Savills examines the office leasing market in Frankfurt am Main in the fourth quarter of 2025

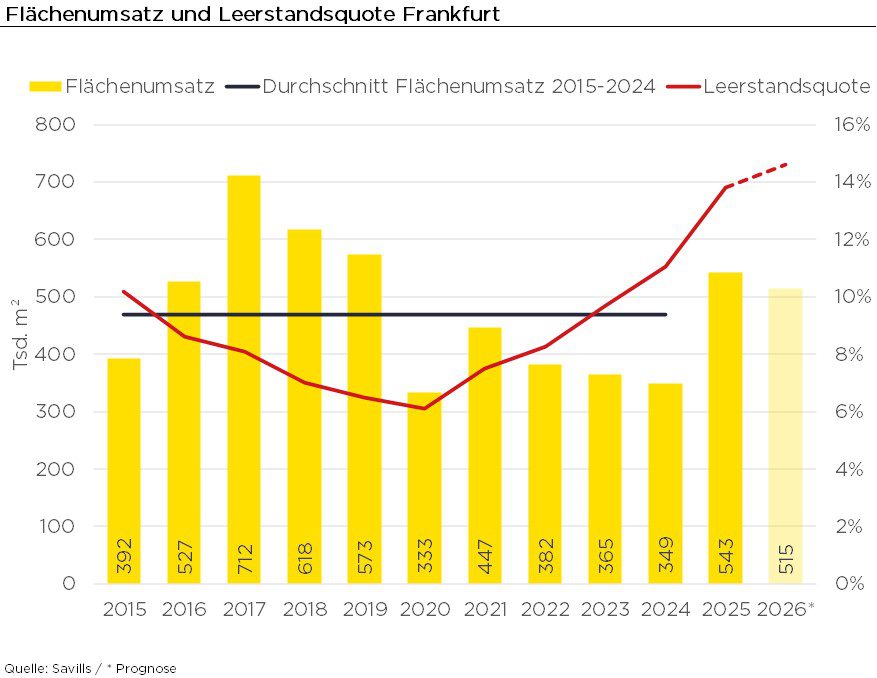

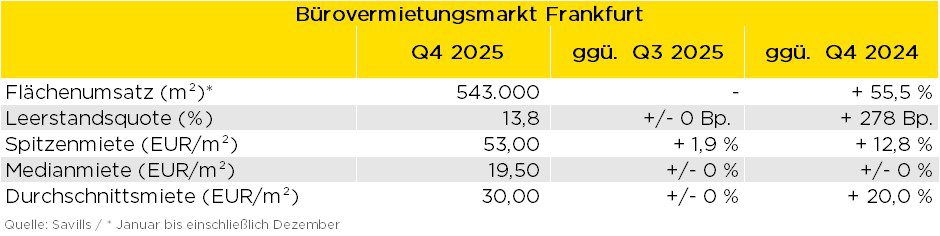

In 2025, take-up on the Frankfurt office letting market amounted to 543,000 m². This represents an increase of 55.5% compared to the previous year. Compared to the ten-year average, sales were around 15.6% higher.

The vacancy rate remained stable in the fourth quarter of 2025 compared to the previous quarter and stood at 13.8%. Year-on-year, the ratio rose by 278 basis points. The prime rent reached EUR 53.00/m², up 1.9% on the previous quarter. It increased by 12.8% year-on-year. The median rent amounted to EUR 19.50/m² and was stable compared to both the previous quarter and the previous year.

Jan-Niklas Rotberg, Managing Director and Head of Office Agency Germany at Savills, reports: “The Frankfurt office leasing market seems paradoxical at the end of the year: the vacancy rate is high, but prime rents are still rising. The core is not so much too much office as too much of the “wrong” office. Vacancies accumulate mainly in peripheral locations and in older properties that no longer fit modern working environments with their floor plans and lack of flexibility. There is certainly demand, even for applications over 10,000 m², but it is very selective and is almost exclusively aimed at state-of-the-art new construction and refurbishment space in very good locations. Because the project pipeline will tend to become smaller in the coming years, it is precisely this premium offer that will remain scarce. The prime rent is driven primarily by financially close users who are willing to pay for central quality because they want to bring their employees back into the office more often and need space that is convincing in the competition for skilled workers. As a result, the pressure to modernize the portfolio is growing, while prime rents continue to have a tailwind.”

Savills expects take-up in 2026 to remain slightly below the previous year’s level, but still above the long-term average. While an increase in the vacancy rate is expected, prime rents are expected to remain stable.

Additional graphs and data can be found in our online dashboard on the top 6 office markets.