Positive impetus from rental and investment markets influences office performance

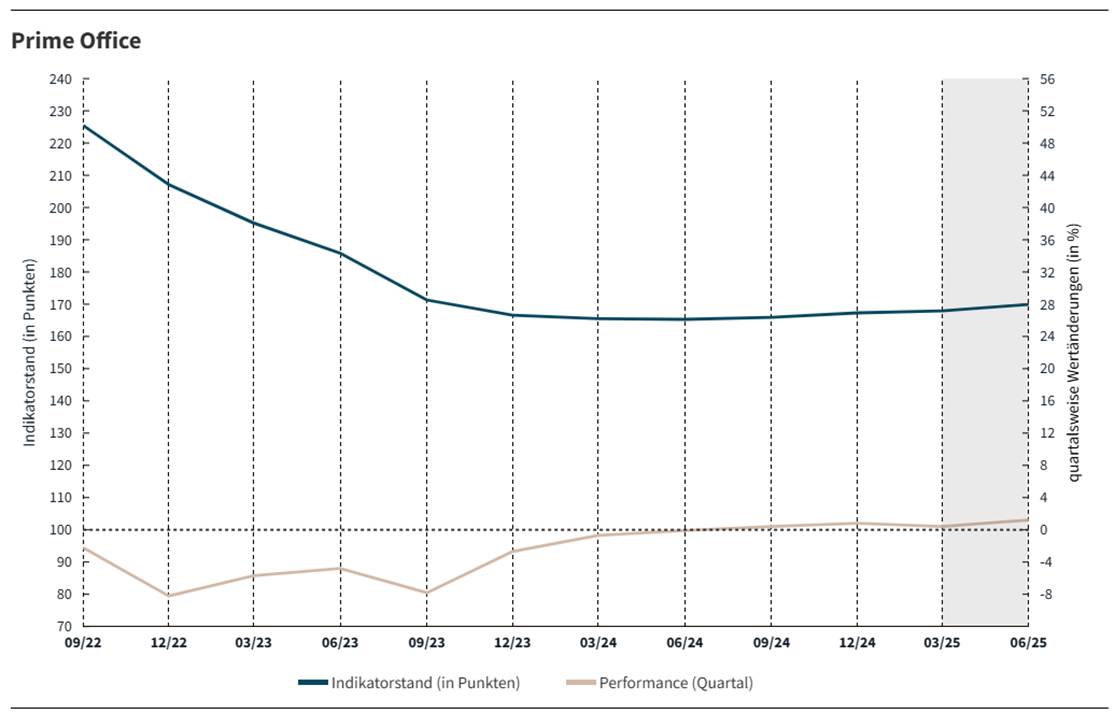

The framework conditions for office investments are improving continuously, which is also reflected in the development of the office performance indicator Victor Prime Office . With an increase of 1.2 percent compared to the previous quarter, the index rose slightly more strongly in the second quarter of 2025 than in the first three months of this year (0.4 percent). The indicator level for the observed top locations in the German real estate strongholds of Berlin, Düsseldorf, Frankfurt, Hamburg and Munich stood at 169.9 points at the end of June 2025. With the exception of Berlin, all cities show positive performance.

“The positive signs on the office investment market are increasing and intensifying, although they are not yet manifesting themselves in a significant increase in transaction volume,” says Ralf Kemper, Head of Value and Risk Advisory at JLL Germany, commenting on the figures. In the five real estate strongholds considered, the volume of investment in offices in the second quarter remained significantly below the result of the previous quarter, which was strongly influenced by the sale of the Upper West in Berlin. Overall, the first half of 2025 nevertheless exceeded the corresponding figure for the previous year (1.4 billion euros) at around 1.6 billion euros. The observed transactions and the ongoing bidding processes provided sufficient evidence for a reduction in prime yields in Munich, Düsseldorf and Hamburg. “Since the second quarter of 2022, rising prime yields have caused the Victor to perform, while the negative development has been dampened by positive rental effects. During the past four quarters, stagnating prime yields and rental impulses more or less cancelled each other out, and now, for the first time, the positive impulses from the investment market and from the rental markets are intensifying again.” There are currently other top products on the market, such as the WestendDuo in Frankfurt or the Dreischeibenhaus in Düsseldorf. “The bidding processes will provide further important data points,” Kemper is convinced.

The office letting market remained robust and take-up in the five cities in the first half of 2025 was just under 1.2 million m², slightly higher than in the first half of 2024 (1.1 million m²). Demand is concentrated on top products and first-class locations: “Examples of this are KPMG’s move from Frankfurt Airport to the city center or Siemens’ move from Neuperlach to Munich’s Werksviertel. In Munich, it is particularly business-related services, lawyers and similar industries that demand high-quality office space,” explains Kemper.

Munich continues to extend its top position

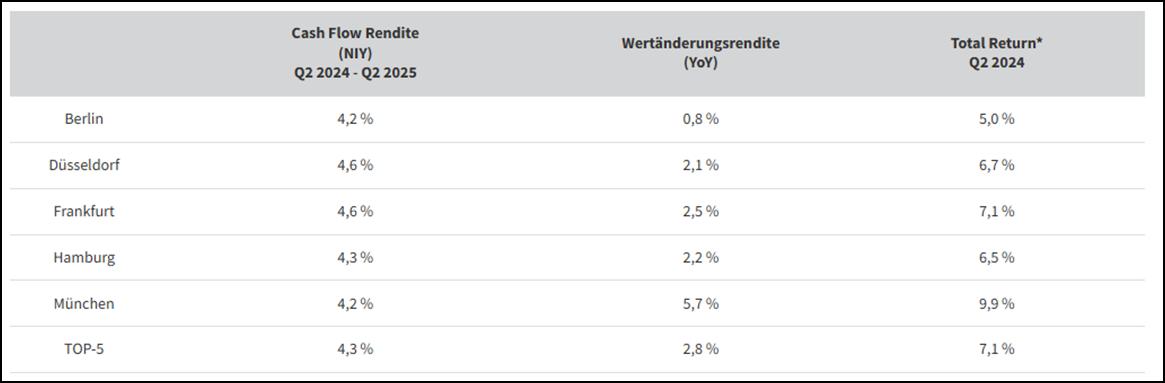

The highest performance growth in the second quarter was achieved in Munich’s city centre. In a quarter-on-quarter comparison, the index value rose by 3.5 percent as a result of a prime yield reduced by ten basis points and a strong increase in rents. With 191.6 points, the Bavarian real estate stronghold is thus expanding its top position. The Düsseldorf banking situation follows in second place with a performance increase of 1.8 percent to 153.1 points. As in Munich, both the reduction in the prime yield (minus five basis points) and positive rental effects were decisive for this development.

In Hamburg, prime rents remained unchanged, so that the reduction of the prime yield by five basis points led to an indicator increase of one percent to 185 points. Frankfurt’s city centre stagnated at 151.1 points (plus 0.1 per cent) due to a lack of impetus from the investment market and contrasting rent effects: While the prime rent in the Main metropolis rose sharply, the rent level outside the top-quality space declined. Berlin’s top locations are the only ones to show a negative performance again. The indicator level fell by 0.6 percent to 179.5 points. With stagnating prime yields, negative rent effects led to this development.

In line with the quarterly performance, the annual performance of the Victor calculated across all locations is also positive at 2.8 percent (comparison of the indicator level Q2 2025 to Q2 2024), after 1.5 percent in the previous quarter. Here, too, Munich is in first place with 5.7 percent due to the good quarterly result. Frankfurt with 2.5 percent, Hamburg with 2.2 percent and Düsseldorf with 2.1 percent are close together. Berlin brings up the rear with 0.8 percent.

“An exciting development can currently be observed in other European countries, especially in London and Paris. Here, interest in large-volume top properties is also increasing noticeably. If you assume sharply rising rents for first-class office buildings and a decreasing pipeline for top products, now is an interesting time to position yourself early,” Kemper explains. In Germany, this trend is not yet discernible, at least in the case of completed transactions. “Here, it continues to be equity-strong investors such as family offices in particular who come into play in most deals with top-of-the-range products. Nevertheless, we are also seeing a significant increase in the depth and breadth of bidding in ongoing bidding processes in Germany. Larger tickets with investment volumes well over 100 million euros are also attracting interest again and are becoming increasingly liquid,” says Kemper.

The return of institutional investors to the German investment market is noticeable, with a high proportion of capital from the international environment. “A further revival in the German office investment market is therefore now very likely – it remains to be seen whether it will come from the returning classic core or private equity investors. In any case, the German real estate strongholds have the potential to follow the usual pioneers London and Paris – and the expected significant increases in prime rents are likely to drive the purchase demand for prime properties in the office segment in this country.”