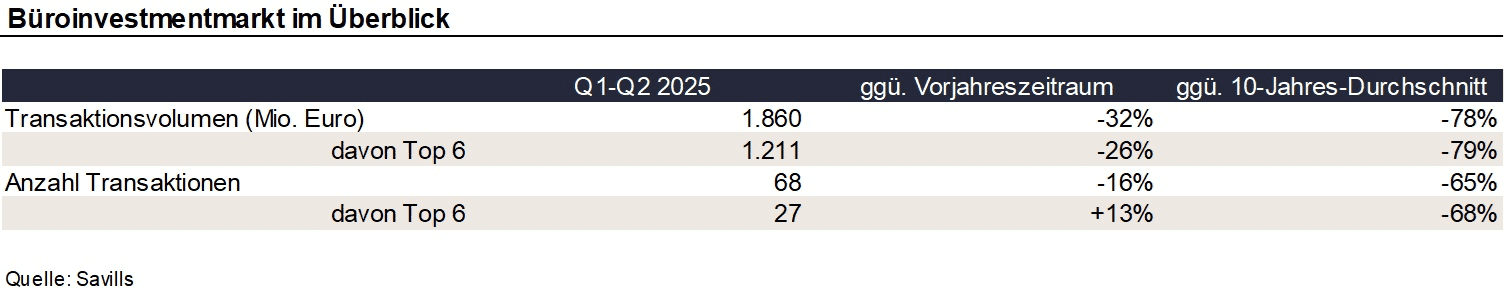

According to Savills, the transaction volume with office properties in the 1st half of the current year amounted to just under EUR 1.9 billion, which corresponds to a decline of around one third compared to the 1st half of the previous year. The 10-year average was even missed by 78%. In the last twelve months, Savills has registered just under 170 transactions, which is 7% less than in the same period last year. With the exception of Munich, where there was a decline of 10 basis points, prime office yields remained unchanged in all top 6 markets*. On average across all markets, they were 4.4% and thus corresponded to the previous year’s figure.

Karsten Nemecek, Deputy CEO Germany and responsible for Capital Markets at Savills, comments on the market as follows: “The office investment market continues to be characterised by considerable friction. Although more and more owners are willing to sell, the properties on offer or the asking price often do not match the expectations of the demand side. Especially in the core segment, capital willing to buy remains scarce; here it is mainly private investors who are taking advantage of the restraint of institutional investors for countercyclical purchases. Even if buyers and sellers do not always come together, the increasing number of sales processes is likely to gradually lead to more deals. Compared to the years before the interest rate turnaround, however, the transaction volume will remain very low for the foreseeable future, and the sales overhang in the market is likely to continue to grow.”

Around two-thirds of the transaction volume was accounted for by the top 6 markets, where the transaction volume also remained significantly below the previous year’s figure (-26%), but at least the number of transactions recently showed an upward trend and exceeded the previous year’s figure by 13%.