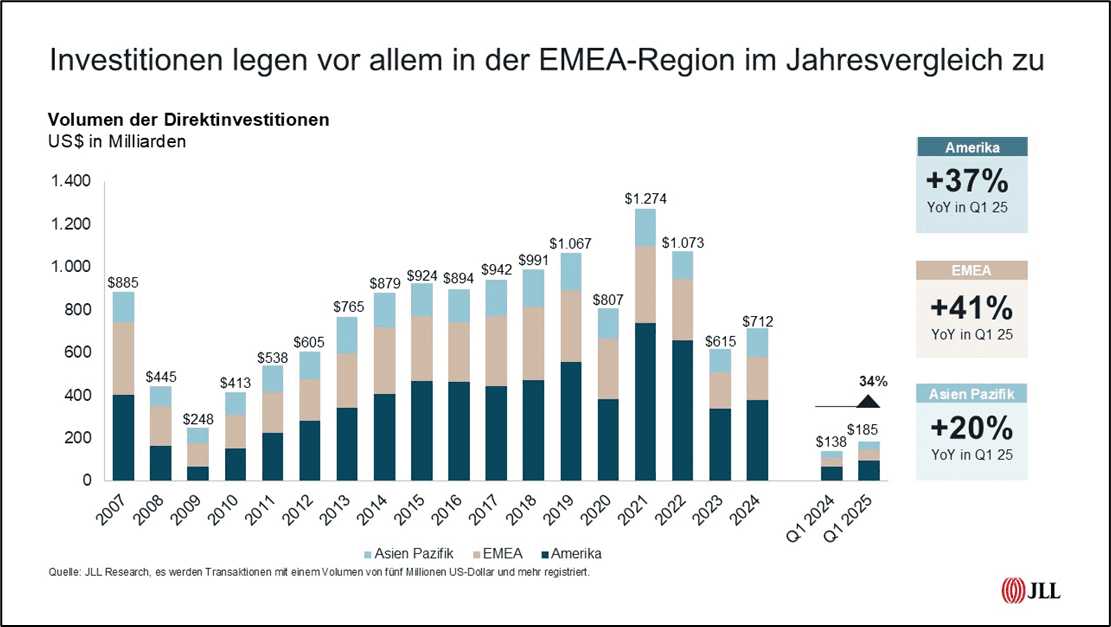

EMEA achieves the largest increase in sales among the world regions at 41 percent

Global real estate transaction volume reached $185 billion in the first quarter of 2025, up 34 percent year-on-year. This is the result of JLL’s latest report “Global Real Estate Perspective”. The EMEA region in particular showed an above-average performance with an increase of 41 percent to 55 billion US dollars, with Germany making a significant contribution to this positive result with growth of 39 percent to eight billion US dollars.

Investors continue to focus on the living and industrial & logistics sectors, but retail properties also recorded growing investment activity in the first quarter of 2025. Against the backdrop of geopolitical challenges and weaker economic growth forecasts, not only in Europe, building and tenant quality continue to play an important role in investment decisions.

However, the strong growth in the UK (up 83 percent to USD 19 billion) was significantly influenced by a one-off effect: the purchase of 36,000 military apartments by the British Ministry of Defence for USD 7.5 billion was the largest residential property transaction. Without this deal, growth in the UK would have been much more moderate at just nine percent, and the EMEA market as a whole would also have seen lower growth at 22 percent. In France, the transaction volume rose by 32 percent to five billion US dollars.

The significant increase in cross-border investment is remarkable. In the EMEA region, volume increased by 51 percent compared to the first quarter of 2024. This trend is also reflected globally, where cross-border investment increased by 57 percent, reaching the highest level of a first quarter since 2022.

Japan and South Korea on growth course, China weakens

In the Asia-Pacific region, transaction volume increased by 20 percent to $36 billion, led by Japan (up 20 percent to $14 billion) and South Korea (up 58 percent to $7 billion). China, on the other hand, recorded a decline of 33 percent due to weaker economic sentiment and geopolitical concerns.

Despite the positive performance in the first quarter, the market remains uncertain due to geopolitical tensions and economic volatility. The recently announced tariff measures could particularly affect the logistics sector and influence rental decisions in some markets. The consequence: “Investors are therefore more cautious in evaluating transactions and lowering their expectations of rental growth for the coming quarters,” says Hela Hinrichs.