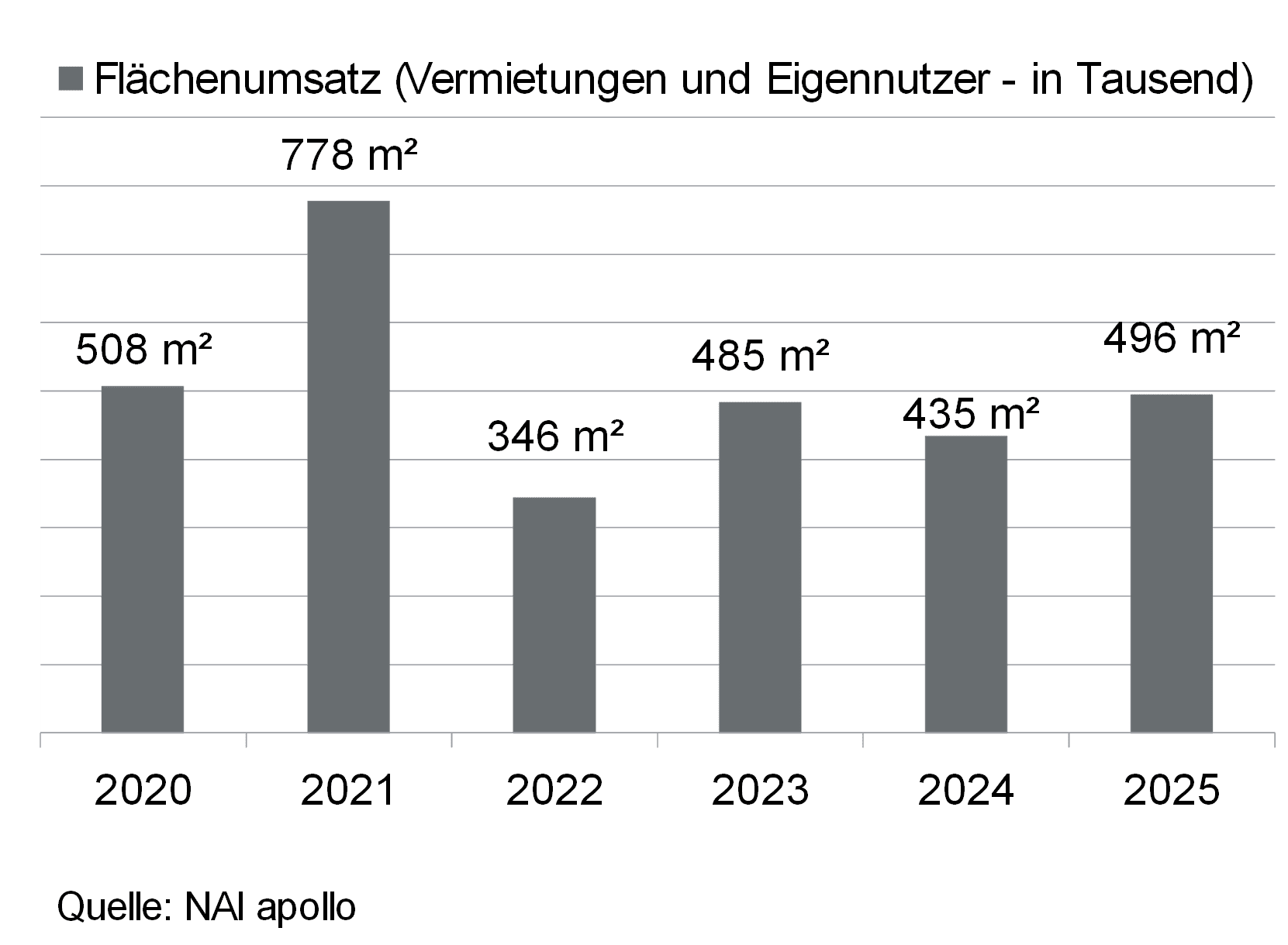

In the warehouse and logistics space market in the Rhine-Main region, leasing activity continued to increase in the fourth quarter of 2025. As a result of an overall more positive second half of the year, the full-year result also exceeded the results of previous years. According to NAI apollo, a member of NAI Partners Germany, take-up as a result of lettings and owner-occupancy in the last three months of the year amounted to around 151,700 square metres, making it the strongest quarter in the past year. The third quarter is exceeded by 14.1 percent and the same quarter of the previous year by 65.9 percent. For 2025 as a whole, take-up totals 496,000 square metres. For the last four years, this is considered a peak value. The previous year’s result was also exceeded by almost 14 percent. “In a long-term comparison, however, the current result is below average. The ten-year average of 567,000 square meters, including the record sales from 2017, 2018 and 2021 with well over 700,000 square meters each, is at a significantly higher level,” says Sven Tilse, Head of Industrial and Logistics at NAI apollo, classifying the current result.

The general conditions have improved only slightly in the past year.

Tariff conflicts with the USA, a slow pace of economic structural change and the effects of the German government’s investment programmes, which are not yet really noticeable, have caused economic development to stagnate. According to calculations by the Federal Statistical Office, GDP increased only slightly by 0.2 percent in 2025. “Against this background, it is not surprising that the mood of the local economy has remained cloudy. In the warehousing and logistics markets, this is reflected in restrained market activity. It is therefore all the more pleasing that take-up in the Frankfurt market area increased, especially in the second half of the year. This is due in particular to several major deals with more than 20,000 square meters of hall space,” says Dr. Konrad Kanzler, Head of Research at NAI apollo. The increased number of sublettings underlines the great importance of flexibly designed rental options that can be implemented at short notice. The market area considered by NAI apollo extends from the cities of Butzbach in the north and Worms in the south as well as the city of Bingen in the west and the city of Aschaffenburg in the east.

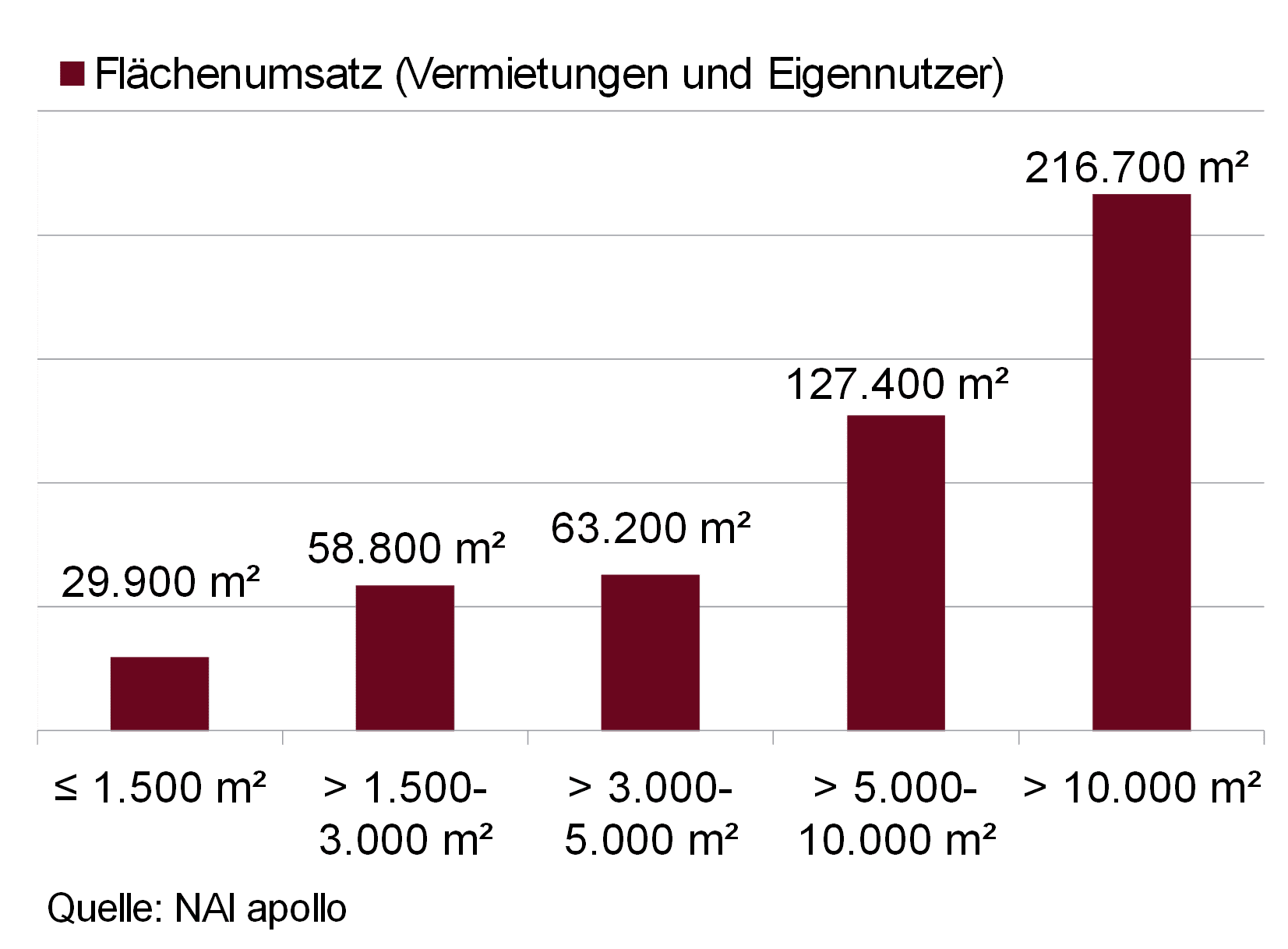

In the large-scale segment above 10,000 square metres, nine deals with a total of 216,700 square metres were recorded in 2025.

With a market share of 43.7 percent, it is by far the most important size class (market share in 2024: 34.9%). More than 40 percent of this is attributable to subletting – including the largest deal of the year, which was concluded by a logistics company for around 35,000 square meters in Gernsheim. The second largest size cluster is made up of deals of 5,000 to 10,000 square metres with a share of 25.7 per cent. These two clusters are also showing the strongest growth compared to the previous year, with a total of 344,100 square metres in lettings. This represents an increase of 32.1 percent compared to the previous year. In contrast, the segment of small spaces up to 1,500 square metres showed the sharpest decline with -42.1 per cent, bringing total take-up to 29,900 square metres. “Subletting – in relation to total take-up – accounts for a market share of around 30 per cent. Against the background that these played almost no role before 2023, the increase, especially in the large-scale segment, is significant,” adds Tilse.

The importance of owner-occupier projects, which have a market share of only around one percent, is declining.

In contrast, there was a strong upswing in leases in new construction projects in the final quarter. Here, the corresponding leases rose over the course of the year from 66,700 square metres at the end of the third quarter to 166,500 square metres for the year as a whole. This also includes the two largest leases of the fourth quarter of 2025 with the deals of a logistics service provider for 30,000 square meters in a project development by Dietz AG in Bürstadt and a trading company for 25,000 square meters in a joint development of Fraport and MB Park in Kelsterbach.

The new construction segment includes both leases in new developments and the construction of owner-occupier projects.

This accounts for a total of 171,300 square metres. The previous year’s level is thus exceeded by 3.8 percent, and the 2023 result by as much as 78.9 percent. New construction developments on the Frankfurt market have recently increased again and are attracting noticeable interest from users, especially in the large-scale segment, where the supply of modern space remains scarce. “However, sales results from the last record years, such as most recently in 2021, when new construction contracts of around 330,000 square metres were recorded, remain far from being matched. For such figures, new construction activities are currently at too low a level, slowed down by high construction and financing costs, but also a lack of suitable building plots,” says Stefan Weyrauch, partner at NAI apollo.

At the end of 2025, the most important demand group will once again be transport, warehousing and logistics companies.

However, having had a weak start to the year, they were the market-dominant land user, especially in the second half of the year. For the year, they have 212,900 square meters and a market share of 42.9 percent. “In the large-scale clusters over 5,000 and over 10,000 square metres respectively, they formed by far the strongest land user group with shares of over 60 and almost 50 per cent respectively. In the segments below 5,000 square meters, on the other hand, warehouse and logistics service providers play a subordinate role,” says Kanzler. Here, companies from industry and manufacturing occupy first place with a market share of just under 30 percent. “In terms of total sales, the warehouse and logistics service providers are followed by retail with 21.4 percent. Companies from industry and manufacturing hold third place with 18.1 percent,” says Weyrauch.

In terms of space, market activities were once again concentrated on the two southern sub-markets.

Both the largest and the most deals have taken place here. The south-west, located between the A63 and A5 motorways, stands out in particular. “220,400 square metres, or 44.4 per cent of this year’s take-up, were recorded here – including the five largest deals and the majority of new leases of the year. In comparison, the sub-markets outside the south are falling behind with market shares of between 2 and 10 percent,” says Tilse.

The general conditions for the warehousing and logistics markets in Germany show little improvement.

According to current forecasts, economic output will increase somewhat more strongly in 2026, but a real trend reversal is not yet expected. At the same time, there are risks – as shown by the customs dispute with the USA, which briefly resurfaced at the beginning of the year – that could still prevent a further market recovery. “Positive impulses will continue to be associated with the current investment programmes of the Federal Government. Above all, an increasing demand for warehouse and logistics space is expected from the security and defense industry. However, it remains to be seen to what extent the local market can benefit from this,” said Kanzler.

It is currently to be expected that market participants will act predominantly cautiously in 2026, as in the previous year.

Rental decisions will also take more time in the coming months than in the past or will be cancelled altogether. Flexible rental options are preferred. In the year just ended, this led to longer re-letting periods for vacant space, especially on the fringes of the market and for older properties. At the same time – as the results in the last quarter of 2025 show – demand for modern warehouses and logistics halls in central locations remains high. “New construction sites are in demand. Especially in the large-scale segment above 10,000 square meters, the demand for new developments continues to exceed supply. In this way, the few current speculative construction projects, such as the development of a project developer in Kahl am Main with around 25,000 square meters of logistics space, will quickly find a user,” says Weyrauch. This excess demand has recently led to rising rents. For example, the prime rent for warehouse and logistics space of 5,000 square metres or more at the end of 2025 will be 8.60 euros per square metre. This is 20 cents more than in the previous quarter. Compared to the end of 2025, there is an increase of 50 cents. A further moderate increase in prime rents is expected in the coming months. With regard to take-up, it can be assumed that take-up will stabilise at the current level or that there will be a slight increase in market activity. “The economic development in the coming quarters is of central importance here. Against this background, a sales result for 2026 in the range of 500,000 square meters is possible at this point in time, which would exceed the 2025 result, but the long-term average would again remain unreached,” Tilse predicts.