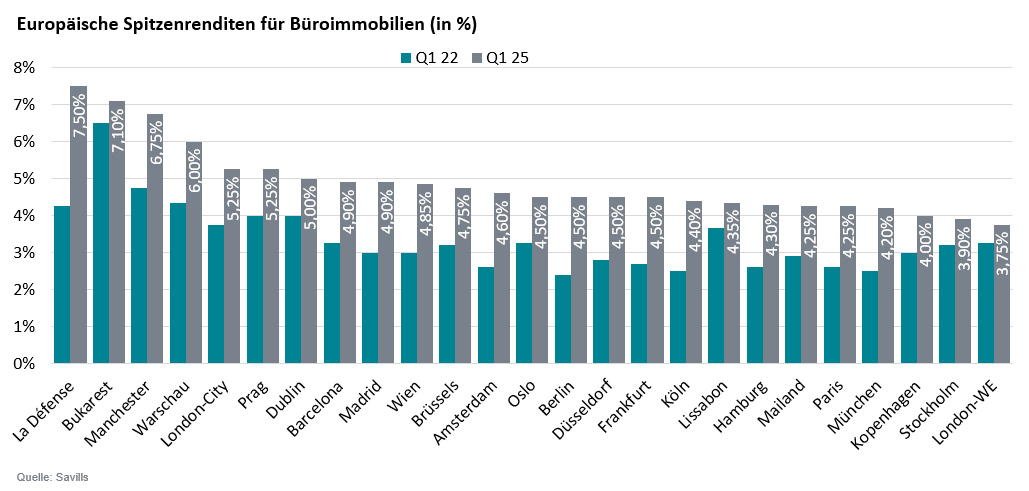

From a fair value perspective*, the Madrid market and the Central Business District (CBD) of Paris are currently the most attractively valued European office markets, reports Savills. The international real estate consultant believes that this is due to the positive outlook for real rental growth and the decline in risk-free interest rates, which increases the attractiveness of top offices.

On a quarter-on-quarter basis, Savills notes that the average prime yields of European office properties fell by an average of 3 basis points to 4.89%. This movement was mainly driven by developments in London’s West End (-25 basis points to 3.75%), Vienna (-15 basis points to 4.85%) and Brussels (-5 basis points to 4.75%).

James Burke, Director Global Cross Border Investment at Savills, comments: “Contrary to the expectations of some observers given the current economic environment, we continue to see strong activity on both the buyer and seller side in the European property market. Investors continue to pursue their strategies to take advantage of opportunities in the revalued European markets, where a higher supply of transactions is currently being observed. The targeted commitment of German and Spanish buyers to Central European office properties is particularly striking. We are also seeing growing interest in this segment from North American private equity firms.”

Mike Barnes, Director in Savills’ European Commercial Research team, said: “From a user perspective, the European office markets continue to perform well. Take-up increased by more than 8% year-on-year in 2024 and the vacancy rate fell for the first time in this cycle. As a result, the IPF Consensus’s average five-year forecasts for European office rental growth have risen from 2.1% to 2.4% per year as tenants continue to compete for high-quality space. Investors are convinced that real rental growth is possible again.”

*Methodology: Savill’s European Office Value Analysis compares the fundamental (calculated) return with current market prices in 20 European markets, including London City, Stockholm, Manchester, Lisbon, Oslo, Berlin, Paris CBD, Dublin, Amsterdam, La-Défense, Prague, Hamburg, Madrid, Barcelona, Munich, Brussels, Warsaw, Frankfurt, Milan and Bucharest.

The investor must be compensated for the risk of investing in real estate versus government bonds – the risk premium. The calculated rate of return is based on the current risk-free rate plus the average risk premium for office properties for 2017-21, taking into account nominal rent growth (source: IPF, Savills), inflation (source: Oxford Economics) and impairment in each market. The fundamental rate of return represents a hypothetical rate of return, with a fully

liquid market and the investor is fully hedged against currency risks.

Considering the inverse relationship between returns and NPV, we use the following definitions for fair pricing:

- Market NPV >10% above the fundamental NPV, we consider overvalued

- Market capital value within 10% of the fundamental NPV, we consider it to be fairly valued

- Market NPV >10% below the fundamental NPV, we consider it undervalued