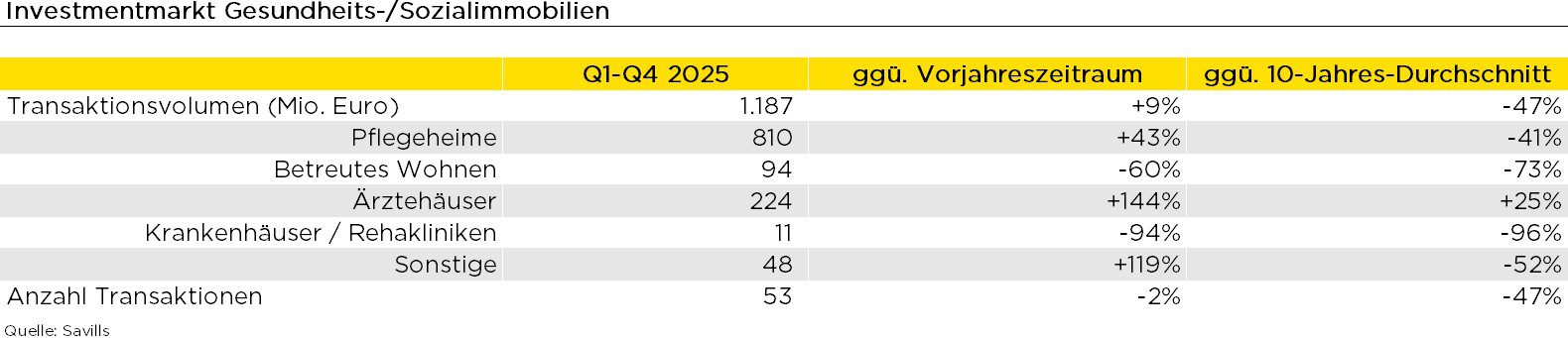

According to Savills, the transaction volume in healthcare and social real estate amounted to just under EUR 1.2 billion in 2025, an increase of 9% compared to the previous year. As in the previous year, a portfolio transaction accounted for a significant share of the transaction volume. In 2025, for example, around one third of the total volume was accounted for by the sale of a nursing home portfolio of Deutsche Wohnen AG to the City of Hamburg. Despite the year-on-year increase, the 10-year average was missed by 47%. Last year, Savills registered around 50 transactions, which is about the same as the previous year’s figure. The prime yield for nursing homes remained unchanged from the previous quarter at 5.2% and thus also corresponded to the previous year’s figure.

Max Eiting, Director and Head of Healthcare Operational Capital Markets at Savills in Germany, comments on the market as follows: “In 2025, the weights in the market for healthcare and social real estate have shifted noticeably. Although nursing homes remained the segment with the highest turnover with a volume share of around two-thirds, a significant share was attributable to the acquisition of Pflege & Wohnen Hamburg at the beginning of the year. Instead, it has become clear in the course of the year that medical and outpatient care facilities in particular are increasingly becoming the focus of investors. We are seeing increasing demand for medical centers in particular – not only from established market participants, but also from new investors and newly launched funds. Despite the market shift, nursing homes have by no means disappeared from the shopping list, as sector specialists and some new international players remain active and buy selectively. The fact that many nursing home operators have recently returned to more stability and new operators have been found for almost all insolvent facilities contributes to building trust. Although market activity has increased over the course of the year and we are seeing more sales processes again, the overall recovery is only gradual. The transaction processes take longer due to extensive property and operator reviews, and both equity and debt investors continue to act very cautiously. We therefore expect the market to develop at a similar pace in 2026. However, some acquisitions and platform sales in the pipeline could move the transaction volume noticeably upwards.”

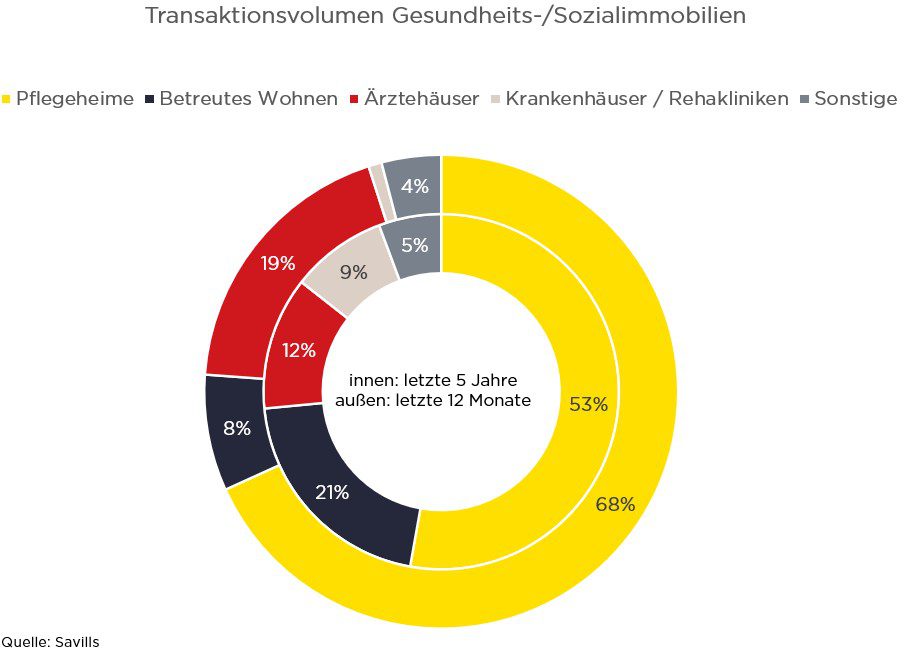

Nursing home transactions dominated the market in 2025. They generated sales of a good EUR 810 million, or 68% of the total volume. Medical centers had a turnover of 224 million euros, which corresponds to an increase of 144% compared to the previous year. All other types of objects played a clearly subordinate role.

For more information, please visit the online dashboard .