Large portfolios of medical centers and clinics characterize current market activity

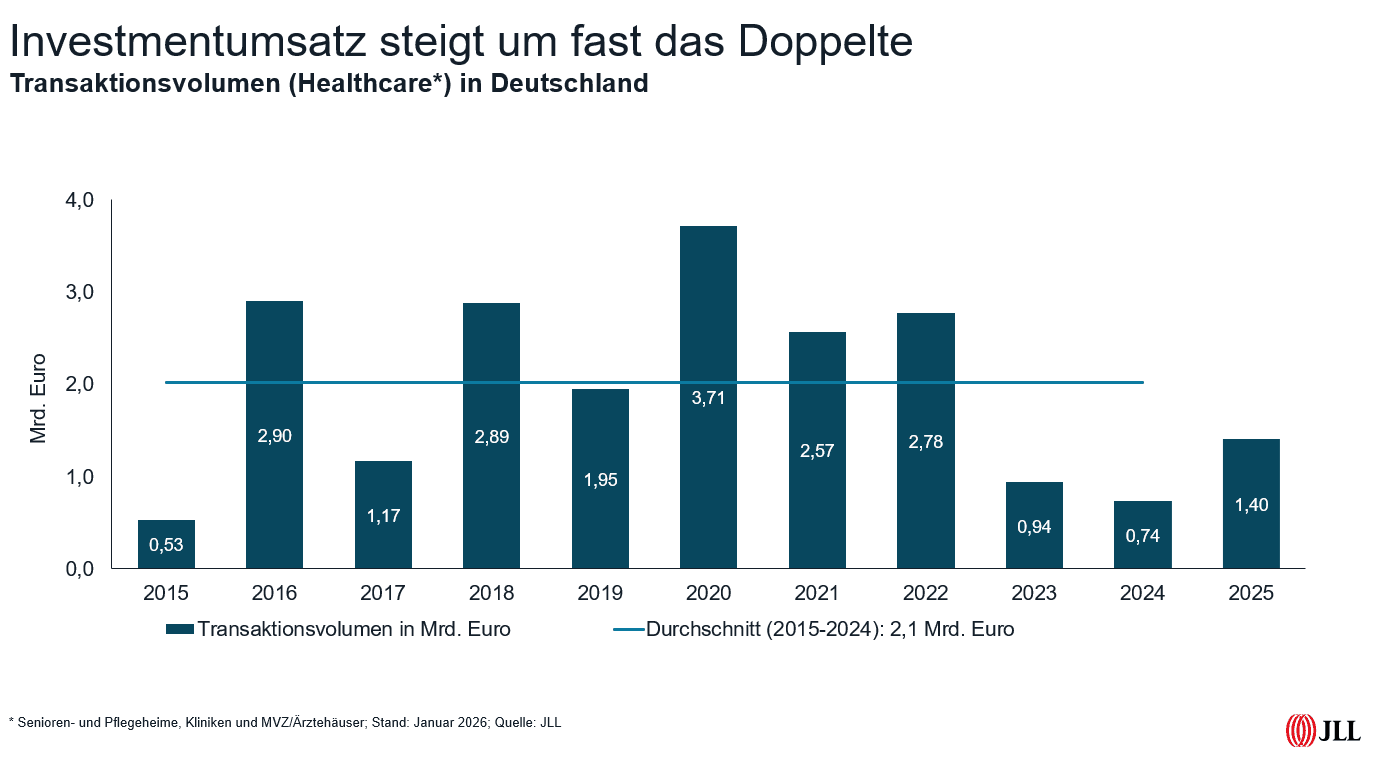

Investors in healthcare real estate have shown themselves willing to buy in 2025, especially in the first half of the year. The transaction volume for the year as a whole totalled EUR 1.4 billion, almost doubling the previous year’s figure. The focus was once again on nursing homes. That could change this year.

A total of 50 deals were concluded last year, compared to only 20 in the previous year. Last year, international investors were still ahead.

Nursing homes continue to dominate the market with a share of 81 percent of total turnover. However, their dominance is no longer quite as clear as in the previous year (84 percent). On the other hand, hospitals have slightly increased their market share from ten percent to 16 percent in 2025.

Portfolio with medical centers could give the market a good boost

Medical centers come to three percent, but are the most popular subsegment together with assisted living, according to Peter Tölzel, Team Leader Healthcare Investment JLL Germany. “Investors would like to buy both more. In particular, good, new medical centers in larger cities are in great demand. However, there is a lack of the corresponding product range.”

However, this has changed with the turn of the year. For example, a portfolio of 32 medical centers in Germany and the Netherlands is currently up for sale. In addition, the sale of a hospital portfolio of a similar size, which was already close to completion at the beginning of 2025 and was ultimately cancelled by the prospective buyer, could possibly still be sold. “If this portfolio were also to find a new owner, there would already be a very decent turnover in the statistics in the first months of 2026,” Tölzel calculates, drawing parallels to the previous year, when the purchase of 13 care facilities by the city of Hamburg in the first quarter of 2025 ensured a massive start to the year.

Investors are gradually shedding their reluctance to buy

Unlike in 2025, however, Tölzel does not expect such a significant slowdown in market momentum in the following months. “We have recently had quite high pitch activity and expect further product, especially from the nursing home and perhaps assisted living segment, to come onto the market.” It is also slowly becoming apparent that the broad reluctance to buy among some investors has given way. In the meantime, there are also international addresses that are waiting for the right opportunity. “However, these would then be value-add topics with high return requirements, which often do not yet fit together. On the other hand, we also see established addresses among German asset managers who have capital commitments and can buy again.”

The transaction volume should therefore be higher in 2026 than in 2025, “but it is difficult to predict whether the long-term average of around two billion euros will be reached.”