In 2008, Aengevelt Research developed the Aengevelt Residential Investment Index AWI* as a qualified scientific guide to the residential investment market. It collects the assessments of experts from all areas of the housing industry on market sentiments and developments every six months.

The most important facts of the current winter survey 2025/2026 in brief:

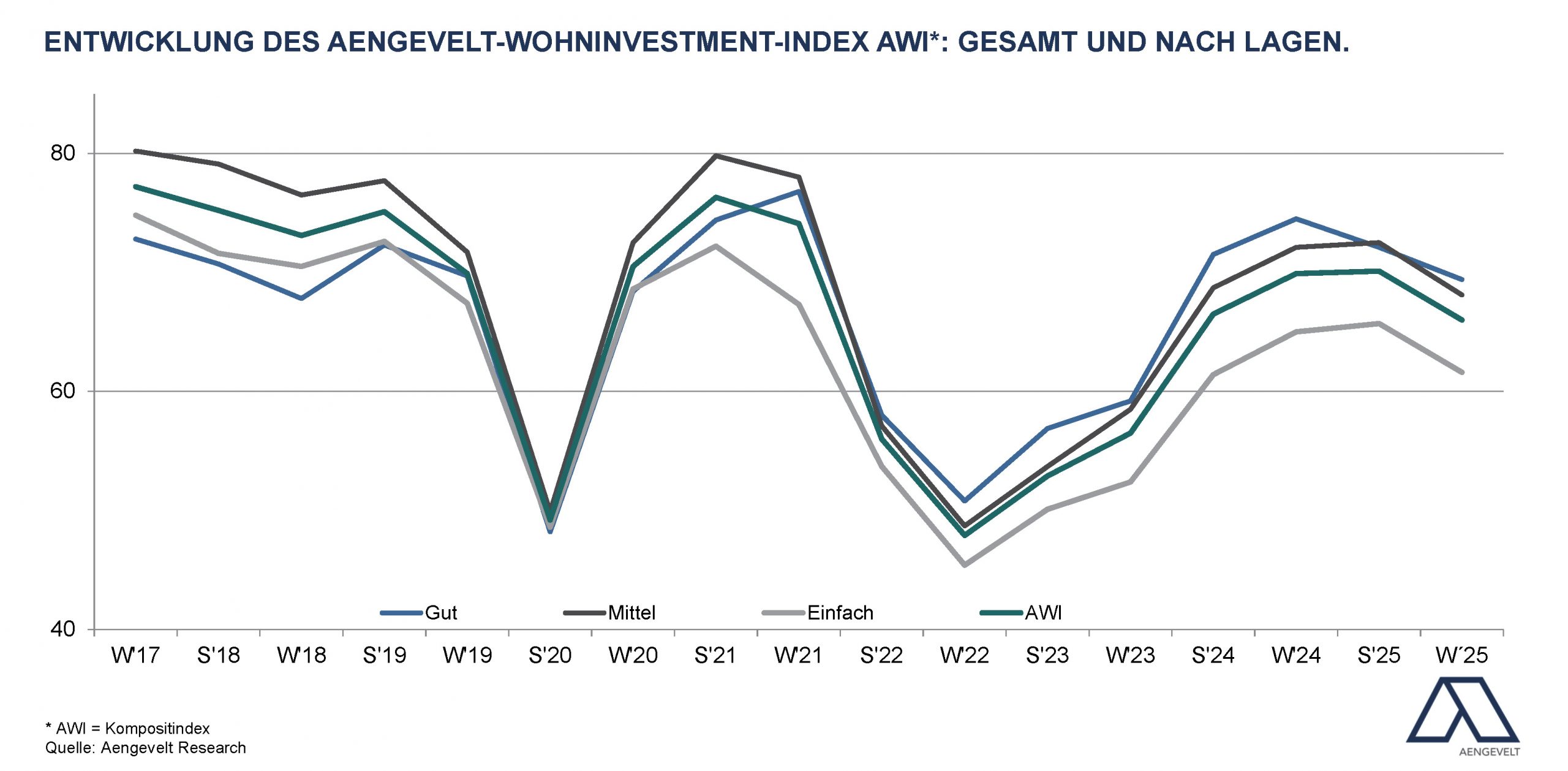

After the AWI achieved its worst result since the beginning of the survey in the 2022/2023 winter survey with 47.9 points, its value rose continuously again thereafter.

This trend continued until the summer 2025 survey with a value of 70.1 points. In the current winter survey 2025/2026, the value has fallen to 66 points, but remains at a high level. This development is stringent across all residential areas:

- The AWI fell by 4.1 points to 61.6 points in simple locations and by 4.4 points to 68.1 points in medium locations. Good locations recorded the smallest decline and fell by 2.7 points to 69.4 points.

- Regardless of the decline, all three sub-indices indicate an imbalance in favour of owners and landlords (market equilibrium: 40 – 60 points).

“The AWI shows two trends: On the one hand, the market conditions for the rental and sale of apartments and residential investments remain favourable. On the other hand, the further decline in housing completions since 2023 (2023: approx. 294,900 residential units; 2025 according to the Ifo forecast: approx. 205,000 residential units) prove that the current governmental and economic framework conditions are not sufficient to significantly and sustainably boost new residential construction across the board and to remedy the existing housing shortage, especially in the growth regions. That’s why we now need even more effective incentives for investors and project developers,” says Dr. Wulff Aengevelt, commenting on the AWI results.

Rental housing market.

The current survey results confirm this assessment:

- Only 1% of respondents expect rents to fall (summer 2025: 3%).

- In contrast, the majority of survey participants (72%) (summer 2025: 76%) still expect rents to rise. In simple residential areas, the figure is 62% (-6 percentage points), in medium locations

New residential construction and renovation.

- This is also due to lower investments in the construction of new rental apartments. The majority of survey participants do not see any short-term change here. For example, the proportion of respondents expecting an increase in investment has fallen to 10% (summer 2025: 16%), while the rate of those who expect a decrease in investment in new construction has risen to 51% (summer 2025: 41%). This confirms the statement of Dr. Wulff Aengevelt regarding the need for even more effective incentives for investors and project developers.

- The survey found stable or slightly increasing values for the importance of modernisation or refurbishment of housing stock: 24% of respondents expect increasing investment in modernisation and repair measures, compared to 23% in the summer of 2025. With regard to increasing investments in energy-efficient building renovation, the figure is 34% (summer 2025: 33%).

__________________________________________________________________________________________________

* The AWI is a composite index and takes into account the future development of demand for rental apartments, the supply of rental apartments, vacancies and rents, as well as assessments of future supply, demand and purchase price developments in the residential investment segment.

Residential investments: AII in market equilibrium

- The expectation of the capital value development of residential investments can be seen from the AII (AENGEVELT Investment Index). This reached a historic low of 23.2 points in the 2023 summer survey.

In the winter of 2023/24, a slight recovery of 28.2 points began, which continued continuously in the next three surveys to 59.5 points in the summer 2025 survey. In the current winter survey 2025/2026, the value fell to 53.9 points. - The AII sub-index fell most sharply in middle locations, namely by 6.8 to 54.8. In simple locations, the AII also fell significantly by 5 points to currently 49.6. The good locations are also declining, but by only 3 points to currently 60.8.

- Across all location categories, a stable high proportion (42%) expects demand for residential investments to increase (summer 2025: 42%; Winter 2024/2025: 38%; summer 2024: 24%; winter 2023/2024: 12%). Only 12% expect demand to decline (summer 2025: 18%, winter 2024/2025: 21%). In the summer of 2023, the figure was still 67%.

- At the same time, 37% of the survey participants expect rising prices for residential investments (summer 2025: 47%; Winter 2024/2025: 38%; summer 2024: 26%; Winter 2023/24: 9%; Summer 2023: 7%)). The proportion of those who expect prices to fall has risen to 21% (summer 2025: 11%; Winter 2024/2025: 17%; Summer 2024: 29%; Winter 2023/2024: 57%; summer 2023: 69%). Overall, these values show that price discovery on the buyer and seller side is well advanced overall, but is still not completely completed.

Result.

- The AWI remains at a high level in the 2025/2026 winter survey. This continues to reflect favourable market conditions for the letting and sale of apartments and residential investments. However, the extent to which this will also be reflected in an increase in new residential construction in the future depends on the development of interest rates, on the regulatory framework conditions such as the construction turbo, building type E, etc., and on the development of land and manufacturing costs. As long as it remains difficult to present new residential construction economically, investors’ interest is more focused on the housing stock.

- For tenants, especially in growth regions, the outlook remains unfavourable or continues to deteriorate: In view of the development of completion figures in particular, no relief on the housing market is expected in the medium term. Accordingly, a further increase in the rent level can be expected in tense housing markets. In addition, there is a rent cost burden that is well above average, especially for lower-income households. Here, too, no easing is to be expected in the short and medium term.