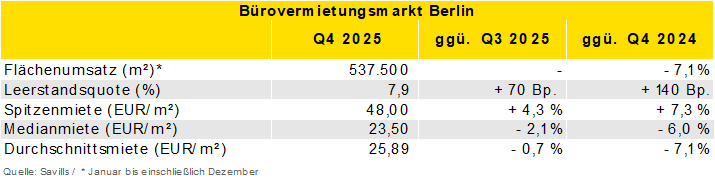

In 2025, take-up on the Berlin office letting market amounted to 537,500 m². This corresponds to a decrease of 7.1% compared to the previous year’s figure. Compared to the ten-year average, sales were around 32% lower.

The vacancy rate rose by 70 basis points to 7.9% in the 4th quarter of 2025 compared with the previous quarter. Year-on-year, the ratio increased by 140 basis points. The prime rent was EUR 48.00/m², an increase of 4.3% compared to the previous quarter and 7.3% compared to the previous year’s figure. The median rent amounted to EUR 23.50/m², a decrease of 2.1% compared to the previous quarter and a decrease of 6.0% compared to the same quarter of the previous year.

Karina Sauer, Associate Director and Team Leader Office Agency at Savills in Berlin, comments: “Anyone looking for reliable activity in the Berlin office letting market will currently find it in the segment up to 1,500 square metres. There was a lot of movement there over the course of the year, often triggered by contract terminations, space optimisation or increasing requirements in building technology and ESG. But this is precisely where the central break in the market becomes apparent: there is a quality gap between what is sought and what is available. A noticeable part of the areas is technically outdated or has too rigid floor plans and thus falls out of the search grid for many users, even if the location or price fits. Without modernisation, re-letting quickly becomes a question of patience, especially since the competing space is increasing. On the other hand, those who can deliver ready for occupancy, with the fit-out, plug-and-play and rent-free periods, will reach their destination much faster. In the large-scale segment of 2,000 m² or more, demand remains subdued, but is becoming increasingly stable overall. Such users are currently finding what they are looking for, especially in project developments. For the first quarter of 2026, some leasing decisions are emerging in this segment, which should support a positive start to the year.”

For 2026, Savills expects take-up to be slightly below the previous year’s level, while prime rents are expected to remain stable due to continued demand for high-quality office space.

Additional graphs and data can be found in our online dashboard on the top 6 office markets.