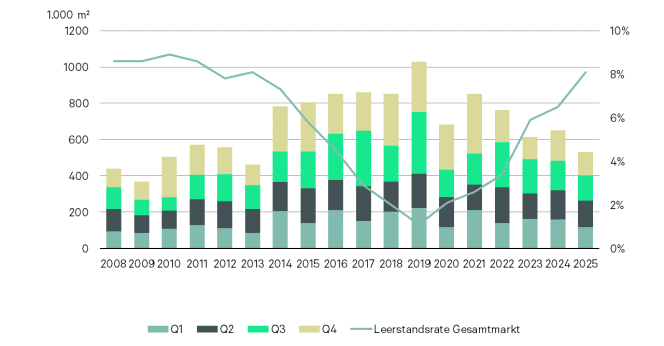

Although the Berlin office letting market recorded a 19 per cent decline in take-up to around 531,000 square metres in 2025, the number of new leases rose by 20 per cent to around 900 contracts. This is the highest value since the beginning of the market survey in 2009. More than 50 per cent of take-up was accounted for by deals with less than 1,000 square metres. Only two deals were registered in the size class above 10,000 square metres – in the previous year there were eight.

The total investment volume in Berlin in 2025 fell by 21 percent to 4.9 billion euros. Nevertheless, Berlin remained the leading location among the top 7 markets – the capital accounted for a total of 36 percent of the top 7 investment transaction volume. Investment momentum increased significantly in the second half of the year in particular: the volume was 35 percent higher than in the first half of the year. The office investment market has developed more positively than in the previous year, with a 22 percent increase in take-up, and is also the leading segment location among the top 7 markets with a share of take-up of 28 per cent. These are the results of a recent study by the global real estate service provider CBRE.

Office rental market

“While large-scale leases remained rare in 2025, the Berlin office market showed its stable foundation with a previously unseen large number of deals,” says Marc Vollmer, Head of Office Leasing Berlin at CBRE. The average transaction size in 2025 was less than 600 square metres. Instead, there was a 45 percent increase in lease renewals (in square meters) – this shift in relocation decisions increases the tenant potential of the future.

“We see a strong differentiation in rents between absolute top products in outstanding locations and high-quality products in acceptable locations. At the same time, users are increasingly making demand-oriented decisions and renting only the space they really need. The flexibly divisible Prime product thus remains an important driver of the Berlin office letting market.”

The prime rent rose slightly by one percent to 45 euros per square metre per month in 2025. Deals at this price level were concentrated in particular on the CBD sub-markets Central, Hackescher Markt, City West and Alexanderplatz. Across the market as a whole, the weighted average rent fell by ten percent to 25.47 euros. In peripheral city locations, the average rent fell by 13 percent year-on-year. “Many of these spaces are well connected and economically feasible for many users – especially for companies that have increasingly looked for alternatives in recent years in view of the strong rent level in Berlin,” explains Vollmer. “Nevertheless, the increasing spread in rents in particular underlines how important investments in property/space quality and ESG standards are. Outdated properties are coming under greater pressure and elementary modernizations are becoming a decisive competitive factor,” says Vollmer.

In terms of demand sectors, real estate and IT companies led the way, each accounting for 13 percent of take-up. The public sector, which is traditionally strong in Berlin, was much more cautious in 2025. Its share of sales fell significantly compared to the previous year.

The vacancy rate in relation to the overall market rose moderately by 1.6 percentage points to 8.1 per cent in 2025 and was thus at a similar level to the end of 2013. This was driven by lower demand for large-volume space and at the same time by the large number of unabsorbed completions: Of the approximately 408,000 square metres completed in 2025, around half remained unlet.

The changed demand profile is also reflected in the project development pipeline. While around 634,000 square metres of additional office space will be added in 2026 – with a pre-letting rate of around 33 per cent – the pipeline will be significantly thinned out from 2027, especially for speculative project developments. “In the short term, the new building may increase the vacancy rate somewhat. In the medium to long term, however, the supply of prime products in prime locations is likely to become scarcer if fewer new spaces follow,” says Vollmer. “Against this background, there is a noticeable need for the repositioning of obsolete space in the central prime locations.”

Investment market

“Despite the stronger second half of the year, the total volume in 2025 fell by 21 percent to 4.9 billion euros,” says Steffen Pulvermacher, Head of Investment Berlin & Region East at CBRE. “However, it should be taken into account that in 2024, out of a total of seven major transactions (each with more than 100 million euros), were in the residential asset class, which were not available in the Berlin market in 2025 due to the portfolio adjustments of large portfolio holders, which have already been largely completed.

In terms of asset classes, the investment volume in the residential segment thus fell significantly compared to the previous year, but remained the asset class with the highest volume at EUR 1.6 billion. In the commercial real estate sector, the office segment was by far the leader, recording a positive increase of 22 percent to EUR 1.2 billion. In the case of retail properties, the transaction volume fell significantly – but here, too, it should also be taken into account that 2024 was characterised in particular by the large-volume KaDeWe transaction of over one billion euros.

The share of domestic investors was 57 percent in 2025, which is still higher than foreign capital. Private investors were the most active buyer group across all asset classes, accounting for 21 percent of the transaction volume. In the commercial segment, their share was 25 percent.

When it comes to office investments, the focus of investors in 2025 was clearly on central locations. The CBD submarkets combined over 900 million euros and thus a total of 75 percent of the office transaction volume. “Most office investors currently still have small to medium-sized ticket sizes as a sweet spot – across the various risk classes. We see that the investment market is increasingly picking up on the dynamics of the rental market – investors are specifically looking for properties with repositioning potential in CBD locations,” says Pulvermacher. “Together, core-plus and value-add transactions amounted to around EUR 537 million, or 44 percent of the office investment volume. This value could be higher, especially for value-add transactions, but is limited by the currently highly risk-adjusted behavior of the banks or thus indirectly puts pressure on the values. As a consequence, vacant or vacant office properties offered on the market are increasingly being examined for conversion into commercial housing and hotels, with adequate capital values, and are also being implemented. Selective core capital for small and medium-sized office investments in top locations is still available, but Berlin simply lacks suitable products here at the moment.”

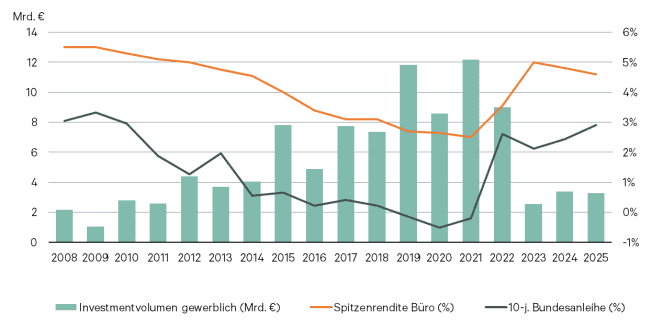

The prime yield for office properties in central locations fell slightly by 0.2 percentage points to 4.6 percent in the course of 2025. In contrast, a risk premium was registered in locations on the outskirts of the city, where prime yields rose to 6.1 percent. For peripheral properties, the prime yield remained stable at around 7.0 percent. This means that the differentiation according to location and property quality continues here as well.

Outlook for the full year 2026

“In 2026, office space take-up is likely to be slightly above the level of 2025. We see a fundamental continuation of the previous trends: many small and medium-sized leases concluded, but few large-scale searches. Positive impetus will come from the emerging gradual economic recovery and a continuation of the increase in prime rents,” Vollmer expects.

“For 2026, despite a continuing challenging economic situation, we expect higher investment activity, also because additional portfolio properties are likely to come onto the market, especially from long-term portfolios. Many institutional investors, such as insurance companies, funds and pension funds, have reached the strategically planned holding period of the assets or have already significantly exceeded it due to the last supercycle, i.e. taking value creation through pure value appreciation, and are therefore subject to transformation pressure that should not be underestimated. Since office properties from these portfolios in particular are usually in need of modernization/repositioning due to their age and the supply of corresponding space on the rental market in CBD locations is limited, there is a clear business case for Core+ and value-add investors with an adequate price-performance ratio that is now prevailing. Certainly, in addition to a greater willingness to finance, this will and must once again include international players,” says Pulvermacher.

Berlin office market: Office take-up (incl. owner-occupancy) and vacancy rate

Investment volume (commercial), net initial yield & yield 10-year Bund