Investors expect hardly any impetus from falling interest rates in the euro area

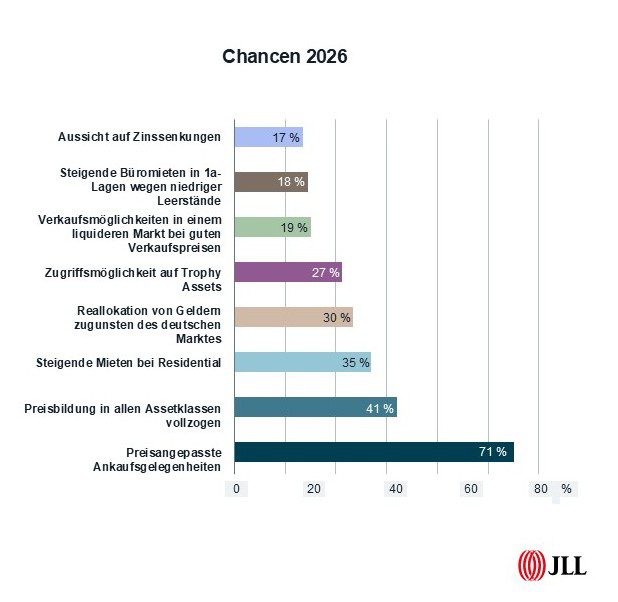

The vast majority of real estate investors in Germany consider the potential for growth impulses from falling interest rates to be exhausted. Only 17 percent still see corresponding opportunities for 2026, compared to 29 percent in the previous year. At 71 percent, respondents see the greatest opportunities in price-adjusted purchase opportunities. At the same time, 41 percent now assume that pricing in the asset classes has been completed, slightly more than in the previous year (35 percent).

Konstantin Kortmann, CEO JLL Germany & Head of Capital Markets: “The market’s expectations are characterized by realism. For example, 85 percent of investors expect the total transaction volume to end up in a corridor between 30 billion and 40 billion euros, which would correspond to a sideways movement rather than clear growth after 33.9 billion euros in the past year. At 42 percent, not even half of the participants expect a higher volume.”

Almost 150 market players took part in the annual investor survey at the end of last year, managing a total real estate portfolio of 1.3 trillion euros.

Pricing is almost complete across all asset classes, which should lead to more momentum

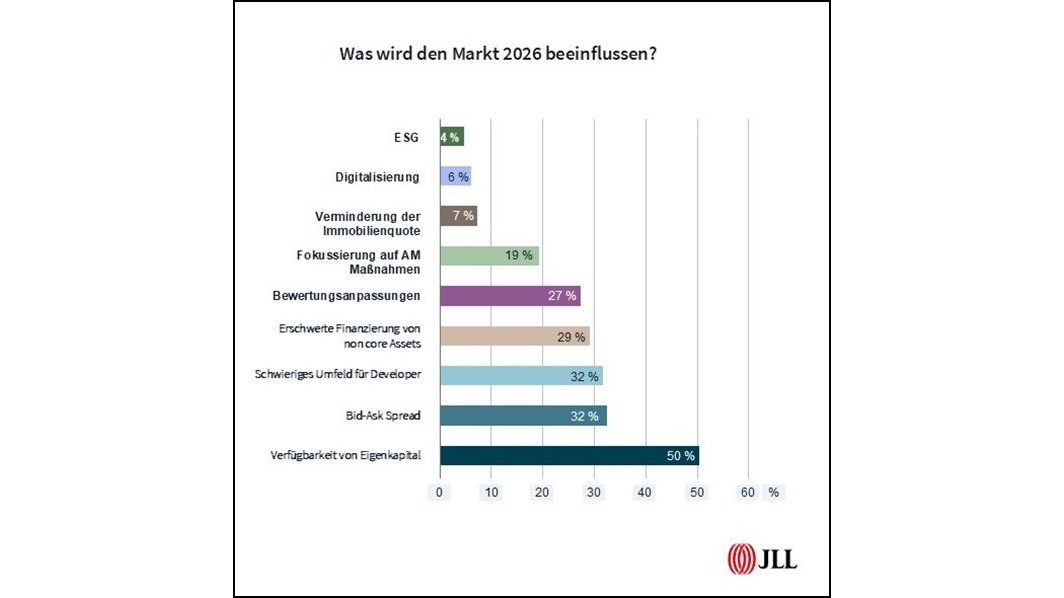

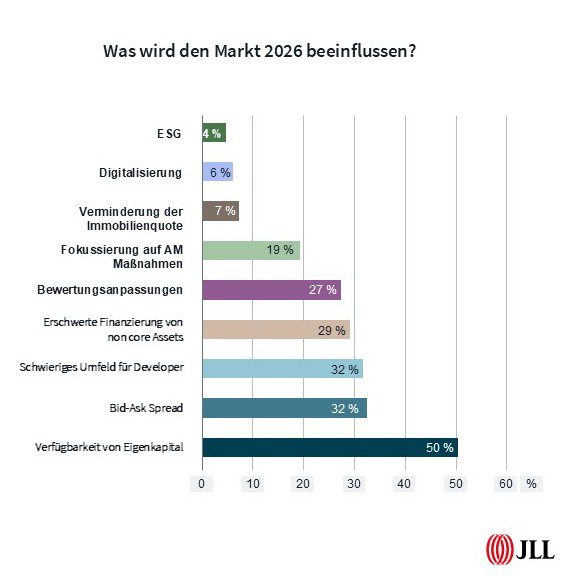

According to the survey participants, the availability of equity capital will influence the market this year. Every second participant is of this opinion. Likewise, much is likely to depend on whether seller and buyer can come to a common denominator on price. “32 percent see the bid ask spread as a decisive criterion for market dynamics. We are observing that the gap continues to close and that price discovery in all asset classes is almost complete. 41 percent of those surveyed also agree with this. This could lead to stronger momentum in the course of the year and thus to growth in transaction volume,” says Kortmann.

Likewise, 32 percent see the challenging market environment for developers as a hurdle in the market. “Construction activity is at an all-time low and is already ensuring that there is an undersupply of good properties. The limitation of the total transaction volume is much more due to a weak supply situation than to too little demand,” observes Kortmann.

Compared to previous years, the focus on ESG (four percent) and digitalization (six percent) is significantly lower. “However, this does not mean that these aspects are less important for the industry,” explains Kortmann, “but rather that they have now become a matter of course in the processes and strategy of real estate companies.”

If you want to increase the value of your real estate, you have to actively work with it

Price-adjusted acquisition opportunities and completed pricing offer opportunities for transactions this year, according to most survey participants. “However, when it comes to value increases, this only works through an improvement in cash flow,” Kortmann emphasizes. “Here, investors expect rents to rise, especially in the residential sector, while the price spiral in the office segment offers less potential for most. The exception is high-quality space in prime central locations, where there is already a bottleneck and only a small amount of free space will come onto the market in the future.”

At the same time, a reallocation of capital to the German market could provide momentum. “We have been observing for some time that international investors have a much more positive view of the German real estate market than domestic players do,” says Kortmann. It is crucial that the supply side grows with the increasing demand, so that interest and demand are not followed by a large amount of “frustrated” capital in the end.

This is because the survey shows a gap that the market needs to bridge: 65 percent of respondents want to make more purchases in 2026 than in the previous year, but at the same time only 39 percent want to sell more than in the previous year. “As a consequence, this should mean that the competition for good products in good locations will increase again in 2026,” Kortmann expects.

Investors see the greatest potential for returns in residential real estate

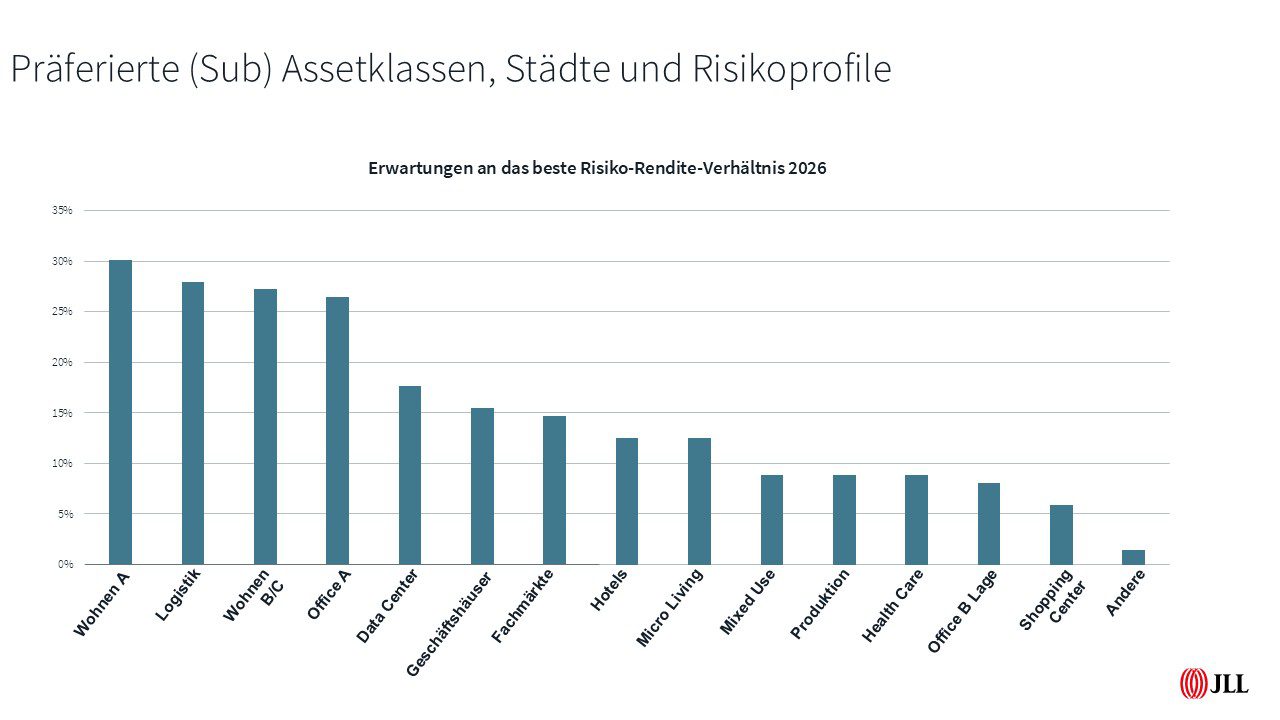

The survey participants expect the greatest potential for a good risk-return ratio in the current year in high-quality residential properties in prime locations. However, residential properties in B and C locations follow at a short distance, so that the topic of housing clearly attracts the greatest hopes of investors. Only logistics properties can move between the two residential categories. The ranks of the four most important asset classes, each of which is more than 25 percent popular, are completed by office properties in prime locations.

The field of pursuers is led by data centers, which have worked their way up to fifth place this year, followed by commercial buildings and specialty stores, the most sought-after types of retail use for years. But special niche products such as micro living, mixed use and health care are also represented and all rank ahead of offices in B locations.