The most important things in brief:

Aengevelt analyses the subdued office market in Leipzig.

- Downwards: Office space take-up falls below decade level.

- Up: Supply reserve continues to rise.

- Crisis-proof: Prime rents remain stable.

No year-end rally – declining sales.

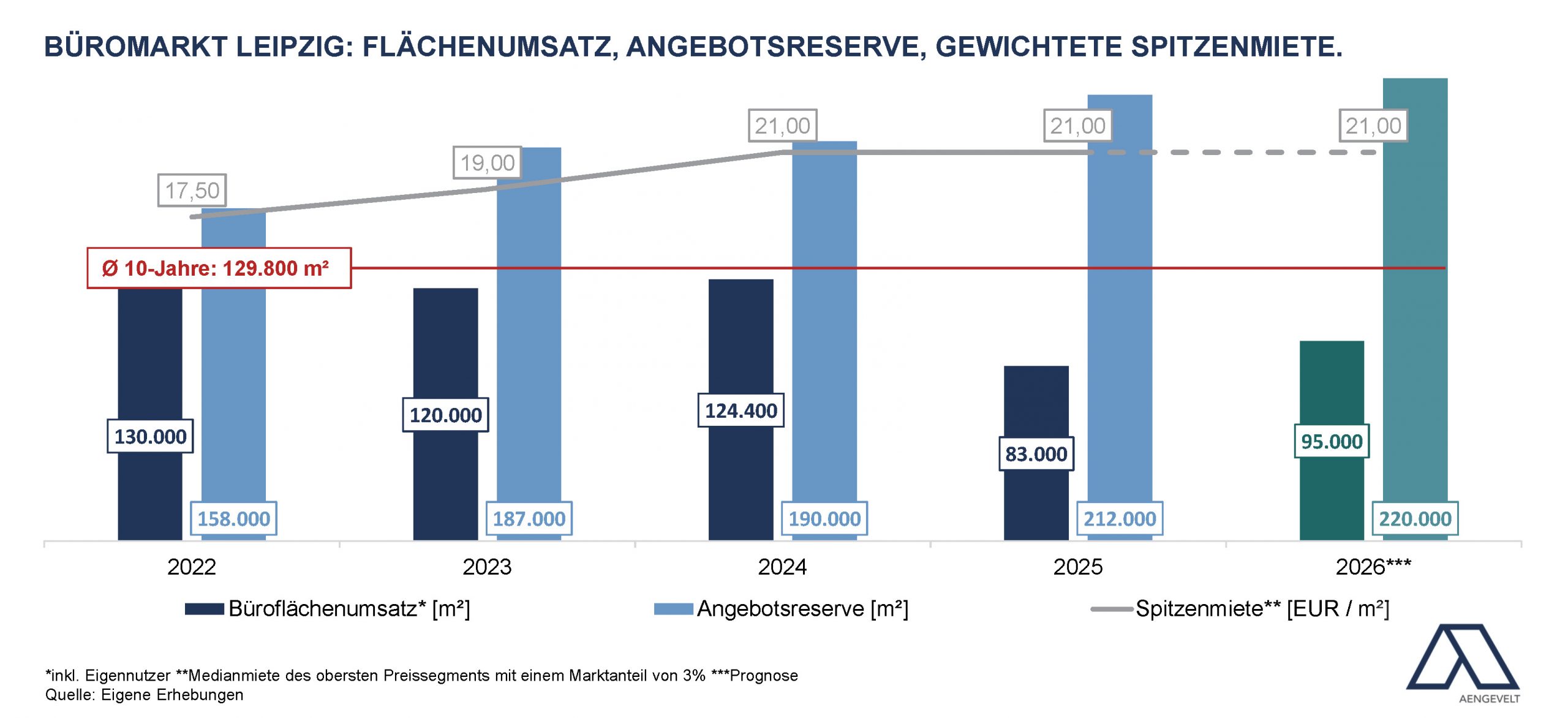

- According to analyses by Aengevelt Research, the Leipzig office market achieved office space take-up of around 83,000 m² in 2025. This figure is slightly one third below the previous year’s figure (2024: approx. 124,400 m²) and around 36% below the decade average (Ø 2015–2024: 129,800 m² p.a.).

- The fourth quarter, which is normally strong in terms of take-up, was also very restrained at just 20,000 m² and remained well below the average of the last ten years (Q4 2015–2024: 42,600 m²).

- For 2026 as a whole, Aengevelt Research forecasts an upward but again below-average result of 95,000 m².

Supply reserve increased.

- The short-term supply reserve (ready for occupancy within three months) on the Leipzig office market has been rising continuously since 2021 (approx. 170,000 m²), albeit moderately, and stood at around 190,000 m² or a vacancy rate of approx. 4,7 %.

- This trend continued in 2025: the supply reserve rose by 12% to around 212,000 m² by the end of the year. With a total stock of around 4 million m² of office space, the vacancy rate is currently around 4 million m². 5,3 %.

- By the end of 2026, Aengevelt Research forecasts a further, more moderate increase in the supply reserve to around 220,000 m². In particular, older properties that have not yet been optimised in terms of energy efficiency will see growth, while modern first-occupancy areas will be rented out quickly.

Above-average office space completion.

- In 2025, around 50,000 m² of office space was completed in Leipzig. This figure is thus stable at the previous year’s level (2024: approx. 50,300 m²), but exceeds the long-term average (Ø 2015-2024: approx. 32,400 m² p.a.) by a full 54%.

- For 2026, a decline in the volume of office space is expected to increase by 25,000 m², which would also be below the decade average.

Stable prime rent level.

- The weighted prime rent for office space has increased significantly in recent years. While it was still around EUR 14/m² at the end of 2018, it will be EUR 21.00/m² at the end of 2025, as in the previous year.

- For 2026, Aengevelt continues to forecast a stable weighted prime rent of around EUR 21.00/m².