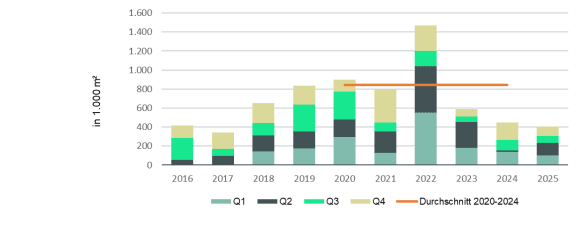

The industrial and logistics real estate market in Central Germany achieved take-up of 406,000 square metres in 2025. This meant that the annual result was nine per cent below the take-up of 2024, while space units in the 5,000 to 10,000 square metre segment (up 18 per cent) and in the 10,000 to 20,000 square metre segment (up 23 per cent) increased. New construction space also gained in importance, with its share of take-up rising by ten percentage points to 59 per cent. By contrast, the proportion of owner-occupiers declined (minus 18 percentage points to 39 percent) – although the largest deal was an owner-occupier purchase of Birkenstock near Dresden with around 90,000 square meters. These are the results of a recent analysis by the global real estate service provider CBRE. The Central Germany market area examined includes the regions of Leipzig/Halle (208,000 square metres, down 38 per cent), A4 Saxony (105,000 square metres, up 424 per cent), A4 Thuringia (51,000 square metres, down 24 per cent) and Magdeburg (42,000 square metres, up 70 per cent).

“The various market areas in Central Germany developed very differently in 2025. While demand remained subdued overall, Dresden, Magdeburg and the smaller space units as a whole were able to grow,” says Mirko Baumann, Team Leader Industrial & Logistics East Germany at CBRE.

The big-box vacancy rate rose by 3.8 percentage points to 10.8 percent in 2025. While it is quite high in Leipzig/Halle, it is significantly lower in Dresden in the A4 Saxony market area. “We assume that the peak of the vacancy rate has been reached,” says Baumann.

The prime rent for logistics properties in Leipzig/Halle fell slightly by two percent to 5.90 euros per square metre per month in the course of 2025. In the A4 Saxony area, on the other hand, it rose by two percent to 6.10 euros. In the other two market areas, it remained stable – at 5.80 euros along the A4 in Thuringia and at 5.50 euros in Magdeburg.

Compared to 2024, the share of the various demand sectors in take-up in 2025 remained largely stable. Transport and logistics companies continued to lead the way with a share of 42 percent. They were followed by manufacturing companies with a share of 36 percent, followed by retail companies (including online retailers) with 22 percent.

Outlook for 2026

“In view of a high number of speculatively built new construction sites, especially in the Leipzig area, Central Germany offers potential that does not exist in southwest Germany. So if tenants are looking for large spaces with a short-term connection, space is available here – and usually near the motorway. This is ideal for retail and e-commerce. In the Dresden area, suppliers to the chip industry can also act as demand for space, although in this market there is a shortage of the medium-sized space they are looking for,” says Baumann.