• Increase 1: Office take-up significantly above previous year’s figure.

• Increase 2: Supply reserve continues to grow.

• Increase 3: Prime office rents rise again.

Take-up significantly exceeds previous year’s figure.

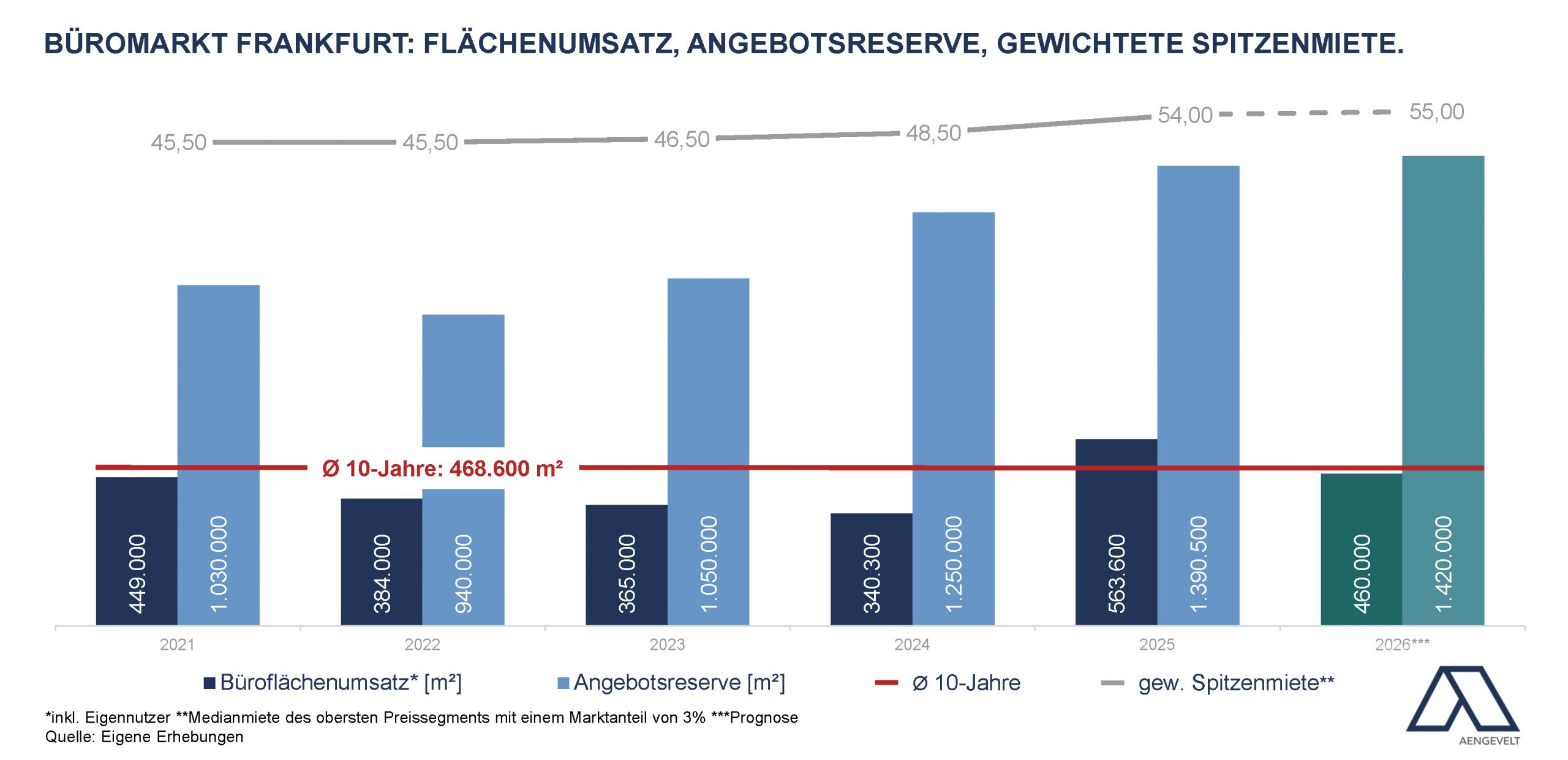

- According to analyses by Aengevelt Research, the Frankfurt office market (including Eschborn and Offenbach-Kaiserlei) achieved office space take-up (including owner-occupiers) of around 564,000 m² in 2025 as a whole. Compared to the same period last year (2024: 340,300 m²), this represents an increase of approx. 66 %. The decade average (Ø 2015 – 2024: 468,600 m² p.a.) was exceeded

by around 20%.With this take-up result, Frankfurt ranks first nationwide, ahead of Munich (approx. 550,000) and Berlin (approx. 475,000 m²). - The main driver of this result was the first quarter of the Frankfurt office market, with take-up of around 200,000 m². The importance of large-volume deals should also be emphasized overall. In 2025, for example, more than half of Frankfurt’s take-up was accounted for by contracts of 5,000 m² or more.

- For 2026, Aengevelt Research expects office space take-up to decline by 460,000 m² and thus at the level of the ten-year average.

Supply reserve increased.

- In the course of 2022, the supply reserve fell to around 940,000 m² by the end of the year (end of 2021: 1,030,000 m²). The vacancy rate stood at 8.2%.

- Since then, the supply reserve has risen steadily to 1,390,500 m² or a vacancy rate of 12% out of a total stock of around 11.6 million m² (beginning of 2025: approx. 1,250,000 m² or 10.1%).

- By the end of 2026, Aengevelt Research forecasts a further slight increase in the supply reserve to a value of around 1,420,000 m².

In view of the focus of demand from broad, especially international user groups for sustainable, ESG-compliant office space, vacancy rates in older, energy-suboptimal properties in particular are growing.

Below average completion level.

- For the year 2025, Aengevelt Research in Frankfurt calculates an office completion volume of around 60,000 m². This figure is around 68% below the previous year’s value (2024: approx. 190,000 m²) and around 58% below the decade average (Ø 2015 – 2024: 141,400 m² p.a.).

- For 2026, Aengevelt Research forecasts a rebounding but still below-average completion volume of 120,000 m².

Prime rent continues to rise.

- The weighted prime rent in Frankfurt has risen to currently around EUR 54/m² within a year (beginning of 2025: EUR 48.50/m²). This corresponds to an increase of 11%.

- The median rent in city locations has risen by around 7% and currently stands at EUR 31.50/m² (beginning of 2025: EUR 29.50/m²).

- For 2026 as a whole, Aengevelt Research forecasts a further increase in the weighted prime rent to EUR 55.00/m².