BNP Paribas Real Estate publishes investment figures for the first half of 2025

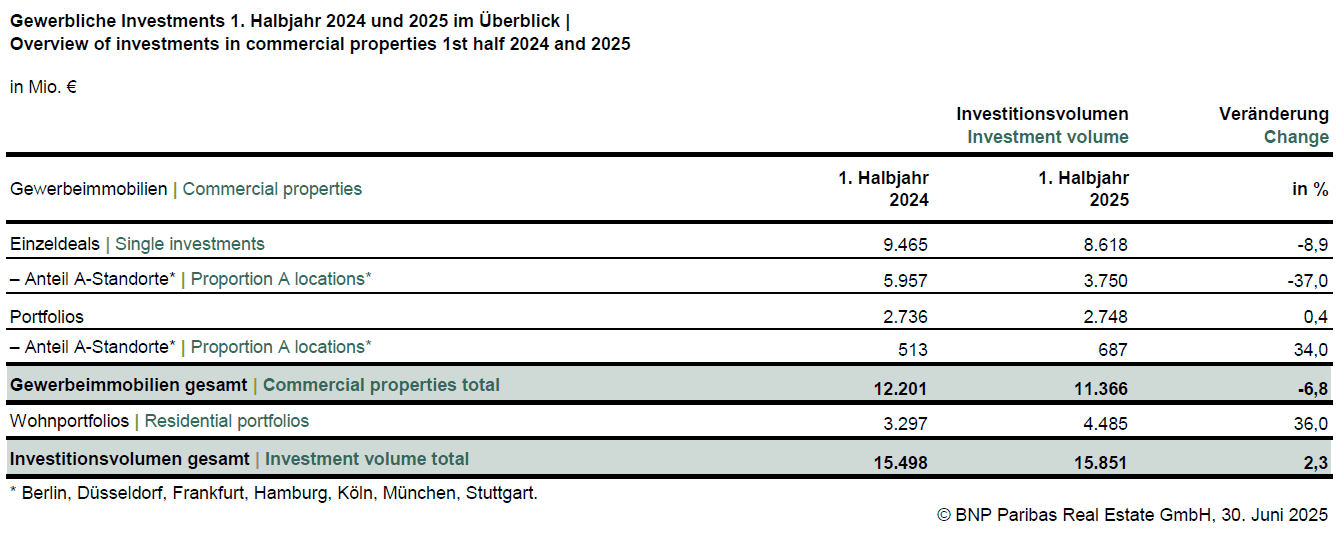

The recovery trend of the German investment markets observed at the beginning of the year took a little breather in the second quarter. With total sales of just under €15.9 billion in the first half of the year, the previous year’s result was nevertheless exceeded by around 2% overall. In principle, however, there is a different development between residential investments (from 30 units) and commercial transactions. While the investment volume of commercial real estate fell by around 7%, a 36% increase in turnover was recorded for residential real estate. However, the transaction volume in this market segment was also lower in the second quarter than at the beginning of the year. This is shown by the latest analysis by BNP Paribas Real Estate.

The most important results at a glance:

- At just over €15.9 billion, investment turnover was 2% higher than the previous year’s figure

- Of this, around €4.5 billion (+36%) is attributable to the Residential market segment

- Commercial investments account for a good €11.4 billion (-7%)

- 76% (€8.6 billion) of commercial turnover is attributable to individual deals

- Portfolio sales totalled €2.7 billion

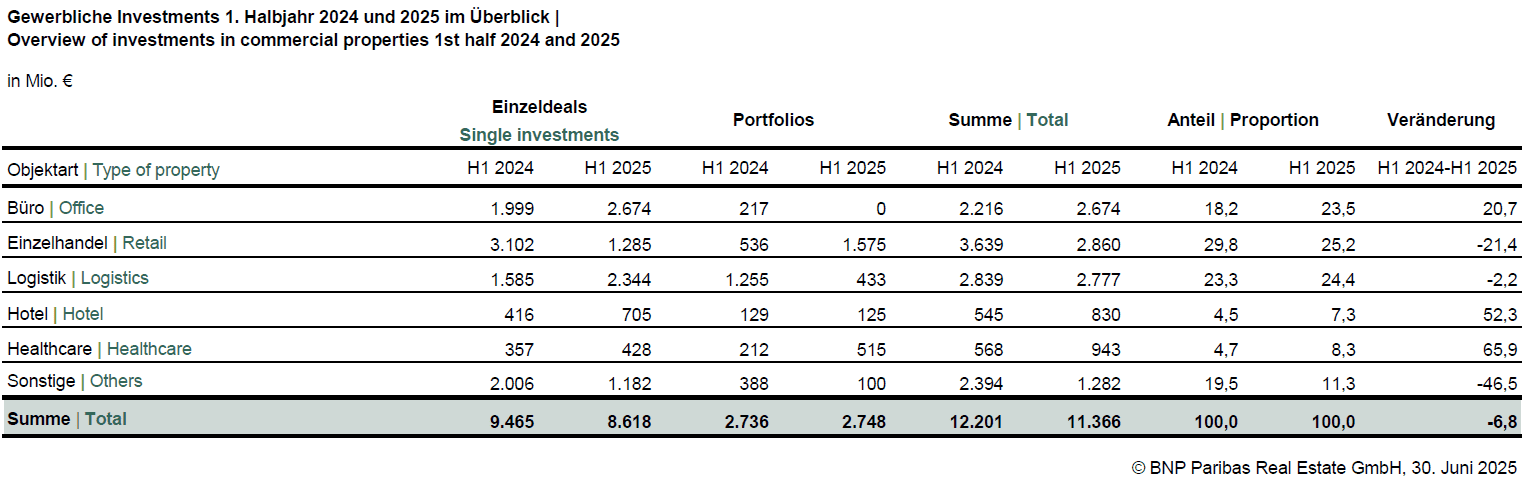

- In the commercial market segment, retail investments are at the top with just under €2.9 billion, ahead of logistics and office investments with just under €2.8 billion and €2.7 billion respectively

- Berlin is once again the number 1 German A-location (a good €1.3 billion)

- Net prime yields remained stable until the middle of the year

- The market share of foreign investors is at its highest level since 2022 at 45%

- Around 540 transactions recorded

“The generally noticeable increase in market recovery in the residential segment continued in the second quarter, even if the increase in revenue slowed somewhat. The somewhat more moderate investment volume in the second quarter is primarily due to the low number of large transactions, but this is only a snapshot, as several large-volume portfolios entered the market in the second quarter and should be successfully completed in the coming months. In addition, there is a comparatively low supply on the market overall, as many owners appreciate the secure cash flows of residential real estate and some other asset classes do not necessarily offer themselves as alternative investment destinations against the backdrop of the current global uncertainties,” explains Marcus Zorn, CEO of BNP Paribas Real Estate Germany. In the medium and long term, interest in German residential real estate will remain sustainable and tend to increase. Several influencing factors are responsible for this. On the one hand, there is the persistently high excess demand on the rental markets, which guarantees secure rental income and offers potential for value appreciation. On the other hand, residential real estate represents a disproportionately safe asset class for investors, especially in macroeconomic times that are difficult to calculate and an uncertain geopolitical environment.

Commercial investment turnover declines in the first half of the year

“After the investment volume with commercial real estate had increased in the first three months of the current year, it was noticeably lower in the second quarter. In total, around €11.4 billion was invested in the first half of 2025, which corresponds to a year-on-year decline of just under 7%. There are various aspects that are responsible for this development. On the one hand, the lower sales are due to a low product range, which will expand significantly in the second half of the year. On the other hand, however, the existing global uncertainties are also reflected in the markets. Statements on tariff levels and validities that keep changing at short notice, as well as the almost unchecked expansion of armed conflicts, be it the Ukraine war, Gaza, the conflicts between the nuclear powers India and Pakistan or the fighting between Israel and Iran, in which the USA has also intervened, are currently not helping to strengthen investor confidence. In addition, the economic policy decisions, in particular the announcement of the special fund worth several hundred billion euros for

infrastructure and environmental protection measures and the creation of considerable financial leeway for defence spending, have contributed to a brightening of the mood, but will only take effect with a time lag,” explains Zorn.

“The increasingly positive expectations within the German economy are likely to play an important role in the further development of the investment markets. This is already reflected in the improvement of important sentiment indicators such as the ifo index, which rose for the sixth time in a row in June, or the ZEW Indicator of Economic Sentiment, which also rose. It is particularly pleasing that the expectation components in the indices were able to increase disproportionately. In addition, it can be assumed that the greater financial leeway in the coming years will also be perceived with great interest in the international context, which should noticeably increase Germany’s attractiveness as an investment location again,” adds Nico Keller, Deputy CEO of BNP Paribas Real Estate Germany.

Retail investments lead the field

Looking only at commercial investments, retail transactions occupy the top position among the highest-volume asset classes in the middle of the year. With a transaction volume of just under €2.9 billion, they contribute a good quarter of commercial investment turnover, but recorded a year-on-year decline of a good 21%. However, it should be noted that an exceptionally strong result was achieved in the first half of 2024, driven by a few major transactions. Although a major transaction in the high three-digit million range was recorded in the current year with the takeover of the Porta Group by XXXLutz, the market is also much more fragmented than usual. Excluding the major transaction, the average deal volume is just €17 million. This reflects not least the fact that the focus of many retail investors is currently less on large-volume inner-city commercial buildings and more on food-anchored local supply and specialist stores. These types of properties account for more than two-thirds of the current retail volume. In addition, there was also a significant upturn in the shopping center segment, which contributed a significantly higher share (16%) to earnings than in previous years at a total of € 450 million. Here, too, the focus in the first half of the year was on small to medium-sized tickets, which often offer significant increases in value through revitalisation potential. However, there are also some larger centers in the pipeline.

Just behind retail investments, logistics transactions follow in second place, with a volume of just over €2.8 billion and thus contributing 24% to the commercial investment volume. Their result is thus roughly at the previous year’s level (-2%). It is noteworthy that the portfolio share of the asset class is currently only around 16%. In contrast, around €2.3 billion was generated from individual transactions alone. This is also a very strong result (+19%) in a long-term comparison and illustrates that logistics real estate is high on the shopping list of a broad investor base. This is further underpinned by the fact that the number of more than 120 registered sales corresponds to the fourth-highest half-year figure ever registered.

Meanwhile, office investments have lost some of their market share compared to the beginning of the year, but nevertheless contribute around 21% more to earnings in absolute terms than in the previous year at €2.7bn. The significant growth is mainly attributable to the sale of the Upper West in Berlin, which amounted to well over €400 million in the first quarter. In the past three months, small to medium-sized transactions of up to a maximum of € 75 million were registered, so that the second quarter could not seamlessly continue the solid start to the year. Meanwhile, the user markets are sending a positive signal. The fact that office space take-up increased by around 9% in the first half of the year could help to strengthen investor confidence in the asset classes.

Fourth place is occupied by healthcare properties with a volume of € 940 million, which corresponds to an increase of almost 66%. Almost 70% of the volume is attributable to nursing homes, which are thus recording a significant market recovery and are slowly approaching their long-term average again. Hotel investments also recorded significant growth, contributing around €830 million to earnings (+52%). The asset class has seen a successive increase in investor interest in recent months. The largest transaction in the second quarter was the sale of Mandarin Oriental in Munich for around €150 million.

Few large-volume individual transactions

By the end of the first half of the year, individual transactions accounted for around €8.6 billion of the volume. Compared to the same period last year, this corresponds to a decline of almost 9%, which mainly reflects the fact that very few deals in the three-digit million range are currently being recorded. In contrast, the total number of registered individual transactions increased by 5%. Meanwhile, the portfolio’s share of total income was around 24% or €2.7bn, almost identical to the previous year’s figure. By far the most investment was in retail packages at €1.6 billion, which is mainly due to the Porta takeover. But even without this special effect, the asset class would still be in first place, as a whole series of food-anchored portfolios were sold in the first half of the year.

At 45%, the share of foreign investors in total commercial real estate take-up is slightly above average in a long-term comparison, which underlines the unbroken attractiveness of the German market. As usual, the highest shares are held by European investors with 28%, followed by North American buyers, who contribute a good 12%.

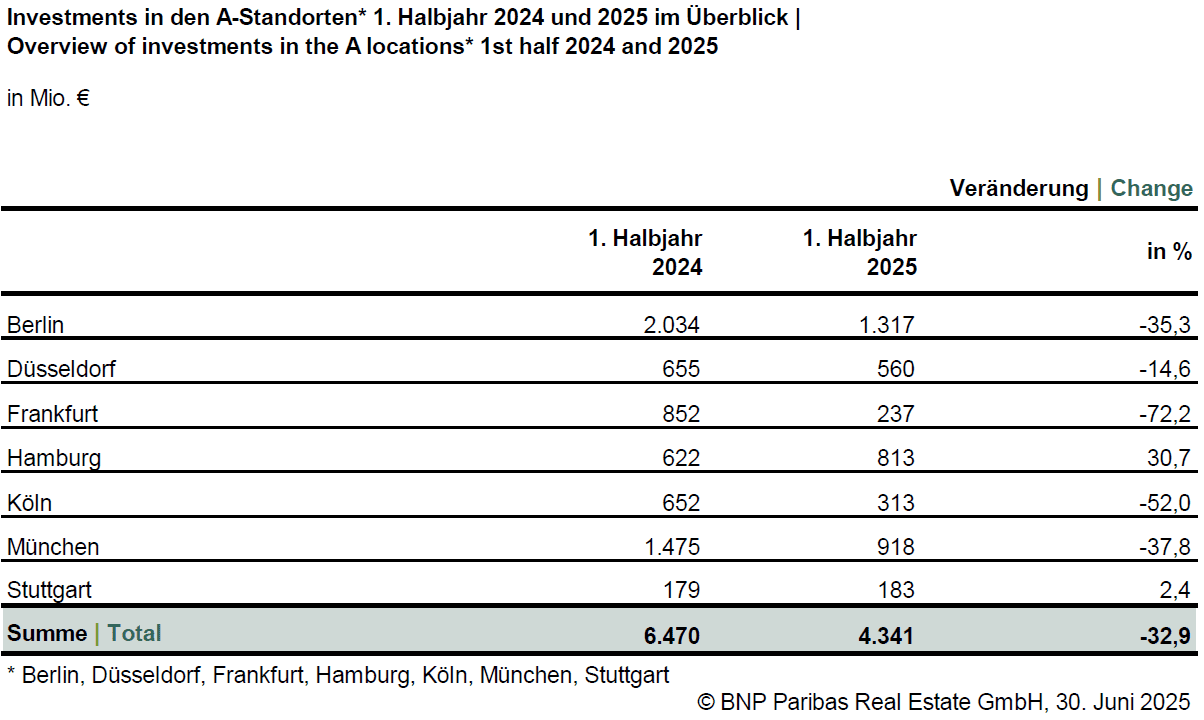

A locations with significantly less movement than in the previous year

“The investment volume in the German A-locations Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich and Stuttgart amounted to € 4.3 billion in the first half of the year, which is around a third below the previous year’s result. Although there is a noticeable revival in the market, a number of transactions are still in the finalization phase and have not yet been included in the volume. In addition, comparatively few large-scale deals are still being recorded. Only four sales above the €100 million mark have been made so far, which is a novelty. The picture in the various cities is correspondingly heterogeneous. In particular, markets that are usually characterised by large transactions, especially in the office segment, are currently recording low results,” explains Nico Keller. Berlin is once again in 1st place by a clear margin with an investment volume of a good €1.3 billion. Although this corresponds to a decline of around 35% compared to the previous year’s figure, the 2024 figure was driven up significantly by the sale of KaDeWe for around €1 billion. With a good €918 million, Munich follows in second place. In the Bavarian capital, too, there was a significant decline (-38%), but this was also largely due to the special effect of a few major transactions in the previous year (e.g. 5 farms). In contrast, Hamburg recorded an increase of 30% to around €813 million. In addition to the purchase of a larger nursing home portfolio by the City of Hamburg, a number of medium-sized transactions contributed to the solid result. The other places are occupied by Düsseldorf with €560 million (-15%), Cologne with €313 million (-52%), Frankfurt with €237 million (-72%) and Stuttgart with €183 million (+2%).

Yields remain stable in the first half of the year

The sideways movement of prime yields continued in the second quarter. So far, no significant change has been observed in any asset class compared to the beginning of the year. While the general market tenor at the end of 2024 was that a first noticeable yield compression was likely to set in in the course of the year, there is currently much to suggest that this process will be delayed somewhat. This is not least due to the financing environment. The cost of capital is currently significantly higher than the assumptions made at the end of the previous year. Concerns about higher government debt and the current geopolitical imponderables ensure that long-term capital market interest rates are hardly easing. As a result, the net prime yields for office properties on average in A-locations remain unchanged at 4.36%. The most expensive location is still Munich with 4.20%, followed by Berlin and Hamburg with 4.25% each. While Cologne and Stuttgart are quoted at 4.40%, Frankfurt and Düsseldorf are quoted at 4.50%. For logistics properties, the prime yield is 4.25%, and for inner-city commercial buildings, it is 3.76% on average for A-locations. 4.65% of retail parks are in stock, and no changes can be observed in discounters/supermarkets (4.90%) and shopping centres (5.60%) either. The prime yield for new-build properties in the residential market is 3.58% on average in A-locations.

Prospects

The prospects of the investment markets are determined by a large number of different influencing factors, some of which can trigger or influence opposing developments. In principle, a distinction must be made between national and global factors. In the national context, everything indicates that the economy as a whole will develop better in the next two years than expected until recently. This is supported by the positive expenditure effects that are to be expected in connection with the approved special funds and which are likely to have additional secondary effects, especially in the user markets. The upward trend is supported by a noticeable improvement in sentiment on the corporate side, which is already evident in important indicators. With regard to the housing market, it must also be taken into account that the high excess demand on the rental markets will continue, at least in the medium term, which means that residential investments remain highly attractive. If one also takes into account that a significantly larger supply of investment properties prepared in the first half of the year will be available in the second half of the year, the aforementioned aspects suggest that transaction volumes should increase significantly in the second half of 2025.

On the other hand, however, global developments must be taken into account that could overshadow or even counteract possible positive effects. Of course, the announced tariffs of the USA and the resulting countermeasures should be mentioned here. In the worst case, a real trade war could develop as a result, which would have catastrophic consequences for the global economy. This is especially true in connection with the current very short half-life of political decisions and statements, which leads to latent uncertainty in the markets. And even though investors are increasingly accustomed to a new reality, such an environment usually does not contribute to prosperous investment markets. In principle, the aspects outlined above have the potential to have a negative impact on the global economy and thus also on the real estate markets, which could lead to falling investment volumes.

If one summarizes the situation outlined above, it becomes obvious that the further development of the investment markets is difficult to predict validly. There are a number of reasons for a continued positive trend with increasing transaction volumes, but there is also a real chance that global trends in particular could hinder the economy and thus also investment activities. In principle, it is positive that real estate is seen by many investors as a comparatively crisis-proof asset class, especially in difficult times, so that a certain amount of capital reallocation from other asset classes would be quite possible. This would have a positive impact on the markets and investment turnover. And another aspect could also strengthen the markets: Currently, it can be observed that capital is being withdrawn from the USA to a certain extent and invested in other countries. Europe and Germany in particular will benefit from this, as growth prospects will have improved in the coming years due to greater financial leeway.

“The different levels of influence show that predictions are extremely difficult and can actually only be made within the framework of scenarios. In our view, the most likely scenario is that positive effects from national developments, such as the gradual implementation of special funds and an increase in GDP, can unfold relatively extensively and are only partially overshadowed by overarching negative trends. The prerequisite is that halfway rational solutions are found with regard to the customs problem, and that current global trouble spots do not escalate further. Based on these key figures, we assume that a result of over € 35 billion for investments in commercial and residential properties is quite possible. From today’s perspective, a stable development in the further course of the year represents the most likely scenario for yield development,” summarizes Marcus Zorn.