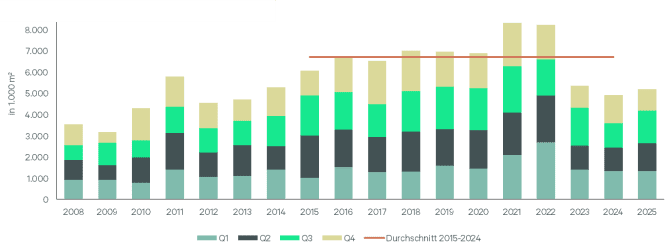

The German industrial and logistics real estate market achieved take-up of 5.2 million square metres in 2025. Compared to 2024, this is an increase of six percent. As in 2024, rentals and owner-occupancy accounted for 74 and 26 percent, respectively. This is the result of an analysis by the global real estate service provider CBRE.

“The German industrial and logistics real estate market developed very differently in 2025 depending on the region. While vacancy rates were extremely low in many established logistics markets and rising prime rents were observed accordingly, less sought-after markets in eastern Germany recorded higher vacancies,” says Kai F. Oulds, Head of Industrial & Logistics Germany at CBRE. “Overall, however, the market was able to record a positive development, especially in the regions of Germany that belong to the ‘Blue Banana’ – but Berlin has also been able to build on good times,” adds Rainer Koepke, Senior Advisor at CBRE.

The increase in take-up is mainly due to medium deal sizes. Unlike in 2024, there was no deal with more than 100,000 square meters in 2025. And growth in the size classes of more than 20,000 square meters was also below average. In contrast, the segment between 10,000 and 20,000 square meters recorded an increase of 20 percent compared to the previous year, while the sales volume in the segment with less than 10,000 square meters increased by ten percent.

The most active market in 2025 was the Ruhr area, with take-up of 528,000 square metres. Frankfurt/Rhine-Main followed in second place with 485,000 square meters. Both markets recorded noticeable growth. The increase in market activity was particularly pronounced in and around Berlin, where take-up of 431,000 square metres was recorded. After the dynamic course of the year, the logistics market in Berlin has stabilised after a recent increase in vacancy rates. For 2026, a gradual reduction in vacancy is expected due to increased demand and the receding pipeline.

However, the market situation in other regions in the eastern federal states remains challenging. For example, the vacancy rate in the Leipzig/Halle region rose by 6.6 percentage points to 15.7 percent in the course of 2025. In the big-box segment, the vacancy rate increased by 1.1 percentage points to 5.0 percent on average in 2025.

In many places, the excess demand ensured that prime rents for modern logistics properties continued to rise. The strongest increases were recorded in Munich (up eight percent to 11.00 euros per square meter per month), Frankfurt/Rhine-Main (up six percent to 8.70 euros) and Stuttgart (up six percent to 8.50 euros). In Leipzig, on the other hand, there was a decline of two percent to 5.90 euros. “The low take-up in 2024, the increase in vacancy rates in some regions and the challenging economic environment have led to reluctance on the part of many developers. Against this backdrop, take-up in new buildings fell noticeably by ten percent to around 2.3 million square meters,” says Oulds. In contrast, take-up in existing properties increased significantly, with a 23 per cent increase to 2.9 million square metres compared to the previous year. “The decline in new construction can be explained by less speculative project developments. For example, some developers have stopped speculative construction projects – instead, they are ready for construction and waiting for built-to-suit opportunities. At the same time, there were move-outs in the portfolio due to the economic situation, but these could often be re-let quickly – especially in the west and south,” explains Koepke.

The most active sector in terms of demand for space was transport and logistics companies with 2.1 million square metres. They accounted for a share of 40 percent. They were followed by manufacturing companies with 1.4 million square meters (share of 27 percent) and retail companies with 1.3 million square meters (including online retailers) (share of 25 percent). “Online retailers from China and their logistics companies played an important role in the large take-up of space by transport and logistics companies,” says Koepke. “Defense companies, whose increasing relevance was discussed in the logistics real estate industry in the course of 2025, on the other hand, were almost non-existent.”

Outlook for 2026

“For 2026, we expect a further slight revival in take-up, also because defence companies could well become increasingly active on the market as owner-occupiers in order to meet the growing demand for specialised storage space for defence and defence material in view of the rapidly changing geopolitical situation. On the other hand, service providers of Chinese online retailers are still expected as tenants, but in regions other than North Rhine-Westphalia, where their focus was to be found in 2025. Overall, there are also signs of a market revival among many, but not all, online retailers. The further course of the German economy is and remains decisive. As soon as significant economic growth is recorded in Germany again, this will also have an impact on demand on the industrial and logistics real estate market,” predicts Oulds.

There are 3.2 million square meters in the current development pipeline under construction. Of this, just over one million square metres were still available for rent at the end of 2025. That is eleven percent less than in the previous year.

*Outside of the top 5 markets, CBRE only records deals of 5,000 square metres or more.

**Distribution halls ≥ 10,000 m², built ≥ 2000, hall height UKB ≥ 10 m

Logistics market in Germany: Take-up of space (letting and owner-occupancy)