home-grown problems specific to Germany, which must be solved quickly and sustainably so that the real estate rental and investment markets experience a significant upswing again.”

From the point of view of the office real estate market, it was positive that last year at least the service companies reported increases in personnel. There was an increase of 164,000 (plus 0.5 percent) to just under 35 million people. In theory, this increase alone would correspond to an additional office space requirement of 3.3 million m² – albeit throughout Germany. In practice, this does not only manifest itself in newly rented space. In the current geopolitical and economic environment, the opposite is more likely to be observed across industries. Rising costs, including energy prices, borrowing, labor and material costs, have made cost efficiency a key issue for the past year and also looking ahead to 2026. The optimisation of land use and operational efficiency is also playing an increasingly important role. Quality instead of quantity – a motto for the year 2025, which is also reflected in the leasing activities in the seven real estate strongholds. “Only those companies that create attractive working conditions benefit from higher engagement, increased productivity and greater employee retention. In many cases, only 50 to 70 percent of the previous space volume is currently in demand for new leases – both economically and structurally due to hybrid working,” analyzes Helge Scheunemann, Head of Research at JLL Germany.

However, where increased demand meets limited supply, rents rise. Since the supply of new properties will not grow in 2026 either, users will continue to be confronted with less choice and higher rental prices for premium space in sought-after locations. “The supply gap can only be closed if property owners of older existing properties seize this opportunity and modernise and reposition existing properties,” adds Scheunemann.

Frankfurt consolidates top position – service providers support the market in the final quarter

Overall, the last quarter of the year was rather unspectacular in almost all strongholds. Although there were again some lettings with a volume of around 10,000 m², the really large, market-defining deals were missing. However, this was the case in the previous quarters, which is one of the reasons why Frankfurt has proven to be the metropolis that has picked up the most momentum from a local perspective, achieving an impressive 53 per cent increase in take-up to 565,200 m² compared to the previous year. Munich, on the other hand, recorded a decline in take-up of almost five per cent to 589,300 m² – but was thus able to maintain its top position by a narrow margin. After all, the Bavarian capital achieved its best quarterly result of the year in the fourth quarter with 173,600 m². Berlin, on the other hand, remained weak and, at 481,000 m², fell noticeably short of the previous year’s figure (minus 19 per cent). Apart from Frankfurt, only Cologne was able to record an increase compared to the previous year with 240,200 m², while Düsseldorf, Hamburg and Stuttgart illustrate the regional differences with lower take-up than in the previous twelve months. “While in 2025 the sectors were dominated by players from public administration, the recent evaluation shows that business-related services in particular were strong in the fourth quarter,” says Miguel Rodriguez Thielen, Head of Office Leasing, observing a change in the ranking of the most active user groups.

Vacancy rate continues to rise and increases pressure on owners – new construction volume falls

The trend of quality over quantity outlined above is very clear in the figures. In addition to the change in the occupied office space stock – in the past twelve months, this figure fell by 666,000 m² across all seven strongholds – the total vacancy rate in the seven metropolises rose significantly in 2025 by almost 20 per cent to more than eight million m². The rate climbed accordingly from 6.8 percent at the end of 2024 to 8.1 percent now. The increase was particularly pronounced in Munich (plus 32 percent), Hamburg (plus 28 percent) and Cologne (plus 17 percent). “However, these figures belie the actual market conditions, as the vacancy rate consists primarily of older, less attractive properties, while modern, centrally located space remains scarce. The apparent tenant market turns out to be a fallacy – high-quality vacancy is rare,” observes Miguel Rodriguez Thielen. This discrepancy is also manifested when looking at the completion volume. With a cumulative volume of 1.1 million m² across all seven strongholds, this was almost 30 percent below the previous year’s level and thus at the lowest level in the past five years.

The decline in office space completions was particularly drastic in Cologne (minus 67 percent), Berlin (minus 55 percent) and Munich (minus 38 percent). Only Hamburg (plus 34 percent) and Stuttgart (plus 252 percent), coming from a very low level, recorded growth. “This development will significantly exacerbate the already existing shortage of modern office space and drive up rents in prime locations,” Helge Scheunemann expects.

For the years 2026 and 2027, a total of 2.1 million m² is under construction according to the current status. Of this volume, almost 39 percent has already been rented or leased to owner-occupiers. “In view of the continuing challenges in the German construction industry, it seems quite realistic that there will be further delays, so that at least the volume of new construction in 2026 is unlikely to lead to a significant reduction in the shortage of supply and the structural shortage of modern office space will continue in the medium term,” warns Scheunemann. Vacancy rates could therefore gradually plateau – the less significant increase in the fourth quarter could be a first sign of this.

Prime rents continue to show a clear upward trend – cautious optimism for 2026

The momentum in the development of prime rents continued in the last quarter of 2025. The increase was particularly strong in Hamburg. The prime rent here is now 41 euros/m², almost 14 percent above the previous year’s level. The highest prime rent is still achieved in Bavarian Munich at 60 euros, ahead of Frankfurt at 52 euros and Berlin at 47 euros. On average across all seven strongholds, rents rose by five percent over the course of the year.

“We are cautiously optimistic about the outlook for 2026. Most economic research institutes are forecasting noticeable GDP growth again for the first time in 2026, according to Consensus Economics this is 1.1 percent, which should give the office market a tailwind. In addition, there are still some large-scale searches on the market that could not be conclusively fulfilled in 2025 and which are expected to have a positive impact on take-up in 2026. Since the selection of space in these applications is already very limited, B locations could increasingly come into focus if the quality and availability are appropriate. Nevertheless, competition for top space with high prices remains. Our take-up forecast for 2026 is 3.0 million m², eleven percent higher than in the previous year,” says Helge Scheunemann , looking ahead to the coming quarters.