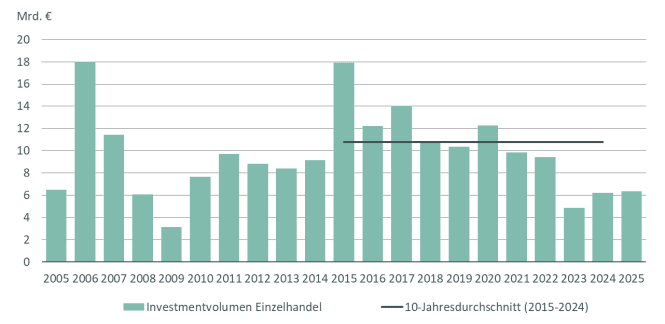

The German retail real estate investment market reached a transaction volume of 6.4 billion euros in 2025 – an increase of two percent compared to 2024. Since 2021, the share of retail real estate in the commercial real estate investment market has risen steadily to 26 percent. This puts the asset class in second place (behind logistics and ahead of office). One reason for the recent increase was twelve major transactions in the course of the year, each with more than 100 million euros. Among other things, the takeover of the Porta portfolio by XXXLutz, the sale of the Oberpollinger in Munich, the sale of the outlet centers in Neumünster and near Berlin as well as the Gropius Passagen in Berlin and several food-anchored retail portfolios are among the most prominent major transactions in this segment. This is the result of a recent analysis by the global real estate service provider CBRE.

“In 2025, the investment market further expanded its confidence in the retail asset class. There were various large transactions – including portfolios – and noticeable new activity on the part of international investors,” summarizes Jan Schönherr, Head of Retail Investment at CBRE. The portfolio ratio increased by 13 percentage points to 31 percent. The share of international investors rose by six percentage points to 45 percent.

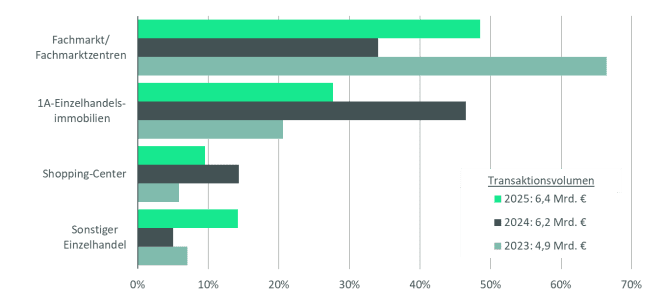

The strongest segment in 2025 was specialist stores and retail parks, which together accounted for a share of 49 per cent of the retail real estate investment market (up 15 percentage points). They were followed by 1A retail properties with 28 percent (minus 20 percentage points) and shopping centers with ten percent (minus four percentage points). As a result, retail park properties have regained their traditional position as the strongest segment within the retail investment market, while the high-street properties that dominated the previous year 2024 still achieved a market share above the long-term average.

“Prime yields tended to be stable in 2025,” says Anne Gimpel, Team Leader Valuation Advisory Services at CBRE in Germany. In the final quarter, there was only a change in prime yields for shopping centers in B locations – it rose by 0.25 percentage points to 7.75 percent. Compared to the same period last year, however, there were smaller declines in the achievable prime yields in other segments. This applies to 1A retail properties in the top 7 markets (minus 0.2 percentage points to 4.44 percent), food markets (minus 0.1 percentage points to 4.6 percent) and retail parks (minus 0.1 percentage points to 4.9 percent). Shopping centers in A locations, on the other hand, remained stable at 5.9 percent.

Outlook for 2025

“In view of a well-filled deal pipeline, a brisk start to the year is emerging after a good year-end quarter. Demand also remains stable, especially for food-anchored properties and inner-city properties. Accordingly, we expect a transaction volume of around six to seven billion euros again for 2026,” predicts Schönherr. “We are mainly seeing international interested parties with good liquidity, who have a focus on value-add and core-plus, who are sounding out the German market for retail real estate.”

“There are also no short-term changes in the yield level so far,” adds Gimpel.

Transaction volume of retail real estate (in billion euros)

Retail transaction volume by type of use