At 5.78 million m², the asset class achieved an increase of six percent compared to the previous year

Last year, the German market for warehouse and logistics space worked its way out of the 2024 low again – but only with difficulty. In total, take-up of around 5.78 million m² (owner-occupiers and lettings) was achieved in 2025. Although the result exceeded the previous year’s level by six percent (2024: 5.47 million m²), it fell short of the long-term averages. The five-year average was undercut by 20 percent, the ten-year average by 16 percent. The number of contracts concluded rose by a minimal two percent year-on-year to 693 contracts – nine percent below the five-year average (760). A quarter of the take-up (1.42 million m²) was attributable to owner-occupiers.

Sebastian Bögel, Head of Industrial & Logistics Agency JLL Germany: “Although the logistics market bottomed out in 2025 in 2025, the recovery is fragile. The increase of six percent is a positive signal, but should not hide the fact that we are still well below the record years. Ongoing geopolitical uncertainties and subdued consumer sentiment mean that many companies are making their expansion decisions very carefully and often at short notice. A sudden recovery was therefore not to be expected, and for the current year I also expect a sideways movement and a similar total take-up as last year.”

Meanwhile, Bögel is hoping for positive impetus from new players in the market: “We are seeing increasing demand from Asian retail and logistics companies that are interested in modern locations in Germany.”

The five largest conurbations recorded an increase of around a quarter

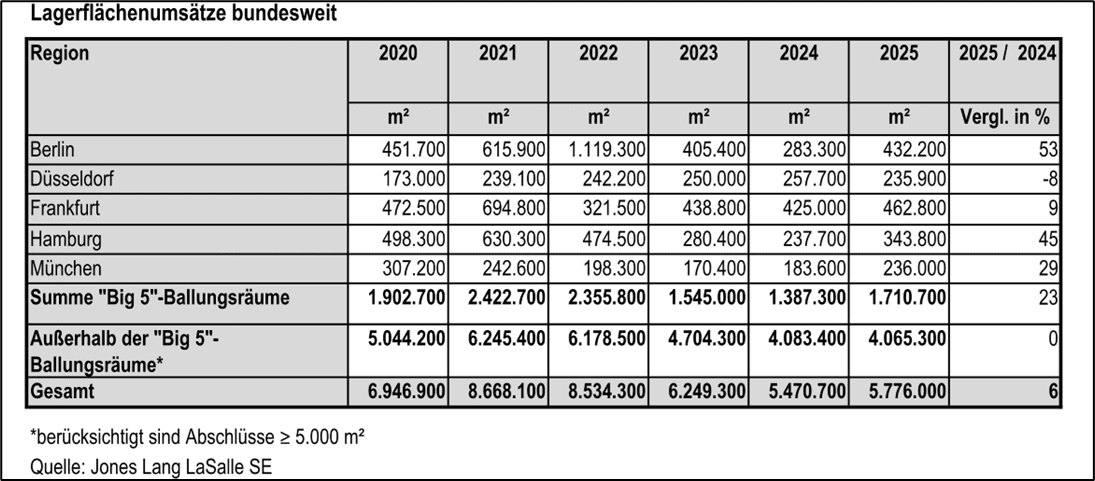

In the five largest conurbations (Berlin, Düsseldorf, Frankfurt, Hamburg and Munich), around 1.71 million m² were taken up in 2025, which is 23 percent more than in 2024. However, the past year benefited from the weak comparative value: Compared to the five-year average, a minus of eleven percent was recorded.

The region with the highest take-up was once again Frankfurt with 462,800 m², an increase of nine percent year-on-year. Last year, take-up also grew in the regions of Berlin (53 per cent) with 432,200 m², in Hamburg (45 per cent) with 343,800 m² and in Munich (29 per cent) with 236,000 m². Only Düsseldorf, with 235,900 m², fell short of the previous year’s figure (minus eight percent).

The year-on-year increase in sales is due to increased demand across all industries. Most of the space was generated by companies in the transport, traffic and warehousing sector with 537,100 m² (up 33 per cent). Industrial users accounted for 467,800 m² (up ten per cent) and retail companies realised 442,100 m² (up 31 per cent). The latter also registered the only deal in the five major regions with more than 50,000 m²: The owner-occupier Netto began construction of its 65,000 m² logistics centre in Kremmen near Berlin.

Deals in the size class from 10,000 m² have increased disproportionately. 41 deals with a total of 786,000 m² were concluded in this segment. In 2024, on the other hand, there were only 26 deals, spread over 464,000 m².

In the five strongholds, around 656,000 m² of new warehouse space was completed in 2025. This corresponds to an increase of around 400,000 m² compared to the below-average result of the previous year. There is also a significant increase of 31 percent compared to the five-year average.

However, hardly any of this was received on the open market: 70 percent of the space had already been rented or given to owner-occupiers before completion. At the end of the year, around 540,000 m² are still under construction, almost half of this space is still unlet. The strongest construction activity can currently be observed in the regions of Berlin (around 232,000 m²) and Düsseldorf (just under 136,000 m²).

Prime rents stable at the end of the year in the metropolitan areas

Prime rents for warehouse space of 5,000 m² or more were stable in the fourth quarter in the five regions mentioned. In a twelve-month comparison, only Frankfurt recorded an increase of 25 cents to 8.20 euros/m². Munich leads the ranking with 10.70 euros/m², followed by Berlin with 10.50 euros/m². In Düsseldorf, 9.00 euros/m² and in Hamburg 8.50 euros/m² are achieved. “Some regions are currently struggling with a shortage of supply with high demand. That’s why I expect the price screw to turn slightly upwards in these regions,” Bögel expects.

Outside the strongholds, the Ruhr area achieves the highest turnover

At around 4.07 million m², almost as many square metres were taken up outside the five largest metropolises in 2025 as in the previous year (4.08 million m²) – 30 per cent of total take-up was accounted for by owner-occupiers. However, the long-term comparison is also negative here: the five-year average was undercut by 23 percent.

With around 672,300 m² and an increase of 56 percent year-on-year, the Ruhr region once again recorded the highest take-up result among the regions outside the five metropolises. The Rhine-Neckar (262,100 m²) and Bremen (220,500 m²) regions follow at a considerable distance.

Companies from the transport, traffic and warehousing sector dominated the demand for space in 2025 with a share of around 47 percent and recorded an increase of 20 percent compared to the previous year. Demand from industrial companies, on the other hand, fell by 22 percent. This industry still generated a good quarter of sales. Outside the five strongholds, sales by retail companies are also declining (by five percent). In total, they account for only 21 percent of take-up.

A five-year comparison confirms the strong position of the transport and logistics sector: With an average of 1.87 million m² in recent years, the industry even achieved a slight increase in 2025 to 1.9 million m². Trade and industrial companies, on the other hand, fell well short of their long-term averages – trade by 50 percent and industry by 25 percent.

The largest take-up of space of the year includes a lease of around 90,000 m² by a logistics service provider in the Rhine-Neckar region and around 80,000 m² for which an online retailer signed a contract in the Ruhr region. As its largest owner-occupier deal, Birkenstock acquired an existing property with around 78,000 m² in the Dresden area. In the size segment of 50,000 m² or more, a total of 16 deals were registered, significantly more than in the five metropolises.