High quality is in demand, while small lettings are declining

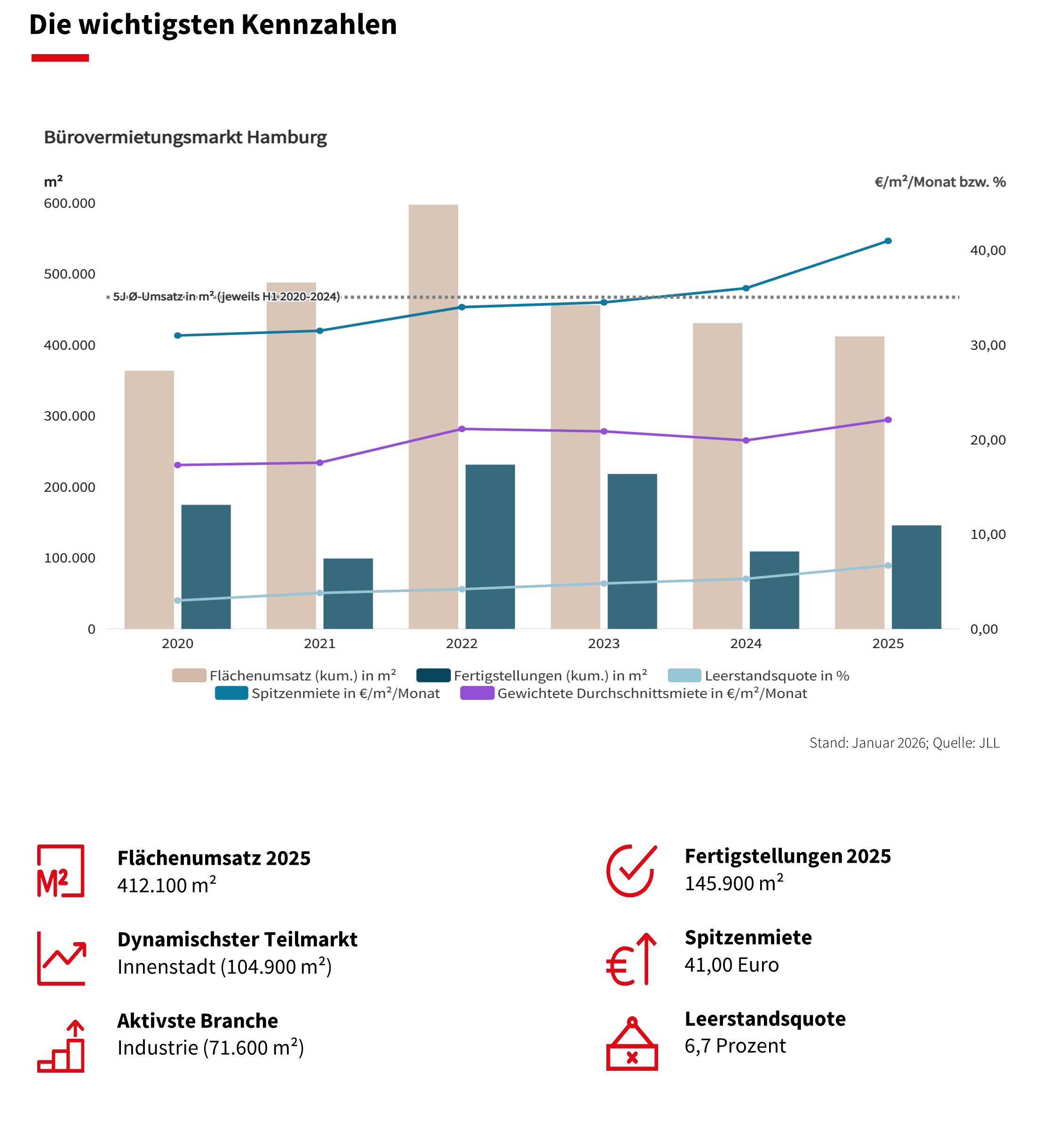

Hamburg’s office leasing market ended 2025 as a whole with a mixed result. The strong first quarter with take-up of 132,100 m² could not be confirmed in the three following quarters, and at the end of the year, the market even delivered the weakest single quarter with 87,000 m². The annual balance sheet shows a total of 412,100 m², which corresponds to a decline of four percent compared to the previous year. Against this backdrop, the vacancy rate grew from 5.3 percent to 6.7 percent, while at the same time the prime rent also rose significantly from 36 euros/m² to 41 euros/m².

Alexander von Bülow, Branch Manager and Senior Team Leader Office Leasing JLL Hamburg: “We were able to see a clear differentiation in the market last year. On the one hand, the number of deals fell by 13 per cent to just 436, which is mainly due to the significantly lower number of smaller lettings of less than 1,000 m² by 78. At the same time, however, we are seeing growth in large and high-quality space between 2,500 m² and 10,000 m², which explains the noticeable turn in the price screw despite the rising vacancy rate.”

The number of large-scale deals in excess of 10,000 m² fell from six to four year-on-year, while take-up in this category almost halved to 61,800 m². The largest of these are the 26,600 m² of NXP Semiconductors in Altona-Ottensen-Bahrenfeld in the third quarter and around 10,500 m² in the fourth quarter in the Stadtkontor in the St. Georg submarket.

While the city centre was able to maintain its position as the frontrunner with 104,900 m² and Altona-Ottensen-Bahrenfeld (52,900 m²) was able to make significant gains in second place, classic office locations such as the core area of City South (minus 25 per cent take-up), its outer area (minus 82 per cent) and City North (minus 94 per cent) recorded significantly less momentum last year. “This will prove to be a snapshot, because high-quality office space with good connections is still in demand in these sub-markets as well,” says von Bülow, classifying this development.

Meanwhile, completions increased by more than a third to 145,900 m², with just under 22 per cent of the office space still available at the time of completion.