Example heading

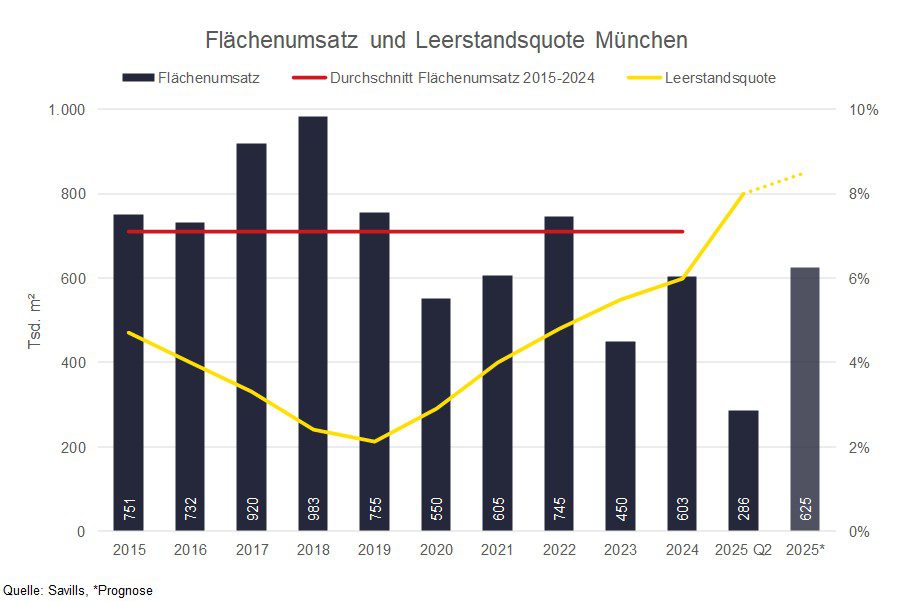

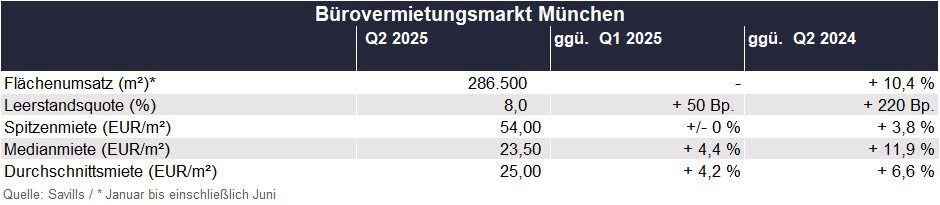

In the first half of 2025, take-up of 286,500 m² was registered on the Munich office letting market. This was 10.4% higher than in the same period of the previous year. Compared to the ten-year average, however, this meant a minus of 11%.

The vacancy rate increased by 50 basis points compared to the previous quarter and reached 8.0% in the 2nd quarter of 2025. Compared to the same quarter last year, the ratio increased by 220 basis points.

The prime rent remained unchanged and remained at EUR 54.00/m² in the 2nd quarter of 2025. Compared with the same quarter a year earlier, however, it rose by 3.8%. The median rent amounted to EUR 23.50/m², an increase of 4.4% compared to the previous quarter and 11.9% compared to the same quarter of the previous year.

Alexander Meyer, Director and Head of Munich Office at Savills, reports: “The Munich office leasing market was largely stable in the second quarter of 2025. A large share of take-up was accounted for by two large-volume owner-occupier contracts, each with more than 10,000 m². Apart from that, larger rentals remained the exception. In Munich, too, the structural change to the hybrid working world is becoming increasingly noticeable. The declining demand for space is clearly reflected in the vacancy rate, which has reached the 8% mark for the first time since 2010. This trend is particularly evident in peripheral locations, while central locations and modern spaces continue to benefit from stable demand. This also explains why the prime rent has remained constant compared to the first quarter despite the rising vacancy rate, but we expect a further increase in the medium term.”

Savills expects take-up for the year as a whole to be slightly higher than the previous year’s level, but still below the long-term average. At the same time, the continuing trend towards high-quality office space is likely to continue to support prime rents over the course of the year.