Challenging conditions are slowing down market dynamics.

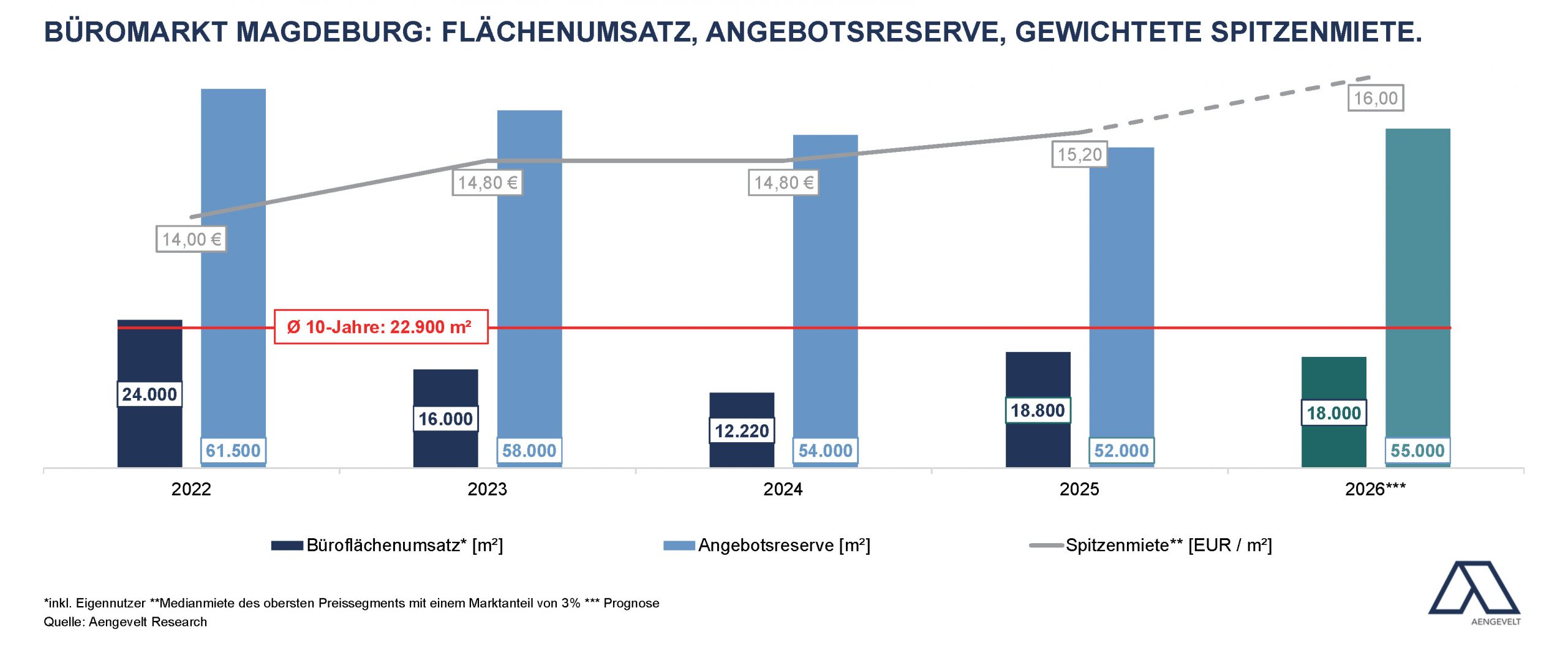

- According to analyses by Aengevelt Research, the Magdeburg office market achieved office space take-up (including owner-occupiers) of around 18,800 m² in 2025, which is significantly higher than the previous year’s figure (12,200 m²), but remains 18% below the ten-year average (Ø 2015–2024: approx. 22,900 m² p.a.).

The background to this development: By the end of the third quarter of 2025, office space take-up of around 16,000 m² was still twice as high as in the same period of 2024 (Ø Q1–Q3 2024: around 8,000 m²) and was even slightly above the ten-year average (Ø Q1–Q3 2015–2024: 15,100 m² p.a.). After that, the market momentum ebbed away significantly, so that in the fourth quarter of 2025 only around 2,800 m² of office space was contracted. This is the lowest figure for a fourth quarter since 2011 (Q4 2011: approx. 2,500 m²), which is also 64% below the decade average (Ø Q4 2015–2024: approx. 7,800 m²).

Annett Lorenz-Kürbis, Branch Manager Aengevelt Magdeburg, comments: “Initially, the Magdeburg office market in 2025 was characterised by high market dynamics, especially in the first four months. During this period, Aengevelt alone brokered three lease agreements, which together amount to more than 6,000 m². The second half of the year, especially the fourth quarter, was primarily characterized by small-scale office space deals. In addition, several large-scale lease negotiations in the four-digit square metre range were not concluded in 2025. We therefore assume that 2026 will be able to build on the good result of the previous year.” - Accordingly, Aengevelt Research forecasts office space take-up of around 18,000 m² for 2026 at the previous year’s level by the end of the year, with upward and downward swings depending on the development of the general economic conditions and shifts in use to the commercial residential sector.

Supply reserve differentiates

- For years, the short-term supply reserve available in Magdeburg (ready for occupancy within three months) has been steadily decreasing, reaching around 52,000 m² of office space at the beginning of 2026 (beginning of 2025: 54,500 m²). With a total stock of around 1.08 million m² of office space, this corresponds to a vacancy rate of around 4.8% (beginning of 2025: 5.1%).

By the end of 2026, Aengevelt Research forecasts a slight increase in supply reserve of around 55,000 m² for the first time. - Annett Lorenz-Kürbis: “Among other things, space optimisation or space reductions for existing tenants with regard to new office concepts contribute to this. Accordingly, the vacancy rate in existing properties in particular will grow, while top new construction projects in city locations are still waiting for the necessary pre-letting rates to start their realisation.”

Increased office space completion.

- The high completion volumes of 2020 (12,500 m²) and 2021 (21,000 m²) could no longer be achieved in 2022 (5,500 m²) and 2023 (2,000 m²). In 2024, there was only 1,000 m² of new office space.

- In 2025, the volume of completions increased significantly to around 24,000 m². The largest share of this, with around 15,000 m² of gross floor space, is accounted for by the new administration building of AOK Saxony-Anhalt, which uses the property entirely itself.

Overall, the completion volume in 2025 significantly exceeds the decade average (Ø 2015 – 2024: 6,400 m² p.a.). - For 2026, Aengevelt expects a significant decline in the volume of completions again, according to what is known so far.

Rental price level is rising.

- The weighted prime rent has risen to currently EUR 15.20/m² within a year (beginning of 2025: EUR 14.80/m²).

The median rent in city locations has also risen: from EUR 11.70/m² to around EUR 12.60/m². - In view of the focus on demand for modern office space in city locations, Aengevelt expects a slight increase in prime rents of EUR 16/m² for 2026 with only low availability of demand-oriented inner-city portfolio properties.