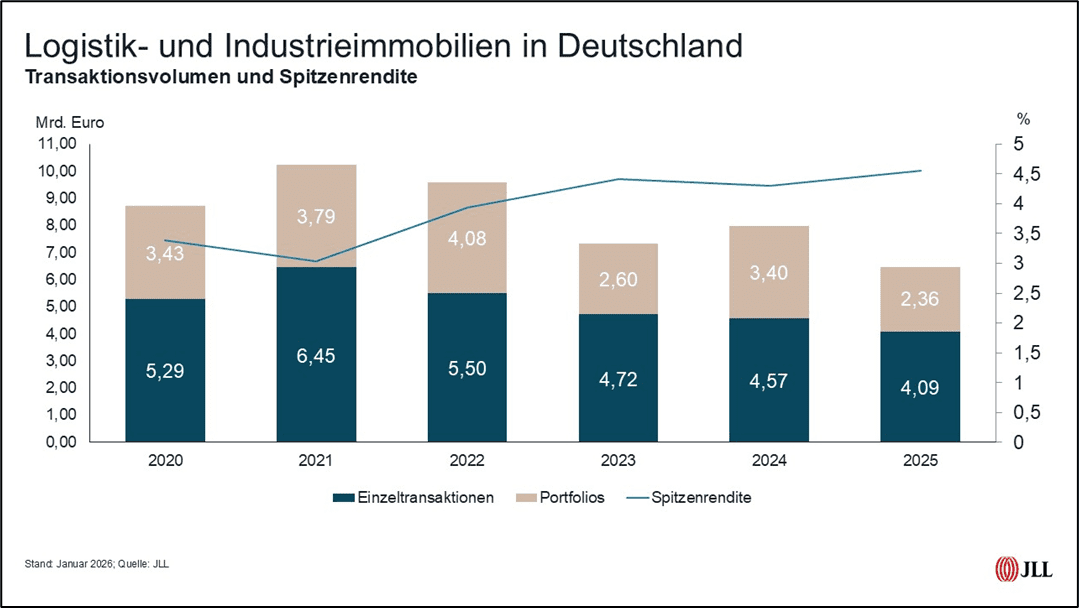

A noticeable decline in major transactions of more than 100 million euros has put a damper on the German investment market for logistics and industrial real estate in 2025. Instead of 25 deals with a total volume of 4.1 billion euros as in 2024, the market recorded only nine with a total of 1.7 billion euros in the past year. With this mortgage, the market achieved a transaction volume of 6.45 billion euros – 19 percent less than in the previous year. However, at the same time he achieved an increase in the number of transactions from 238 in the previous year to 253 now.

“The figures show that the market remains dynamic, but that the focus – especially in the first half of the year – was on small and medium-sized contracts. This underlines the average transaction size of only 18 million euros in the first half of the year,” says Diana Schumann, Head of Industrial & Logistics Investment JLL Germany. “In the second part of the year, however, this figure increased significantly again to 34 million euros, and with more than four billion euros, the larger part of the transaction volume was also achieved. This trend must now be continued in 2026.”

Among the largest transactions of the past year were four portfolio deals, including “Project Helix”, which Palmira Capital sold to Starwood, and “Project Aqua”, which went from Blackstone to GLP in the fourth quarter. Also in the final quarter, the Octo portfolio changed hands from P3 to JD Property, and Logicor sold the “G5” to EQT of Sweden.

“The great interest of international investors in industrial and logistics real estate in Germany is reflected not only in the fact that the largest deals were made by Americans, Swedes and Chinese, but also in the distribution of the total volume. Foreign players achieved 67 percent as buyers and 23 percent as sellers, thus expanding their holdings by more than 2.8 billion euros in 2025. This continues the trend according to which international companies have been consistently expanding their industrial and logistics investments in Germany for five years. Once again, core-plus properties were at the top of the shopping lists, accounting for 52 percent of the total transaction volume. Compared to the previous year, however, Value-add caught up this time and shares second place with Core with 19 percent each. Opportunistic properties achieved their highest share in the past five years at ten percent. On the buyer side, asset and fund managers have once again been particularly active in the past twelve months, with a market share of 51 percent. Only private investors (twelve percent) are still in the double-digit range. On the seller side, asset and fund managers also dominated with 39 percent, followed by corporates with 15 percent and real estate companies with 14 percent of the total volume.

The prime yield rises by ten basis points in all major cities

Prime yields rose slightly by ten basis points across the board in a quarter-on-quarter comparison: Berlin, Düsseldorf, Cologne and Stuttgart are now at 4.6 percent, while Frankfurt, Hamburg and Munich are now at 4.5 percent.

“For the current year, I expect a large number of individual transactions, but also further movement in the portfolio area. The continued manageable liquidity in the core area is offset by high liquidity in the value-add and core-plus segments – we expect that top prices can continue to be achieved only for top projects. In the case of core products, in addition to location quality, the topic of tenant creditworthiness in particular has gained relevance and is examined in detail on the acquisition side,” says Diana Schumann, giving an outlook.