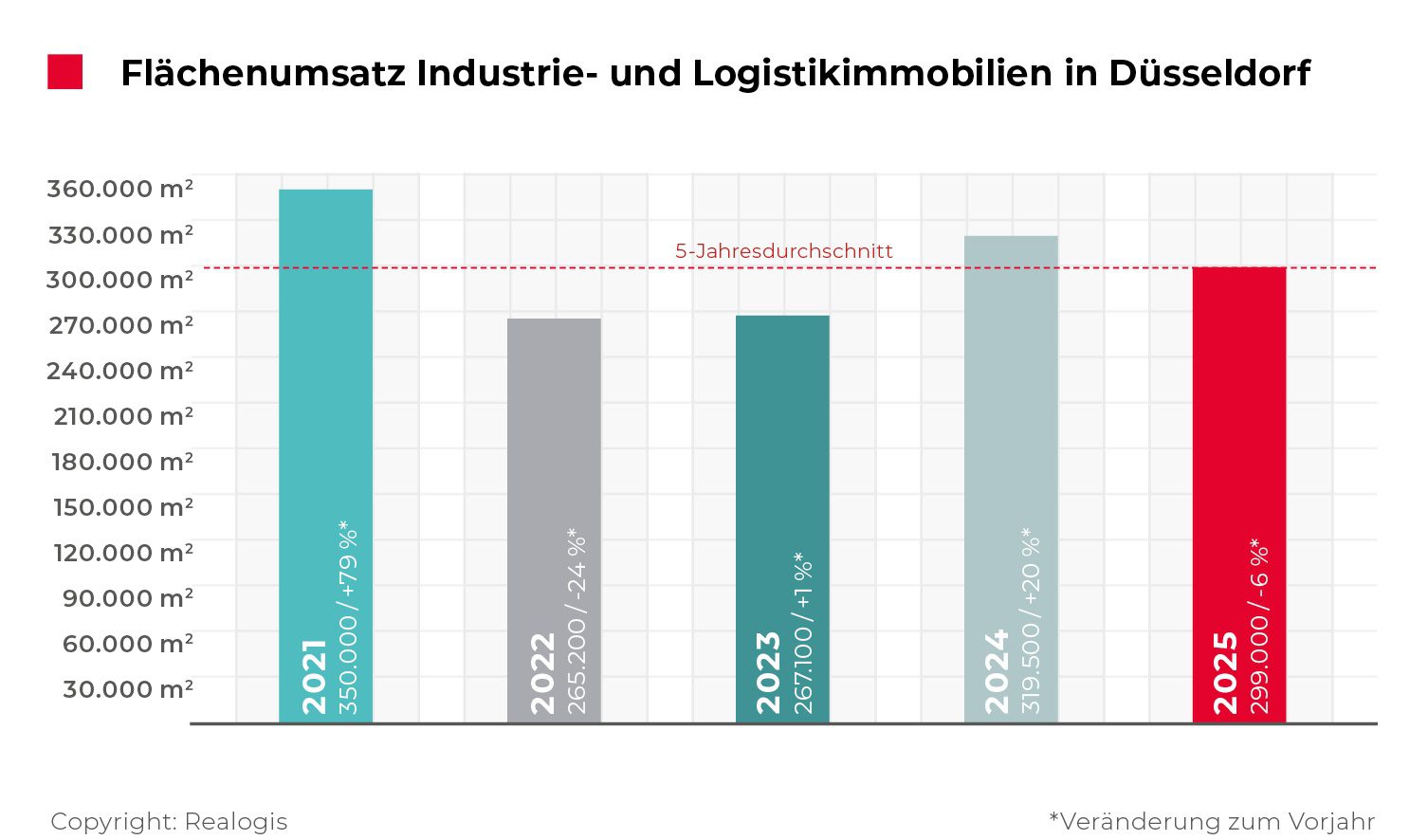

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, registered take-up of 299,000 m² in the Düsseldorf industrial and logistics real estate market in 2025 as a whole. Compared to the previous year, this corresponds to a decline of 20,500 m² or 6% (2024: 319,500 m²). This meant that the result was almost at the level of the 5-year average of 300,160 m².

The five largest revenue generators accounted for 42% of total take-up: Goodcang (43,200 m²), GV Logistik (22,890 m²), an e-commerce company (20,180 m²), Nordlicht (20,000 m²) and Tecpro (20,000 m²).

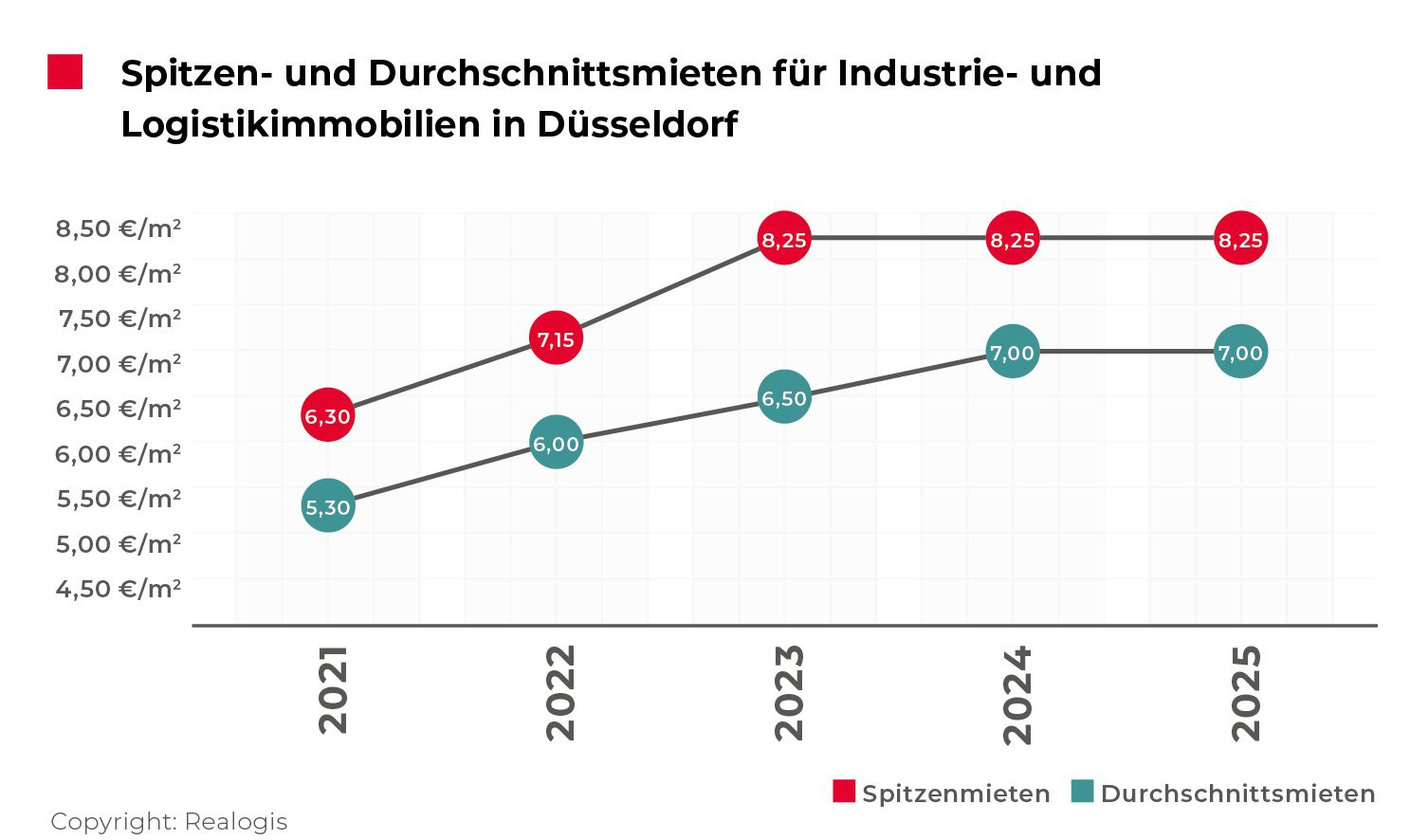

Renting: No movement in 2025

As in the previous year, the prime rent registered for the Düsseldorf market was €8.25/m² at the end of 2025. However, this exceeded the 5-year average of €7.64/m² by 8%. The average rent at the end of 2025 was also at the previous year’s level of €7.00/m². It was thus around 10% above the 5-year average (€6.36/m²).

Take-up: stock dominated, brownfields gained, greenfield site collapsed

Lettings of existing space shaped the market. They totalled 172,400 m², or 58% of total take-up (2024: 168,400 m² / 53%). The deals of Goodcang and Nordlicht together amounted to 63,200 m² and accounted for 37% of the existing space take-up.

Rents in new buildings on former brownfields became increasingly important. They achieved 88,600 m² and a market share of 29% (2024: 66,600 m² / 21%). GV Logistik and an e-commerce company combined 43,070 m² and accounted for 49% of brownfield activity.

Market activity in new buildings on greenfield sites, on the other hand, declined significantly. Here, take-up of 38,000 m² was registered, which corresponded to a total market share of 13% (2024: 84,500 m² / 26%), a minus of 46,500 m² or 55%. Tecpro provided the largest deal here with a deal for 20,000 m² and was thus responsible for 53% of sales in this segment alone.

The growth in existing buildings and brownfields of a total of 26,000 m² did not compensate for the decline of 46,500 m² on greenfield sites; in a year-on-year comparison, there was a minus of 20,500 m². Düsseldorf will remain a pure rental market in 2025.

Types of buildings: Big box spaces were in the lead, rents in business parks were clearly in the red

Big box space dominated in 2025 with 210,500 m² and 71% market share (2024: 182,800 m² / 57%). They were also the only type of building with growth (+15%) in take-up.

Other properties reached 51,600 m² and 17% (2024: 66,500 m² / 21%). Business parks fell back to third place. They accounted for 36,900 m² and 12% (2024: 70,200 m² / 22%).

Industries: Logistics/freight forwarding at the top, trade with clear losses

The logistics/freight forwarding sector generated the highest take-up in 2025 with 171,400 m² and a market share of 57% (2024: 81,500 m² / 26%): With an increase of 89,900 m² or 110%, the 5-year average of 142,680 m² was exceeded by 20%. Goodcang, GV Logistik and Nordlicht together contributed leases of 86,090 m².

Industry/production reached 55,200 m² and 19% (2024: 29,300 m² / 9%).

Retail fell to 47,500 m² or 16% market share. E-commerce with 36,500 m² accounted for 77% of the share of take-up (2024: 95,000 m² / 53%).

Size classes: Deals from 10,001 m² shaped the market

The size class from 10,001 m² again dominated with 210,500 m² and 70% market share (2024: 163,000 m² / 51%). The main deals totalled 126,270 m² and accounted for 60% of take-up.

Key figures at a glance

• Take-up: 299,000 m²

• Prime rent: €8.25/m²

• Average rent: €7.00/m²

• Existing areas: 172,400 m² | New building on brownfields: 88,600 m² |

New building on a greenfield site: 38,000 m²

• Tenants: 299,000 m² | Owner-occupier: 0 m²