More purchase cases, but no price increases yet: This development characterizes the Berlin residential investment market in 2025. This is the result of the ‘Berlin Apartment Building Market Report 2025/2026’, which is published on the basis of figures from the Berlin Valuation Committee and SCHICK IMMOBILIEN’s own calculations.

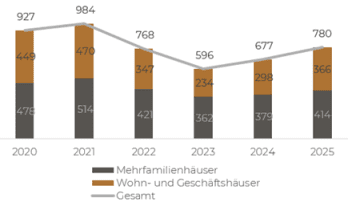

The number of purchase cases continued to rise steadily in 2025. Transaction figures have grown for both apartment buildings and residential and commercial buildings. After buying cases bottomed out in 2023 and stood at 596, they rose by around 13% to 677 in 2024 and then finally reached 780 last year, an increase of around 15%. Although the market is still below pre-crisis levels, it shows a continuing positive trend.

Sales slightly below previous year’s level

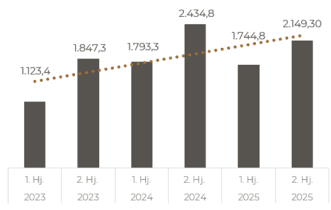

The transaction volume in the 2nd half of 2025 increased from 1.74 billion euros to 2.15 billion euros compared to the first half of 2025 and was thus not far from the figures from the previous year. Overall, the transaction volume in 2025 was 3.89 billion euros, around 8% below the 4.23 billion euros in 2024, but significantly higher than in 2022 and 2023. On the basis of the available figures, the Berlin residential investment market shows a clearly cyclical development of the transaction volume with an as yet incomplete recovery.

“Investors are increasingly returning to the Berlin apartment building market, as the figures for 2025 clearly show. Many market participants are optimistic about Berlin’s potential as by far the largest German investment market. This is a positive signal to all market participants,” says Jürgen Michael Schick, Managing Director at SCHICK IMMOBILIEN and publisher of the apartment building market report for Germany and Berlin.

Purchase prices have not yet risen

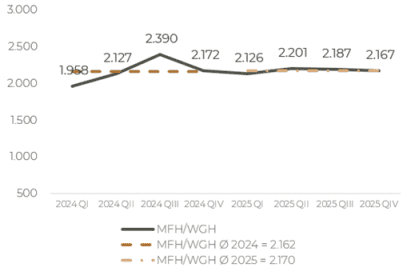

The development of average purchase prices per square metre on the Berlin residential investment market points to further price stabilisation in the period from 2024 to 2025. Short-term fluctuations, which vary in severity in apartment buildings, but also in residential and commercial buildings, remain temporary and are corrected promptly.

Across both segments, the median purchase price reached a temporary high of €2,390/m² in the third quarter of 2024, before being adjusted again to €2,172/m² in the following quarter. Since the beginning of 2025, prices have remained stable to this day. Since then, average prices per square metre have been in a narrow range between €2,126/m² and €2,201/m². Overall, a continued consolidation of the price level can be observed; on average, there were no sustainable price increases in 2025.

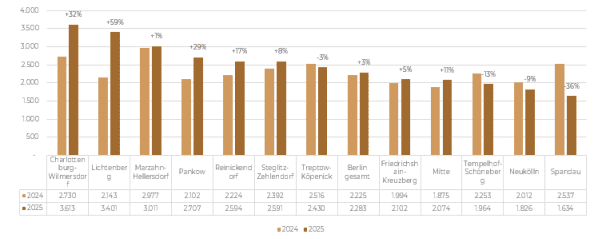

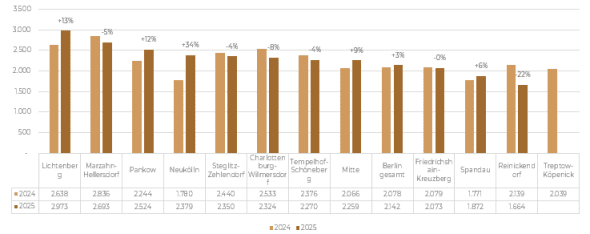

Even though the price development for Berlin was very low overall, there were some major changes in the individual districts.

In the Charlottenburg-Wilmersdorf district, the median purchase price for apartment buildings rose by 32% between 2024 and the end of 2025 and was 3,613 euros per square metre last year. The exact opposite can be found in Spandau, where the average price has fallen from 2,537 euros to 1,634 euros, a decrease of 36%.

In the case of residential and commercial buildings, the average purchase prices per square metre are highest in Lichtenberg, where the percentage increase of 13% corresponds to a price of 2,973 euros. The largest price decline was observed in Reinickendorf, where the figures fell by 22% from 2,139 euros per square metre to 1,664 euros per square metre.

Cautious optimism – expectations for 2026

For 2026, an inconsistent, but overall cautiously positive market development is expected on the German residential investment market. While the market for existing properties continues to pick up, new construction remains structurally tense despite initial political impulses. Investor sentiment has improved significantly, financing remains challenging, but is increasing again.

In the multi-family housing segment, transaction volumes are expected to rise slightly in 2026 while purchase prices remain stable. The market is increasingly perceived as balanced, with growing demand from both private and institutional and international investors. The current price levels are often considered an attractive entry opportunity.

“In 2026, Berlin will maintain its special position as Germany’s most important residential investment market. Population growth, economic dynamism and international appeal support the capital’s long-term attractiveness. Market participants are aware of political risks and are largely priced in. Investments in Berlin thus remain a strategic decision with a long-term investment horizon,” says Jürgen Michael Schick.