Take-up remains below the long-term average

Savills has looked at the development of the top 6 office markets in Germany and comes to the following conclusions:

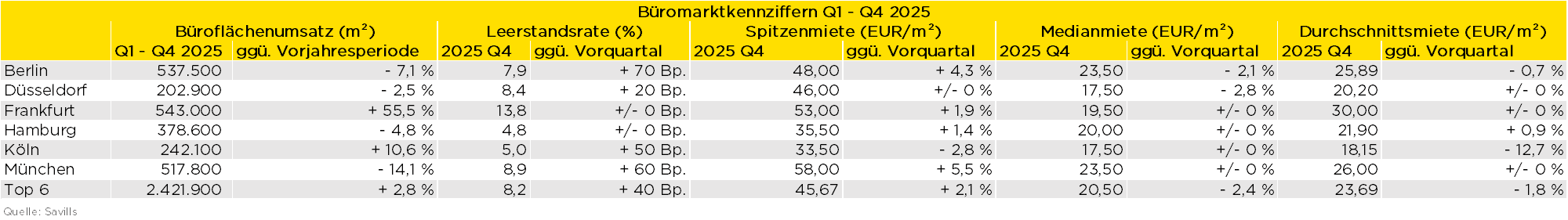

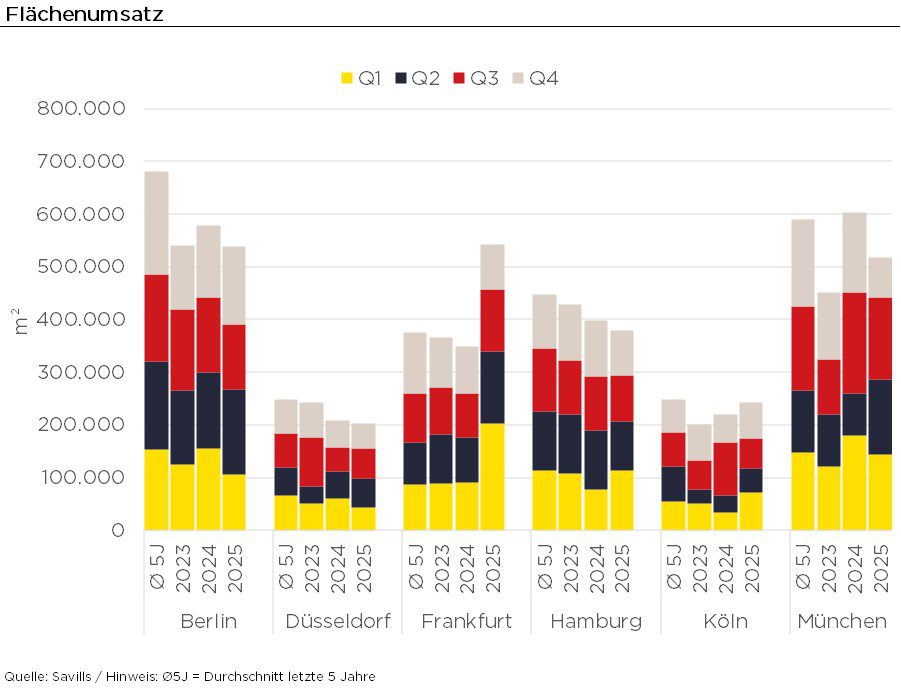

- Take-up: In 2025, take-up amounted to 2.4 million m², which corresponds to an increase of around 2.8% compared to the previous year.

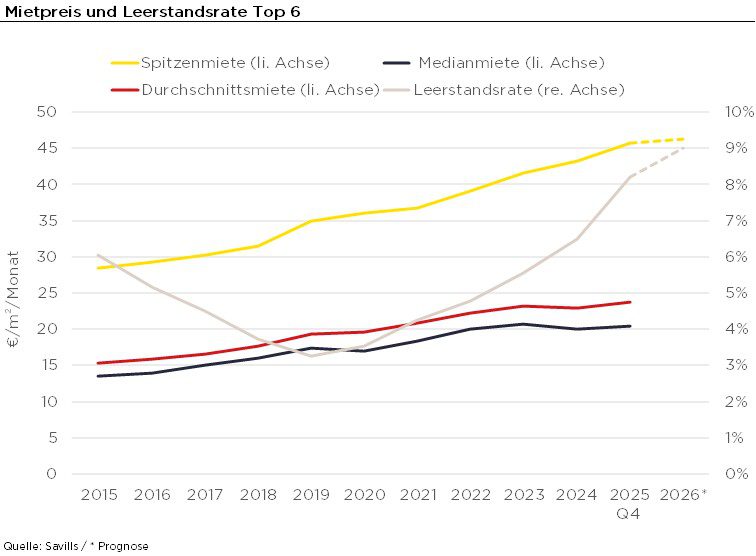

- Rental development: Prime rents rose by 2.1% sequentially, while median rents fell by 2.4%.

- Vacancy: The vacancy rate increased by 40 basis points compared to Q3 2025, reaching 8.2% on average for the top 6 cities.

- Outlook: Take-up in 2026 is likely to be at the previous year’s level. A further increase is expected in both prime rents and the vacancy rate.

Take-up remains below the long-term average

In 2025, take-up in the top 6 office markets* totalled 2.4 million m². This corresponds to an increase of 2.8% compared to 2024, but is still 21% below the ten-year average. At around 930 m², the average rented office space was at a low level for the third time in a row and is below the average of previous years of 1,060 m² (2017-2022). At the same time, the number of rentals declined in a long-term comparison: In 2025, about 2,600 rentals were registered, while the ten-year average is almost 3,100.

Jan-Niklas Rotberg, Managing Director and Head of Office Agency Germany at Savills, comments: “The fact that take-up in 2025 remained below the long-term average is mainly due to the high cost sensitivity of users in an economically uncertain environment. Many users continue to be reluctant to make decisions to move, and when a change of space takes place, this is usually accompanied by a reduction in space. Often, companies only decide to lease a new lease when there is pressure to act – for example, if ESG or technical requirements can no longer be met in the existing space, or if the location no longer meets the requirements of hybrid working models. If this reason is missing, existing leases are often extended, usually for another five years and often combined with a reduction in the area. Overall, occupiers have become more selective, which – together with the ongoing trend towards higher space efficiency – keeps take-up below average.”

Central locations in demand – opportunities for peripheral locations exist

The average vacancy rate of the top 6 cities was 8.2% at the end of 2025. Compared to the previous quarter, this corresponds to an increase of 40 basis points. Antonia Wecke, Senior Consultant Research, puts it in perspective: “As a result of the overall decline in demand for space, vacancies continue to rise, so that the vacancy rate in the top 6 cities has exceeded the 8 percent mark for the first time since 2012. At the same time, demand is shifting to locations that support hybrid working models and facilitate regular office presence – usually central, well-connected submarkets. After all, if companies want more presence in the office, accessibility has a decisive influence on employee acceptance and recruiting. Peripheral locations do not lose their market opportunities across the board, but they need an offer that represents a real alternative to the city. The prerequisites for this are very good public transport connections and modern areas with suitable service offers. Whoever delivers this package has more opportunities even in a selective market than the location category suggests.” Rotberg adds: “Especially for many companies from the surrounding area, the B-location of a city is already a real location improvement. It’s less about prestige and more about reach, because you get closer to the employees and talents. In addition, the current market environment offers a good opportunity for a change of location, because the availability of space has increased noticeably, especially in peripheral locations, and owners are once again giving more leeway in terms of conditions and contract structures. This makes incentives and more flexible terms possible more often and makes it easier for users to implement a location improvement.”

Users are looking for high space and building quality

“Across all locations, the users’ demands on the quality of space and buildings are high. Users are not simply looking for new space, they are looking for space with modern building technology, high quality furnishings and flexible floor plans. Unrenovated existing areas that cannot be adapted to modern working environments are excluded from the search profiles – regardless of the location in which they are located. Some owners have already recognised this and have either already implemented renovations or have plans to do so,” explains Jan-Niklas Rotberg and continues: “The market opportunities of refurbished existing areas are significantly influenced by the availability of new buildings. In markets with a comparatively high supply of new buildings, such as Berlin and Düsseldorf, competition among modern spaces is correspondingly more intense. In places where the project pipeline is becoming scarcer, such as in Frankfurt and Hamburg, well-renovated existing areas are noticeably gaining in importance. Declining approval figures and more difficult conditions for new construction projects due to stricter pre-letting requirements in financing suggest that existing renovations could become even more relevant in the future and close any gaps in supply in the modern space segment. At the same time, however, there will also be existing areas that can neither be adapted nor modernised in an economically viable way. For these properties, the question of possible conversions is increasingly coming into focus.”

While prime rents continue to rise due to the high demand for modern space in central locations, average rents are under pressure. On average in the top 6 cities, prime rents rose by 2.1% compared to the previous quarter, while median and average rents decreased by 2.4% and 1.8%, respectively.

Outlook: Stable market with continued selective demand

With a view to market developments in the current year, Jan Niklas-Rotberg explains: “In 2026, market activity is likely to consolidate at the current level. It is to be expected that the big economic stimulus will be missing, but more companies are still likely to get out of the holding pattern because extensions do not solve every requirement. Rentals are likely to happen above all where accessibility and building quality match. This supports prime rents, even if the momentum is likely to slow. At the same time, peripheral sub-markets and unrenovated portfolios will be more affected by vacancies.”

* Berlin, Dusseldorf, Frankfurt, Hamburg, Cologne and Munich

You can also find additional graphics and data in our online dashboard on the top 6 office markets.