The most important things in brief:

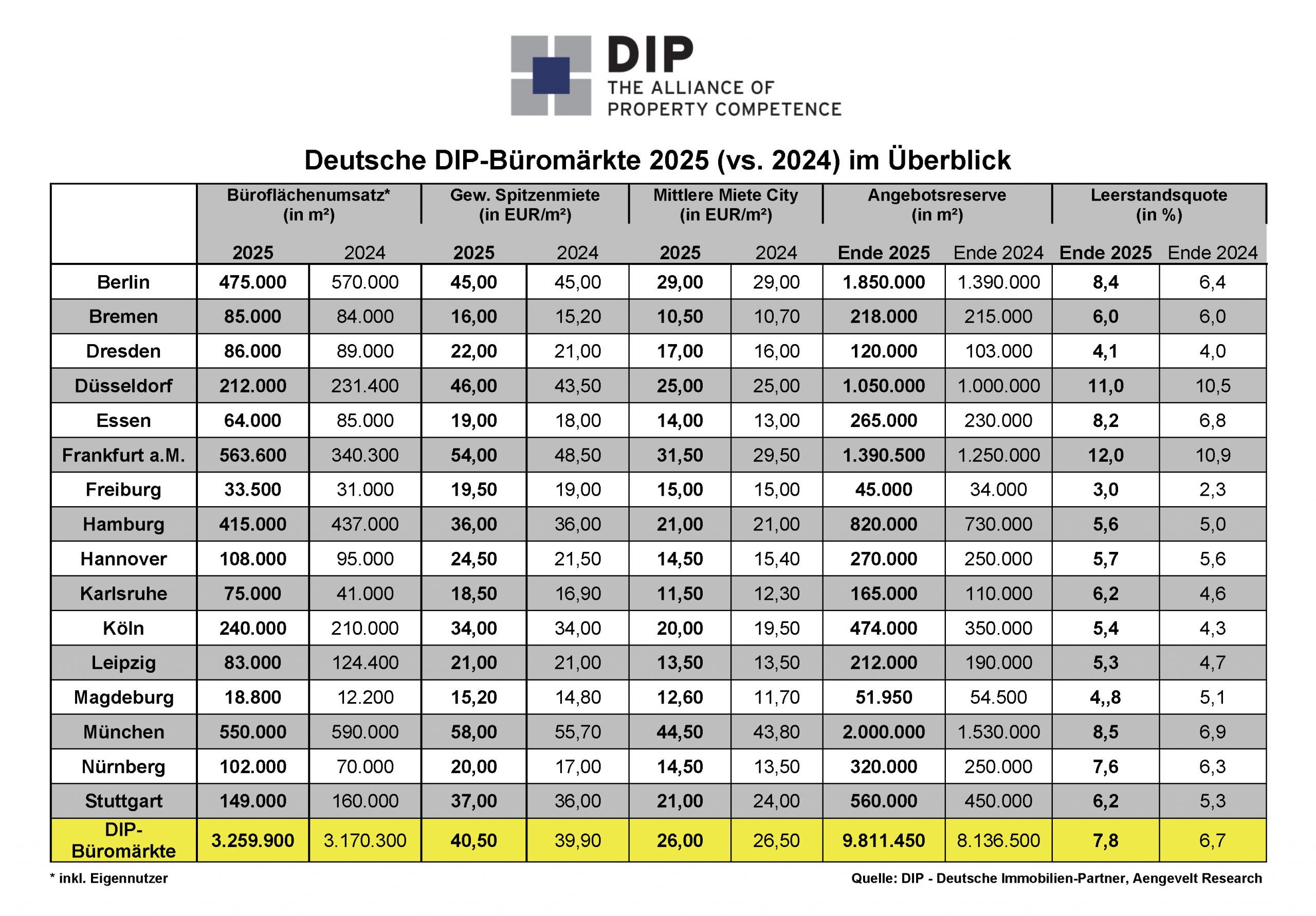

- In 2025, office space take-up (including owner-occupiers) in the office locations analysed by DIP amounted to a total of around 3.26 million m². The result is almost 3% above the previous year’s take-up (2024: approx. 3.17 million m²), but 21% below the average value of the last ten years (Ø 2015 – 2024: approx. 4.1 million m² p.a.).

- Since 2020, the total supply reserve in the 16 office markets had already increased significantly by almost 4 million m² to around 8.1 million m² by the end of 2024. This trend continued in 2025: DIP analyses a further significant increase of around 1.67 million m² to currently around 9.8 million m² by the end of 2025. The vacancy rate increased accordingly from 6.7% to 7.8%.

- At the same time, DIP continues to observe a dichotomy in the office market: While modern space in sought-after inner-city locations that is adequate in particular with regard to increasing ESG and sustainability requirements remains in demand and often achieves new prime rental values, older properties with a modernisation backlog and significantly higher energy requirements as well as rigid, outdated floor plans are coming under increasing pressure in view of the significantly increased level of demand from users.

- In line with this development, the average weighted prime rent in the German office markets analysed rose again within one year, albeit only moderately, from EUR 39.90/m² to currently EUR 40.50/m². By contrast, the average rent level for office space in city locations fell slightly at the beginning of 2026 to currently EUR 26.00/m² (beginning of 2025: EUR 26.50/m²).

- For 2026, DIP forecasts a slight increase in office space take-up of 3.4 million m², further growth in supply reserves, especially in the area of older existing buildings, and a further moderate increase in prime rents.