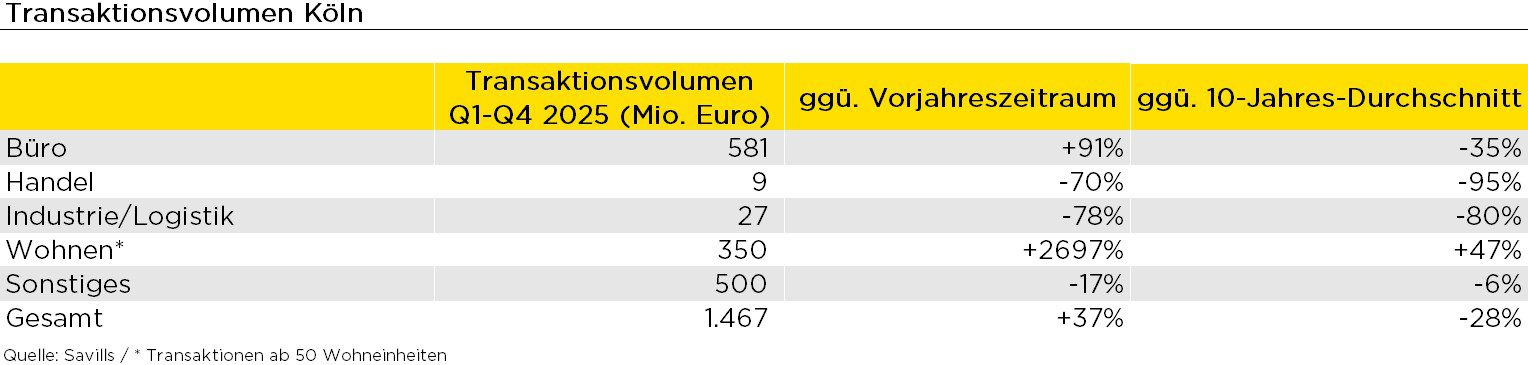

According to Savills, around 1.5 billion euros were turned over on the Cologne real estate investment market in 2025. Compared to the previous year, this corresponds to an increase of 37%. Compared to the 10-year average, sales were 28% lower. In the last twelve months, Savills has registered almost 40 transactions, which represents an increase of 30% compared to the same period last year. Prime yields for offices and commercial buildings were both 4.4% at the end of December, unchanged from the previous quarter and also unchanged from the previous year’s figure. Tobias Schneider, Director Investment at Savills in Cologne, comments on the market as follows: “The range of products on the Cologne investment market was again somewhat larger this year across all asset and risk classes. At the end of the year, the number of completed transactions also increased, not least because some owners have now adjusted their price expectations downwards. After a long break, large core transactions could finally be concluded again. Overall, however, the market remains tough and many transaction processes are dragging on. We currently see the best chances of closing a deal with small and medium-sized properties in good locations. Buyers are mainly family offices and private investors, while institutional investors are only sporadically active. For 2026, we expect market momentum to pick up slowly. However, a fundamental change in the framework conditions is not foreseeable.” With a transaction volume of EUR 580 million, office properties have contributed the most to investment turnover in the last twelve months, followed by residential properties* (approx. EUR 350 million) and mixed-use properties (approx. EUR 300 million). * Only properties with a minimum of 50 residential units Supplemental graphics and data related to this press release can be found on the Savills Online Property Investment Market Dashboard