Number of deals at previous year’s level, revenue falls significantly

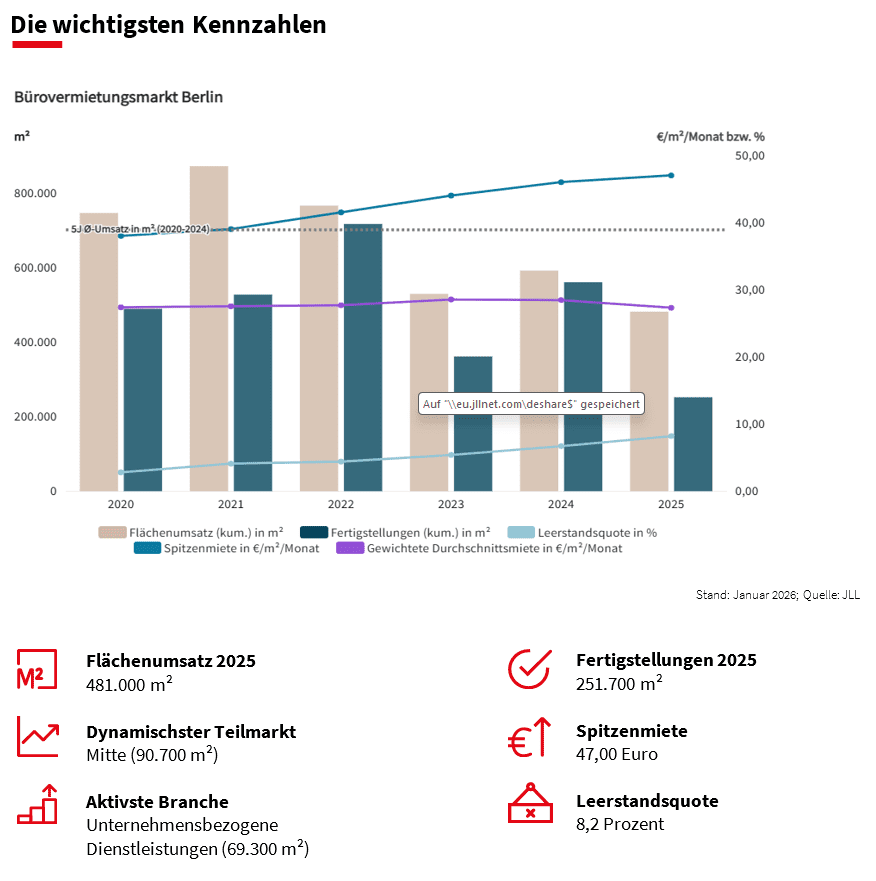

The Berlin office leasing market closed 2025 with one of the weakest results in recent years. A total of 481,000 m² was leased, a decline of almost a fifth compared to the previous year (591,100 m²). The minus is even more pronounced in a long-term comparison: the five-year average was missed by 31 percent, the ten-year average by 40 percent.

There was also no noticeable market recovery in the final quarter. Take-up here amounted to 125,900 m², 16 per cent below the previous year’s figure (149,200 m²). After all, with 221 leases, there were the most deals in a quarter-on-quarter comparison. In the year as a whole, 773 deals were registered, only five fewer than a year earlier.

What is still missing are large-volume deals. In 2025, there were only two lettings above the 10,000 m² mark, compared to seven in the previous year. The largest deal was concluded by the state-owned company Wista Management with 10,900 m² as the operator of the House of Games in the Mediaspree submarket. Two-thirds of the deals were in the size class of less than 500 m². “We are also seeing a slight improvement in demand for medium-sized spaces between 1,000 and 2,000 m², especially in CBD locations. In contrast, there is still restraint in large-volume leasing due to the difficult economic situation,” says Anja Schuhmann, Branch Manager JLL Berlin and Leipzig, commenting on market developments.

Most of the leases in 2025 took place in Berlin-Mitte, with a market share of around 19 percent. This is followed by the Charlottenburg-Wilmersdorf (ten percent) and Kreuzberg (nine percent) submarkets. The sectors with the highest turnover were business-related services with 14 percent and education, health, social affairs and IT with twelve percent each.

When moving, companies often opt for very good quality space in good locations. Accordingly, the prime rent is continuously rising and is currently at 47 euros/m². Because few new products are currently coming onto the market, Schuhmann expects a further moderate increase in prime rents.

In terms of take-up, it forecasts a volume of around 550,000 m² for 2026. “We expect a moderate revival in demand and expect more larger deals again, which indicates a slight improvement in take-up for 2026,” says Schuhmann.