Office leasing market in Hamburg Q2-2025

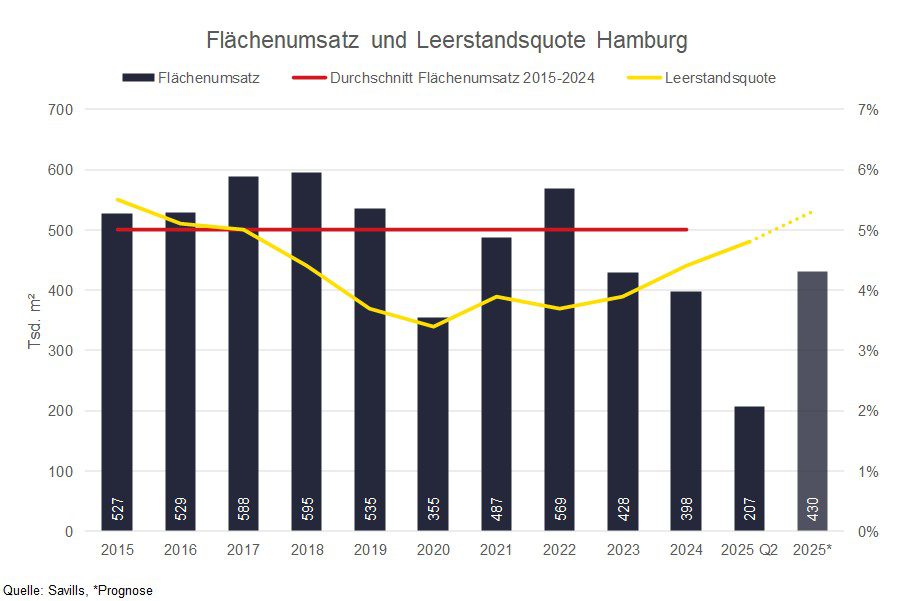

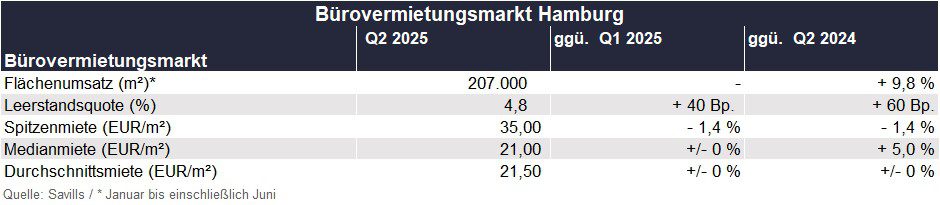

In the first half of 2025, take-up in Hamburg’s office letting market amounted to 207,000 m². Compared to the same period last year, this corresponds to an increase of 9.8%. In contrast to the ten-year average, however, it was about 15% lower. Take-up over the last four quarters amounted to 416,100 m², an increase of 4.9% compared to the same period last year.

The vacancy rate was 4.8% in the second quarter of 2025. Compared to the previous quarter, it rose by 40 basis points and by 60 basis points compared to the same period last year. The prime rent reached a value of EUR 35.00/m² in the second quarter of 2025 – a decrease of 1.4% compared to both the previous quarter and the previous year. The median rent in the second quarter of 2025 was EUR 21.00/m², remained constant compared to the previous quarter and increased by 5.0% compared to the same quarter a year earlier.

Matthias Huss, Director and Head of Hamburg Office at Savills, comments: “The Hamburg office letting market was noticeably more active in the first half of 2025, which can be clearly seen in the increase in take-up. We are currently observing several large-volume inquiries, which suggests that the positive trend is likely to continue in the course of the year. It is also noticeable that high-quality space in prime locations is becoming increasingly scarce. The project pipeline is heavily pre-let: the pre-letting rate for the completions expected for 2025 is around 95%, and for 2026 it is 92%. This puts Hamburg ahead of the top 6 office markets. At the same time, the vacancy rate in the CBD only reaches about 2%, which further tightens the already limited supply in central locations.”

Savills expects take-up for the year as a whole to be slightly above the previous year’s level, but still below the long-term average. At the same time, the ongoing trend towards high-quality office space is likely to continue to support prime rents over the course of the year.