Preference for large-scale, high-quality space increases, demand is likely to increase further

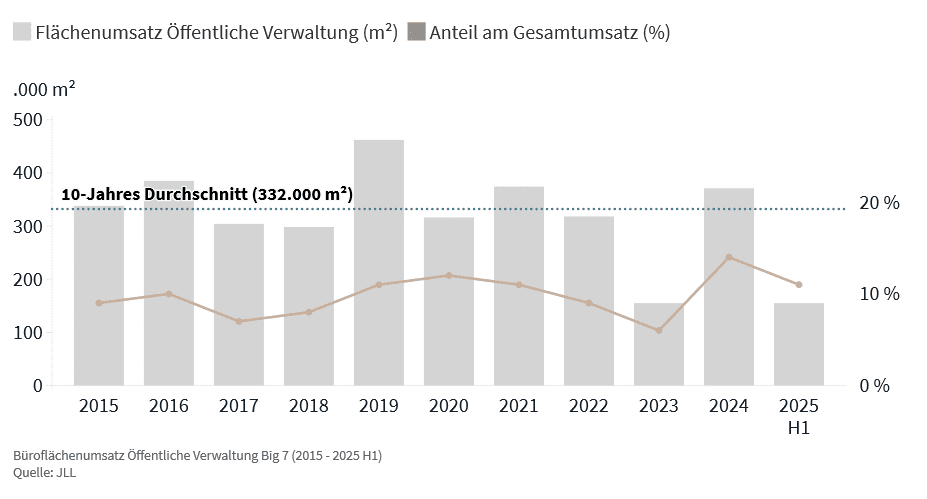

Public administration has established itself as a reliable stability factor on the German office market. With a regularly high letting volume of around 300,000 m² per year, it supports the German office market even in economically challenging times. In the past ten years, the take-up of space by offices and authorities was only significantly below this mark in 2023. When it comes to lettings, the focus is increasingly on large and high-quality office space. This is the result of a recent analysis by JLL, in which the seven largest German office locations were examined.

“Public administration is the largest office tenant in Germany and has been responsible for the largest individual deals in the respective markets in some metropolises for some time,” comments Miguel Rodriguez Thielen, Head of Office Leasing JLL Germany. Examples in 2024 and the first half of 2025 are the lease of around 26,400 m² in the city of Stuttgart in the state capital of Stuttgart, two leases of the Cologne Job Center with a total of more than 30,000 m² or the lease of the Federal Institute for Real Estate (Bima) of more than 25,000 m² in Berlin-Kreuzberg.

On average, the public administration rents office space in the order of 1,500 m². This clearly outperforms all other industries. Telecommunications companies are in second place with 650 m², followed by the industry, insurance, new media and transport, transport and warehousing sectors with 600 m² each.

On average over the past ten years, the leasing volume of the public administration has been 330,000 m². The market share fluctuated between six and 14 percent, with the highest value being achieved in 2024. According to Helge Scheunemann, Head of Research at JLL Germany, the stable high contribution of public administration to take-up results from its long-term planning security in decisions and its lower dependence on the economic cycle: “Administrative tasks remain in place even in times of crisis and require appropriate space capacities. In addition, public real estate decisions are often planned years in advance and go through multi-stage approval processes, making them less susceptible to short-term market volatility.”

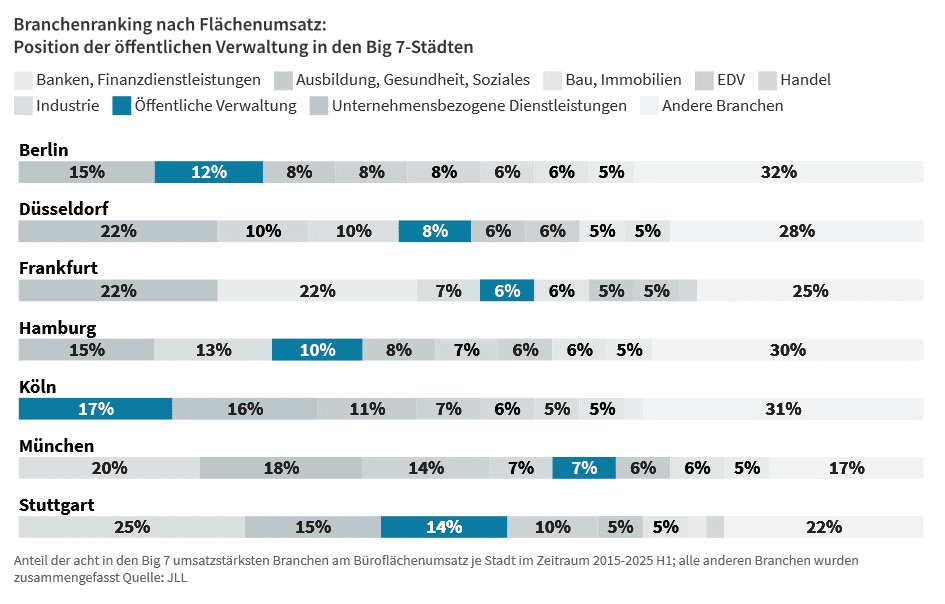

At the regional level, there are striking differences. The market share in Cologne (17 percent), in Stuttgart (14 percent) and Berlin (12 percent) is significantly higher than in Hamburg (ten percent), Düsseldorf (eight percent), Munich (seven percent) and Frankfurt (six percent). “The differences result from the different administrative functions of the cities, with state capitals and authority locations naturally having higher proportions,” explains Scheunemann.

The change in quality standards across cities is striking. Between 2015 and 2019, 42 percent of the rented space of the public administration had A-quality, since 2020 this figure has risen to 59 percent. There was no other industry with such strong growth in the period under review. “The trend towards modern and high-quality office space is also increasingly establishing itself in public administration. This development is driven by sustainability requirements, legal climate neutrality targets and the need for modern jobs to attract skilled workers,” observes Rodriguez Thielen.

Space quality beats location criterion

In contrast to building quality, the quality of the location plays a rather subordinate role. For example, offices and authorities rent much less often in central prime locations than the other industries. While, for example, business-related service providers rent more than half of their space in prime locations, this share is only 28 percent for public administration. On the other hand, it is disproportionately represented in second and third locations with a total of 72 percent.

In the coming years, the developments already taken are likely to continue. Rodriguez Thielen expects demand to increase, driven by the fact that the public building stock is largely outdated and needs to be modernized. As a result, space has to be rented for interim uses. Investments and funds from the Infrastructure and Climate Neutrality Special Fund could provide additional impetus.

At the same time, the ongoing digitalization and establishment of hybrid working models could lead to a certain reduction in space requirements. “From Berlin to Stuttgart, we see a clear trend: authorities are often expanding in terms of area and at the same time consolidating historically dispersed locations into modern administrative centers,” says Rodriguez Thielen.