vdp index records price increases in all four quarters

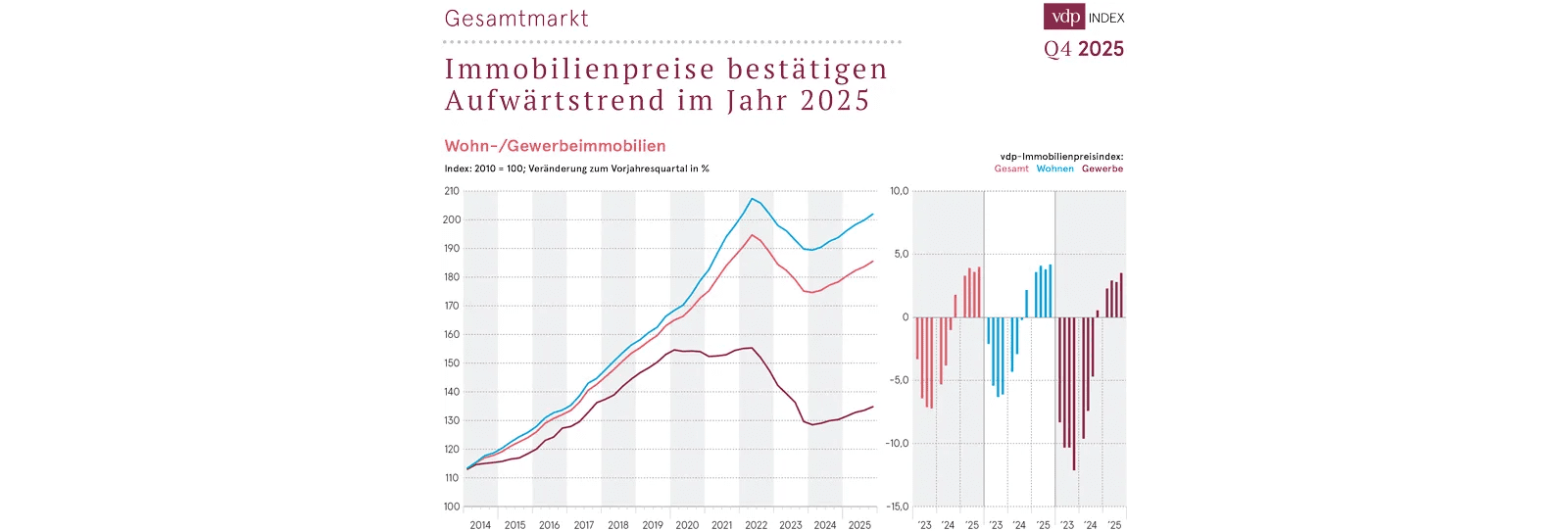

Real estate prices in Germany have been rising for two years: after an increase of 1.8% in 2024, the price increase in 2025 was 4.0%. This is shown by the real estate price index of the Association of German Pfandbrief Banks (vdp), which reached a value of 185.6 points at the end of 2025. Price increases were recorded in all four quarters of 2025, most recently by 1.0% from the third to the fourth quarter.

The figures on which the vdp index is based have been compiled quarterly by vdpResearch since 2010. They cover price developments across the entire German market for residential, office and retail properties and, in contrast to other price indices, are based on real transaction data from real estate financing from more than 700 credit institutions.

Once again, the index increase was more due to the development of residential property prices than to that of commercial real estate prices. Compared with the final quarter of 2024, residential property prices rose by 4.2%, while commercial real estate prices, which consist of office and retail property prices, rose by 3.5% in the same period. Compared with the third quarter of 2025, prices for residential and commercial real estate rose at a similar level (1.0% and 0.9% respectively).

The real estate market continued its recovery phase in 2025 – prices are rising steadily, but much less dynamically than in the low interest rate phase.

“After the abrupt turnaround in interest rates, the real estate market in Germany continued its recovery phase in 2025. Prices are rising steadily, but much less dynamically than in the low interest rate phase,” explained vdp Managing Director Jens Tolckmitt. Due to the ongoing shortage of housing, it can be assumed that residential real estate will continue to record price increases in the current year. The development of commercial real estate prices, on the other hand, is more difficult to predict. “Economic development and geopolitics remain relevant factors of uncertainty,” Tolckmitt said.

Residential real estate: Apartment buildings up 5.3%

As in previous quarters, the 4.2% increase in residential property prices in Germany was driven by the price development of multi-family houses, which rose by 5.3% year-on-year. The price development of owner-occupied residential property, which includes single-family houses and condominiums, was noticeably lower at +3.0%.

The persistent shortage of living space was also reflected in a further increase in new contract rents in multi-family buildings in the fourth quarter of 2025, which increased by 3.5% compared with the final quarter of 2024. However, as rent growth was unable to keep pace with the rise in the price of multi-family dwellings, yields as measured by the vdp property interest index fell by 1.7% over the year.

State guarantees could boost the creation of additional housing.

“One of the political priorities in 2026 must be the creation of housing at affordable prices,” Tolckmitt demanded. Many good ideas for this are on the table from the work of the ‘Alliance for Affordable Housing’ in the last legislative period. The new federal government has also set a goal-oriented impulse with the ‘construction turbo’, which, however, still has to be filled with life by the municipalities and supplemented by further measures. In this context, he once again called for the introduction of state guarantees for the financing of new housing construction in order to stimulate the creation of additional housing and overcome the ongoing situation that is mainly financed in existing buildings. The costs of loans could thus be significantly reduced and thus make new construction economically attractive again. “In view of historically extremely low default rates in residential real estate financing and the marked excess demand in the market, the risk for the state to be called upon from such a measure would be low, but the effect on the housing supply would be considerable if it was appropriately designed,” Tolckmitt underlined.

Housing Top 7: Banking metropolis with highest price growth

In the fourth quarter of 2025, residential property price growth in the top 7 cities was still slightly higher than in the whole of Germany: In Berlin, Düsseldorf, Frankfurt am Main, Hamburg, Cologne, Munich and Stuttgart, residential property prices rose by an average of 4.7% compared with the final quarter of 2024. While Baden-Württemberg’s capital had the lowest increase at 2.2%, Frankfurt am Main was the metropolis with the highest growth rate (5.7%) in the quarter under review.

At an average of 3.5%, the increase in new contract rents in the top 7 cities corresponded exactly to the development throughout Germany. The range in the seven metropolises ranged from +2.0% (Stuttgart) to +5.0% (Frankfurt am Main). Measured by the vdp real estate interest index, yields in metropolitan areas fell by an average of 1.4% in the fourth quarter of 2025 compared with the same quarter a year earlier.

Commercial real estate: Higher growth rates for office properties

The prices of commercial real estate financed by banks rose by 3.5% year-on-year and by 0.9% quarter-on-quarter and were mainly driven by the development of office prices. Office property prices rose by 3.9% compared with the final quarter of 2024 and by 1.1% compared with the previous quarter. At 2.3% and 0.6% respectively, prices for retail properties recorded lower increases.

At 3.3%, financed office properties also showed higher growth rates than retail properties (+1.8%) in terms of new contract rents – in each case compared with the fourth quarter of 2024. By contrast, yield developments, as measured by the vdp property interest rate index, were quite similar: while offices recorded a decline in yields of 0.6%, the decline in retail properties amounted to 0.5%.

Outlook: “Economic stimulus and regulation with a sense of proportion are needed”

“The residential real estate market in Germany needs a stimulus. In addition to a targeted reduction in building standards and a rapid implementation of the ‘construction turbo’, decisive economic policy impulses and banking regulation with a sense of proportion would also be important measures,” Tolckmitt emphasised. In addition, he spoke out in favour of removing the obstacles to the formation of home ownership, as this could noticeably relieve the rental housing market. Specifically, he proposed reducing the ancillary purchase costs, which are particularly high in Germany.

About the vdp Real Estate Price Index

The Association of German Pfandbrief Banks (vdp) publishes quarterly rent and price indices on the development of the residential and commercial real estate markets on the basis of transactions that have taken place. The index, compiled by the analysis firm vdpResearch, is part of the Deutsche Bundesbank’s real estate price monitoring. The basis for this is the transaction data (purchase prices and rents actually realised) submitted by more than 700 credit institutions to the German financial sector for their real estate financing business.

The development of the sub-markets as well as all index data on the individual vdp real estate price indices (2003 – 2024) are presented in the associated publication and are available as raw data under www.pfandbrief.de. A differentiated view of the regional TOP 7 housing markets including all sub-segments (owner-occupied residential property and apartment buildings) is available under www.vdpresearch.de.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information