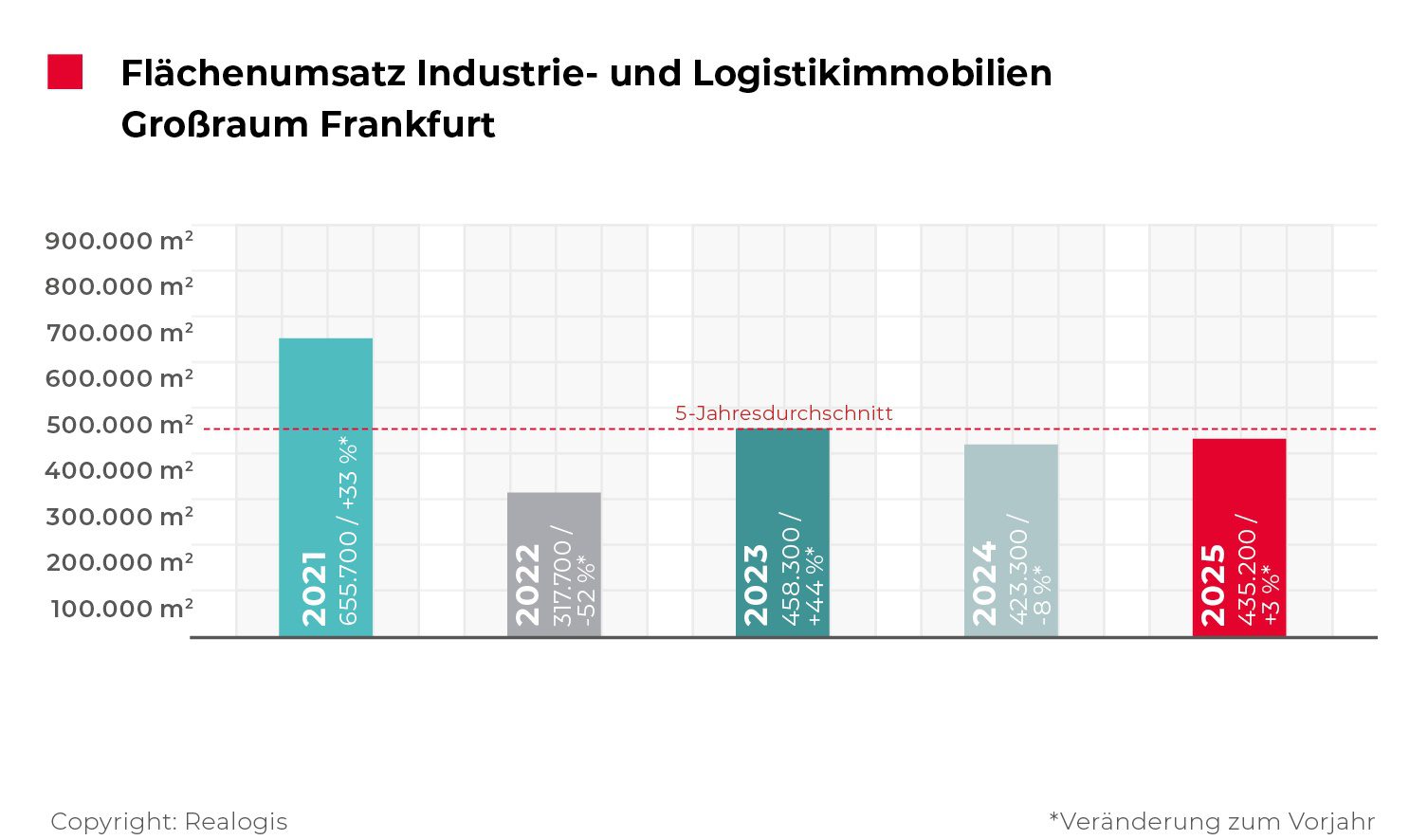

REALOGIS: Frankfurt industrial and logistics real estate market with slight increase, subletting gains in importance

* Take-up with a slight increase of 435,200 m²

* Subletting accounts for 23% of total take-up

at 101,200 m²* Logistics/freight forwarding remains the strongest user group with a share of 48%

* Rhein-Main-Süd dominates with 310,500 m² and a share of 71%

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics properties as well as commercial properties, registered take-up of 435,200 m² for the rental and owner-occupier market of industrial and logistics properties in the Frankfurt area as a whole in 2025. Compared to the previous year, this corresponds to an increase of 11,900 m² or 3%. Earnings were thus 5% below the 5-year average of 458,040 m². The two largest deals in 2025 as a whole were concluded by Shaoke (36,000 m²) and FIEGE (30,700 m²).

Julian Petri, Managing Director of REALOGIS Immobilien Frankfurt GmbH, comments: “Take-up in 2026 is expected to remain below the 5-year average again, as only a few new buildings are currently being planned. Nevertheless, I expect a further gradual market recovery, which will also be reflected in sales figures.”

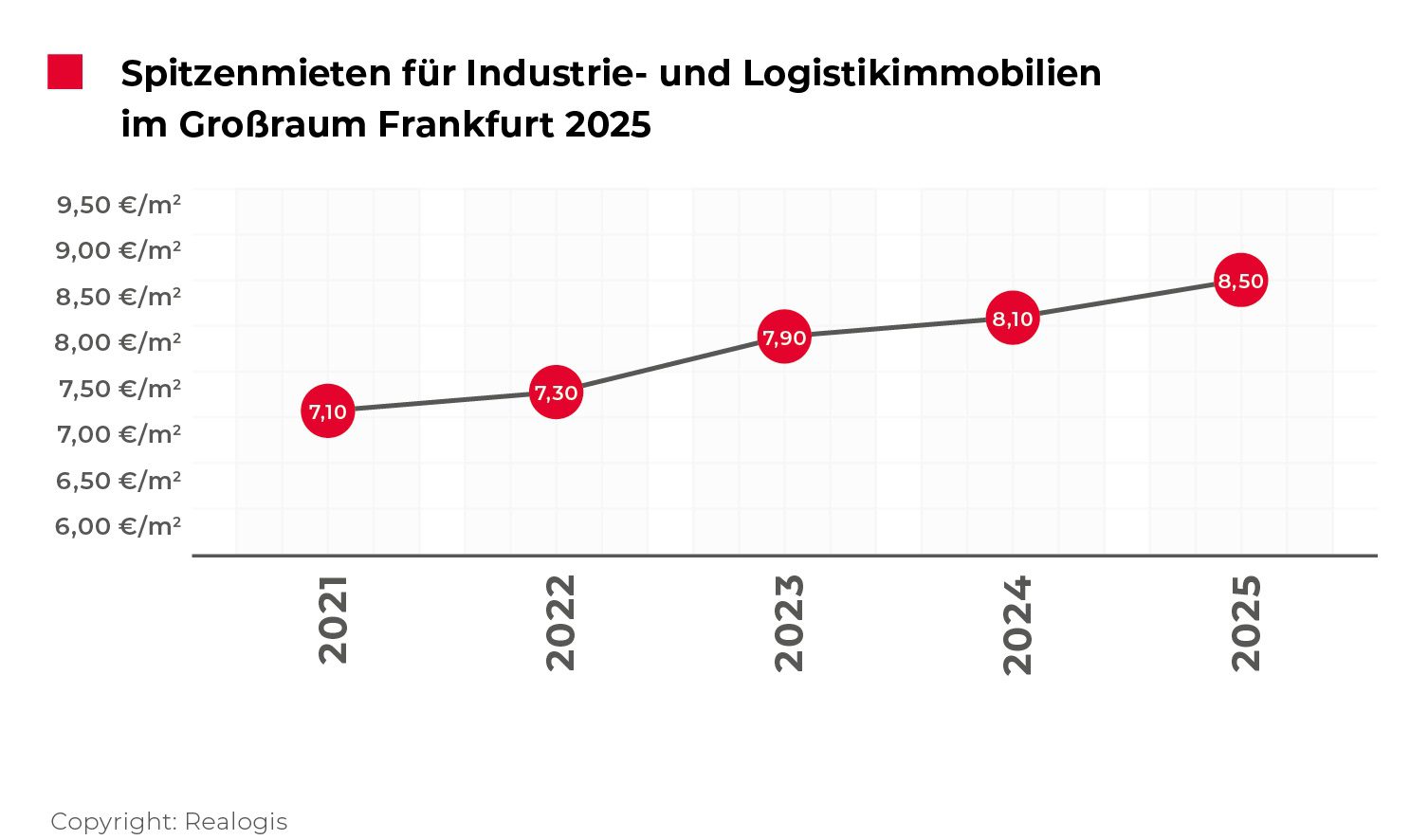

Rents: Prime rents continue to rise

The prime rent rose year-on-year to €8.50/m², reaching a new provisional high. The increase is 40 ct/m² or 5% compared to €8.10/m² in the previous year. At the end of the 1st half of 2025, the prime rent was €8.30/m².

Types of land: Existing areas stable, new construction on greenfield sites with significant growth

The pace was once again set by deals in existing space with 289,700 m² or 66°% of total take-up (2024: 291,600 / 69%). After losses of 20% were recorded for existing properties in the same period last year, there is now a stabilisation. The two major deals by Shaoke and Pirelli Deutschland GmbH together contributed 50,000 m² or 17°% to the take-up of existing space.

Newbuildings on greenfield sites totalled 120,400 m² or 28°% market share. (2024: 72,400 m² / 17°%). The major deals by FIEGE, Alnatura and Aldi Süd were responsible for 69% of take-up in newbuildings on greenfield sites.

Leases on former brownfields contributed 25,100 m² or 6°% to total take-up (2024: 59,300 m² / 14%).

Market structure: Subletting continues to grow, rental market dominates

Subletting remained important for the Frankfurt market. Their share of total take-up rose to 101,200 m² or 23% (2024: 70,300 m² / 17%).

As in 2024, the Frankfurt market area was predominantly tenant-driven. Leases accounted for 96% or 419,300 m², an increase of 54,800° m² or 15%. Owner-occupier deals fell by 43,000 m² or 73% and accounted for 15,800 m² or 4% of the market.

Types of objects: Big box surfaces take the top position

Big box space ranked first with 199,100 m² or 46% share of take-up, replacing the “Other” collective category. In second place was the “Other” category with 119,600 m² or 27% market share. Business parks follow with 116,500 m² or 27%.

Sub-markets: Rhine-Main-South dominates the market

The Rhine-Main-South region remained the clear driver of take-up, reaching 310,500°m² or 71% of total take-up. The largest revenue generators included Shaoke, FIEGE, Alnatura, Aldi Süd and Pirelli Deutschland GmbH.

Rhein-Main-Nord followed in second place with 38,500 m² or 9%. Rhein-Main-Ost achieved 31,100 m² or 7% market share. Frankfurt came to 26,600°m² or 6%, Mainz/Wiesbaden to 16,300 m² or 4% and Rhein-Main-West to 12,200°m² or 3°%.

User industries: Logistics/freight forwarding increases, e-commerce remains declining

Logistics/freight forwarding led the way with 208,500 m² or 48%. The two largest deals by Shaoke and FIEGE accounted for 32% of the industry’s turnover.

Trading followed with 125,200 m² or 29%. Take-up showed an increase of 12,600 m² or 11%. Within retail, brick-and-mortar retail dominated with 113,500 m² or 91%, while e-commerce reached 11,700 m² or 9%.

Industry/production accounts for 73,800 m² or 17°%. The collective category “Other” reaches 27,700 m² or 6°%.

Size classes: Areas of 5,001 m² or more gain in importance

Large areas from 10,001 m² remained the dominant size class. Spaces between 5,001 m² and 10,000 m² each accounted for 67% of take-up on deals of 5,001 m² or more.

Key figures at a glance

- Take-up: 435,200 m²

- Sublets: 101,200 m² (share: 23 %)

- Top rent: €8.50/m²

- Existing areas: 289,700 m² | New building on a greenfield site: 120,400 m² |

New building on brownfield: 25,100 m² - Tenants: 419,300 m² | Owner-occupier: 15,800 m²